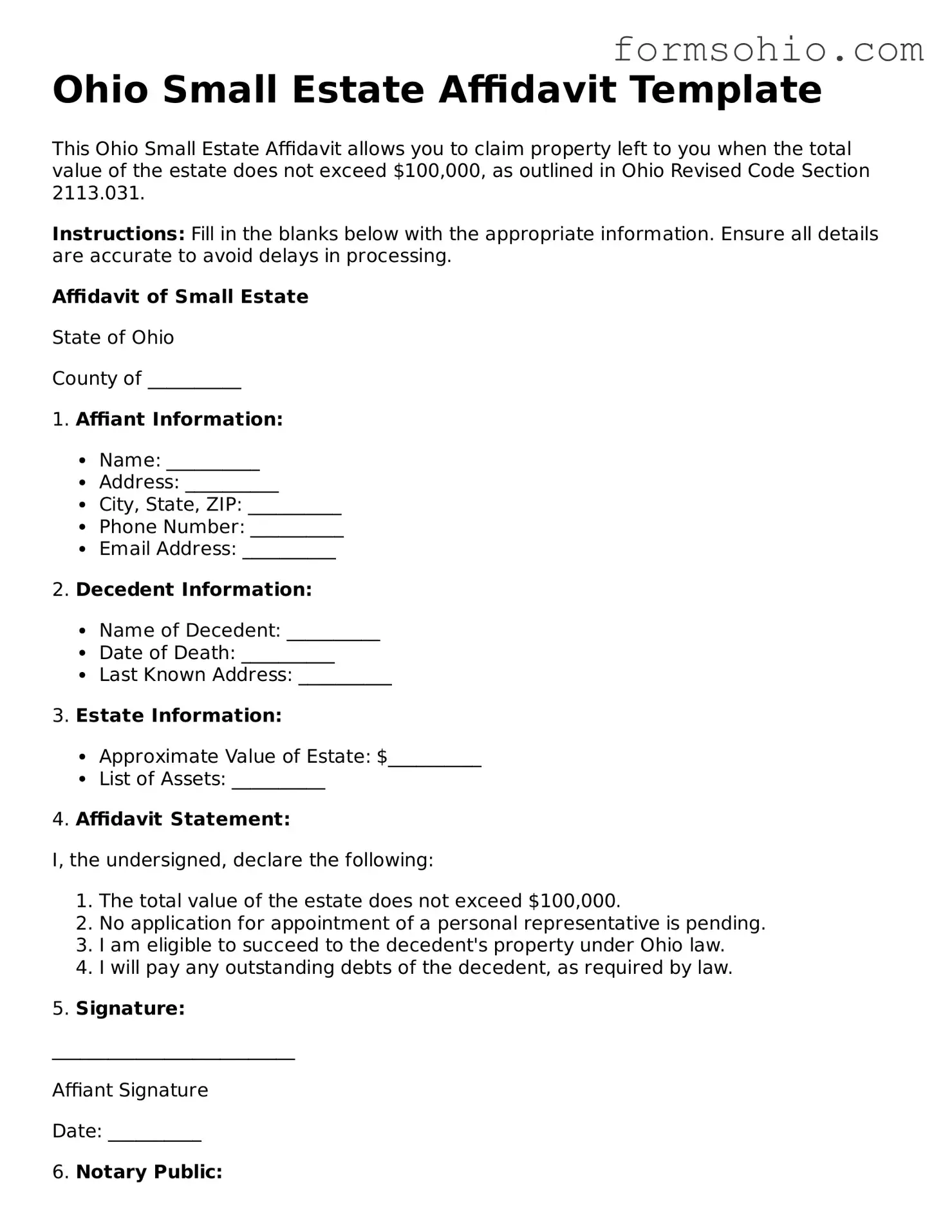

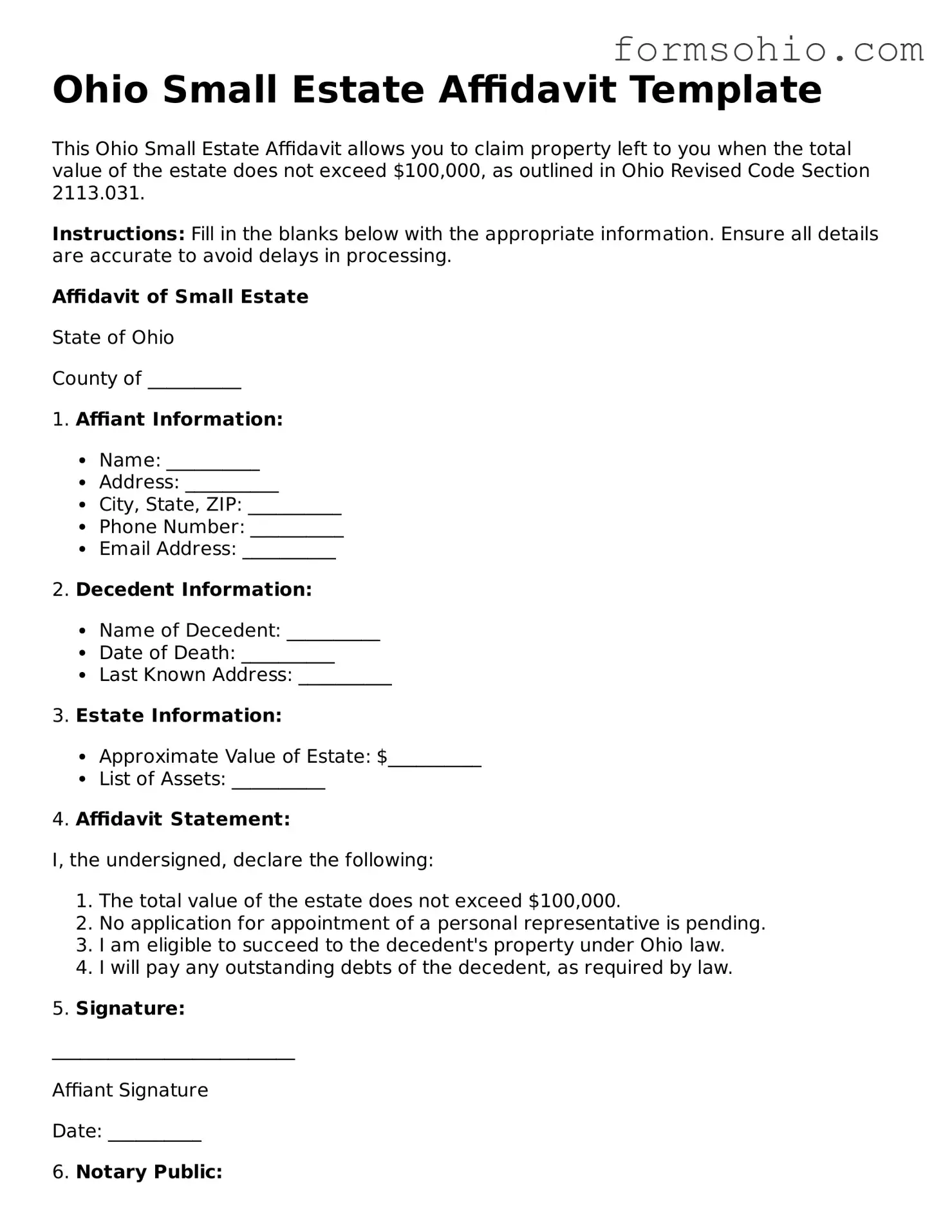

Printable Small Estate Affidavit Template for the State of Ohio

The Ohio Small Estate Affidavit is a legal document that allows individuals to settle the estate of a deceased person without going through the lengthy probate process. This form is particularly useful for estates that fall below a certain value threshold, streamlining the transfer of assets to rightful heirs. Understanding how to properly utilize this affidavit can significantly ease the burden during a difficult time.

Get This Document Online

Printable Small Estate Affidavit Template for the State of Ohio

Get This Document Online

Complete this form efficiently and quickly

Complete Small Estate Affidavit online without printing hassles.

Get This Document Online

or

Free PDF File