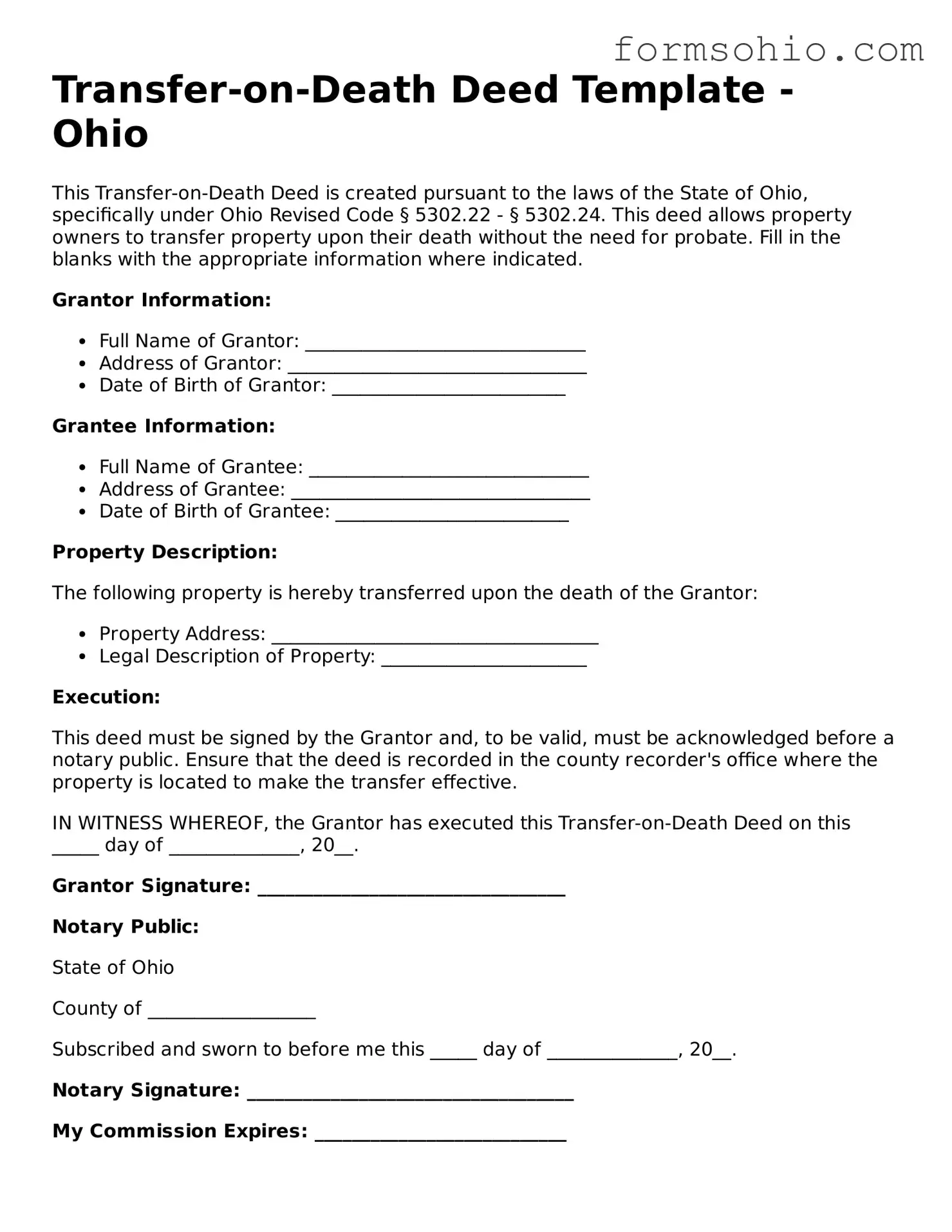

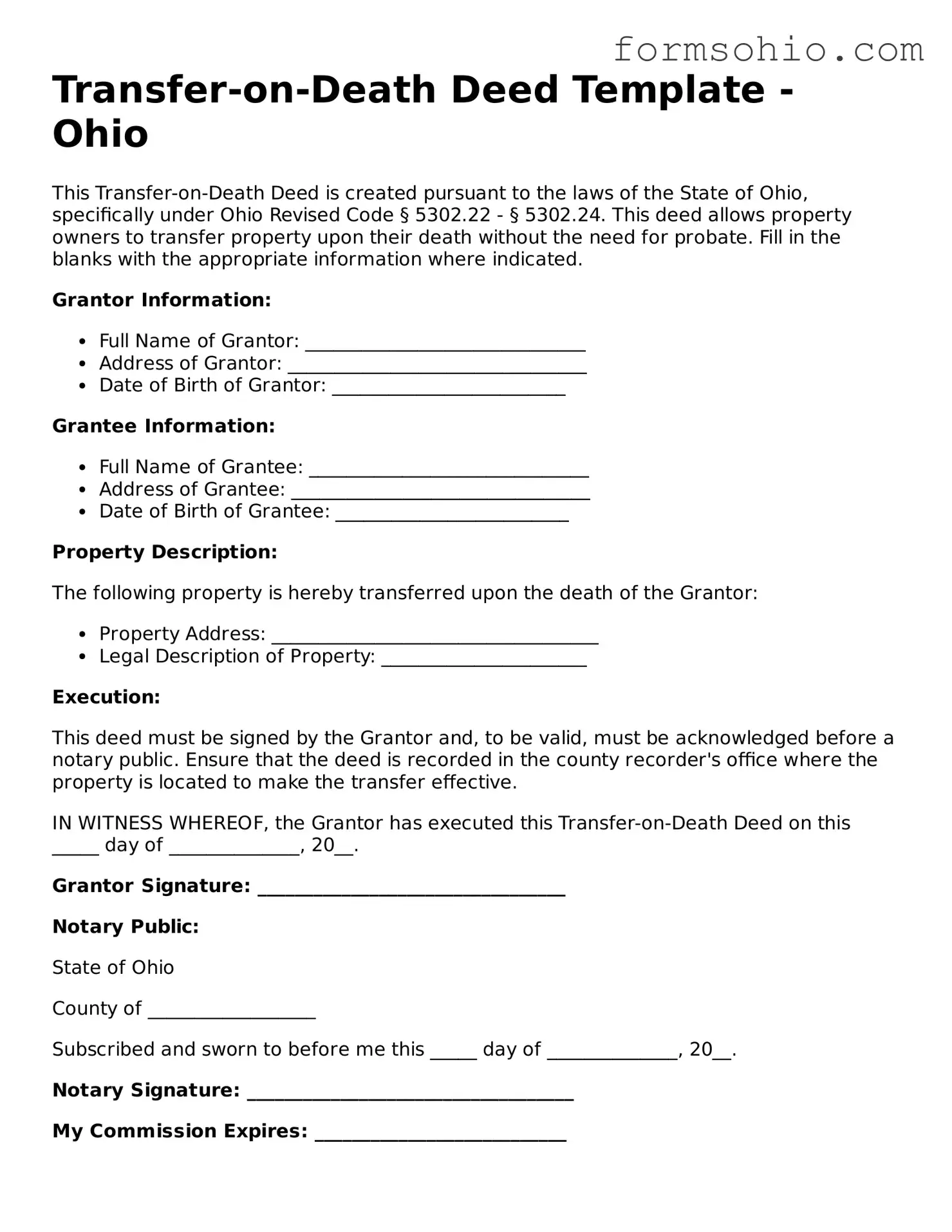

Printable Transfer-on-Death Deed Template for the State of Ohio

The Ohio Transfer-on-Death Deed form allows property owners to transfer real estate to beneficiaries upon their death, without the need for probate. This deed provides a straightforward way to ensure that property passes directly to designated individuals. By using this form, property owners can maintain control of their assets during their lifetime while simplifying the transfer process for their heirs.

Get This Document Online

Printable Transfer-on-Death Deed Template for the State of Ohio

Get This Document Online

Complete this form efficiently and quickly

Complete Transfer-on-Death Deed online without printing hassles.

Get This Document Online

or

Free PDF File