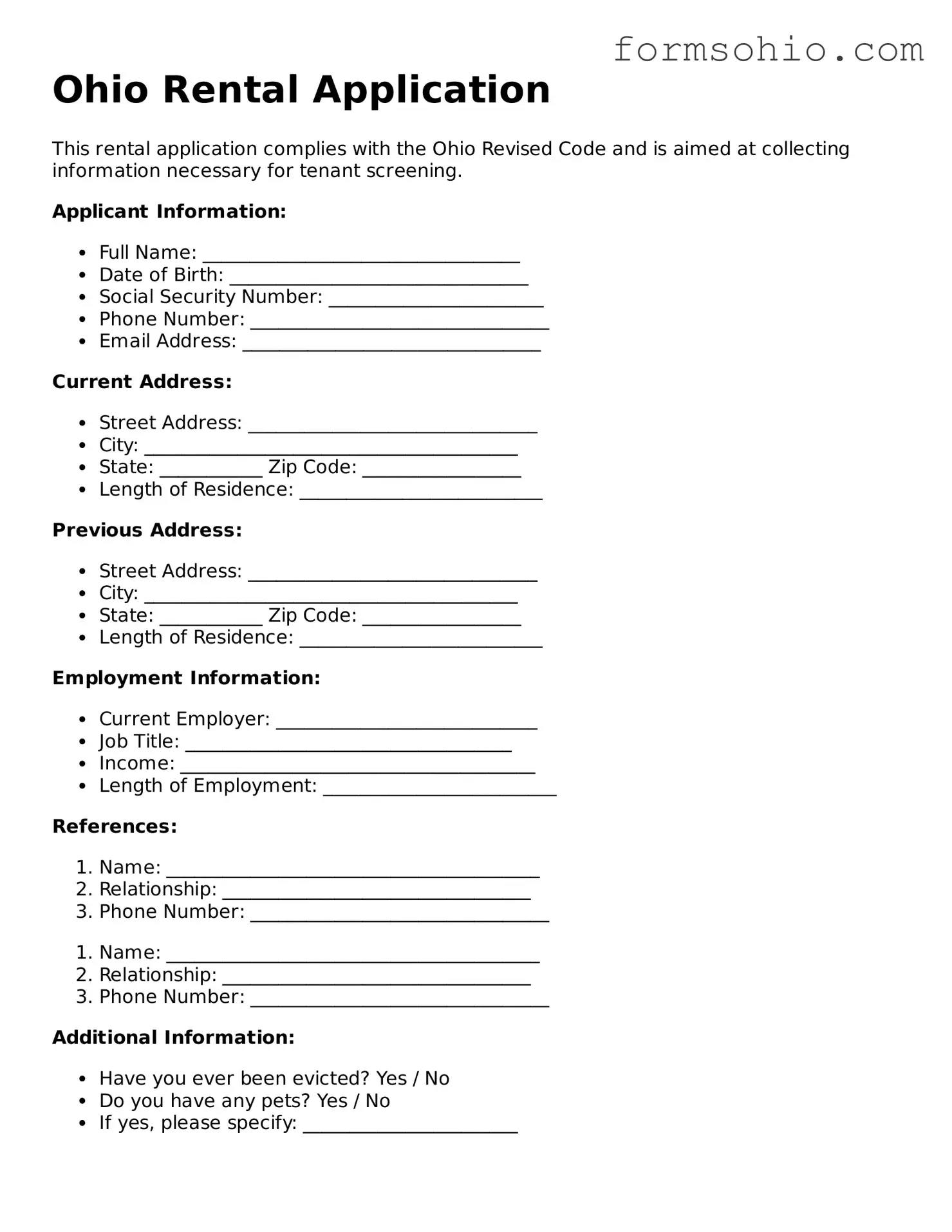

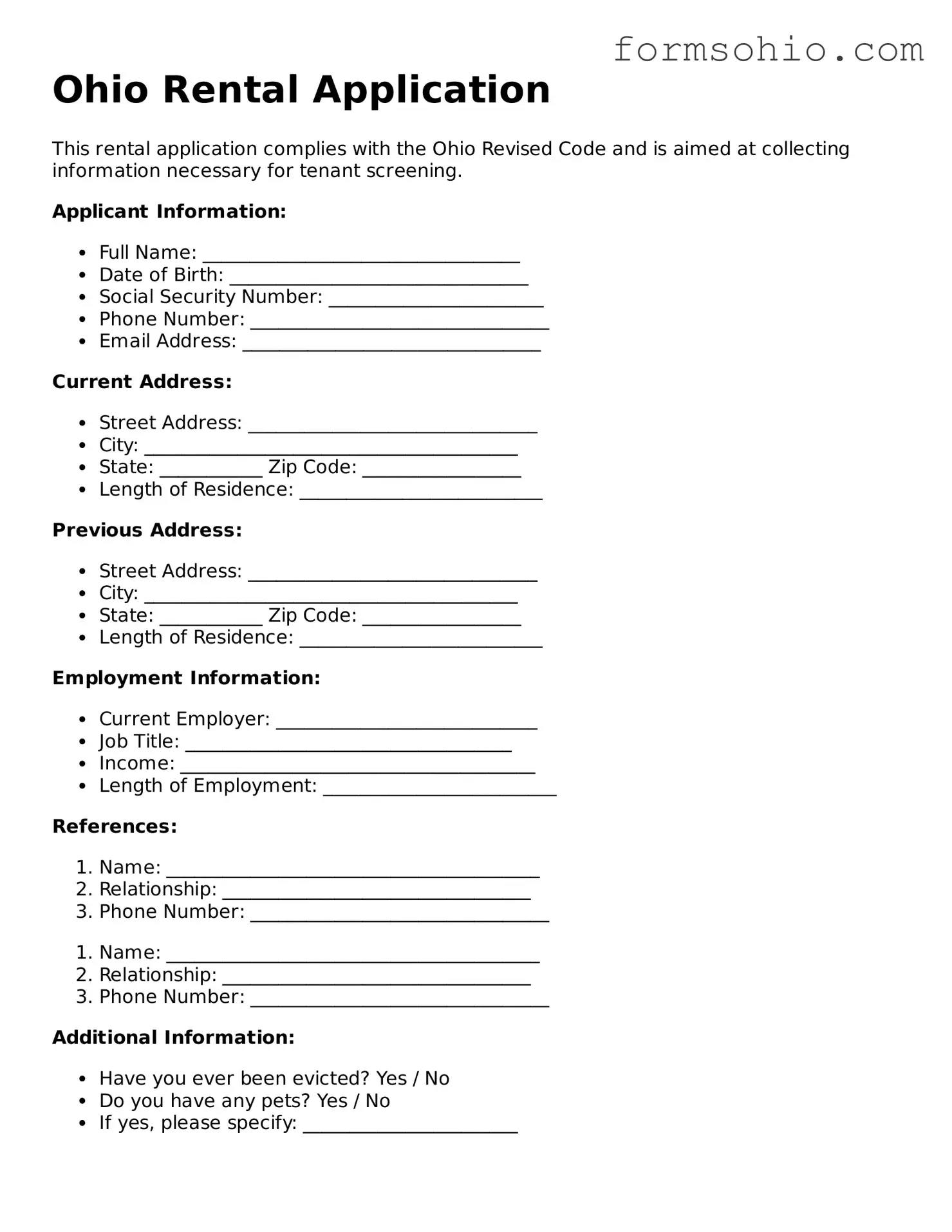

Printable Rental Application Template for the State of Ohio

The Ohio Rental Application form is a document used by landlords to collect essential information from prospective tenants. This form typically includes personal details, rental history, employment information, and references. Completing the application accurately is crucial for both parties, as it helps landlords make informed decisions and assists tenants in securing housing.

Get This Document Online

Printable Rental Application Template for the State of Ohio

Get This Document Online

Complete this form efficiently and quickly

Complete Rental Application online without printing hassles.

Get This Document Online

or

Free PDF File