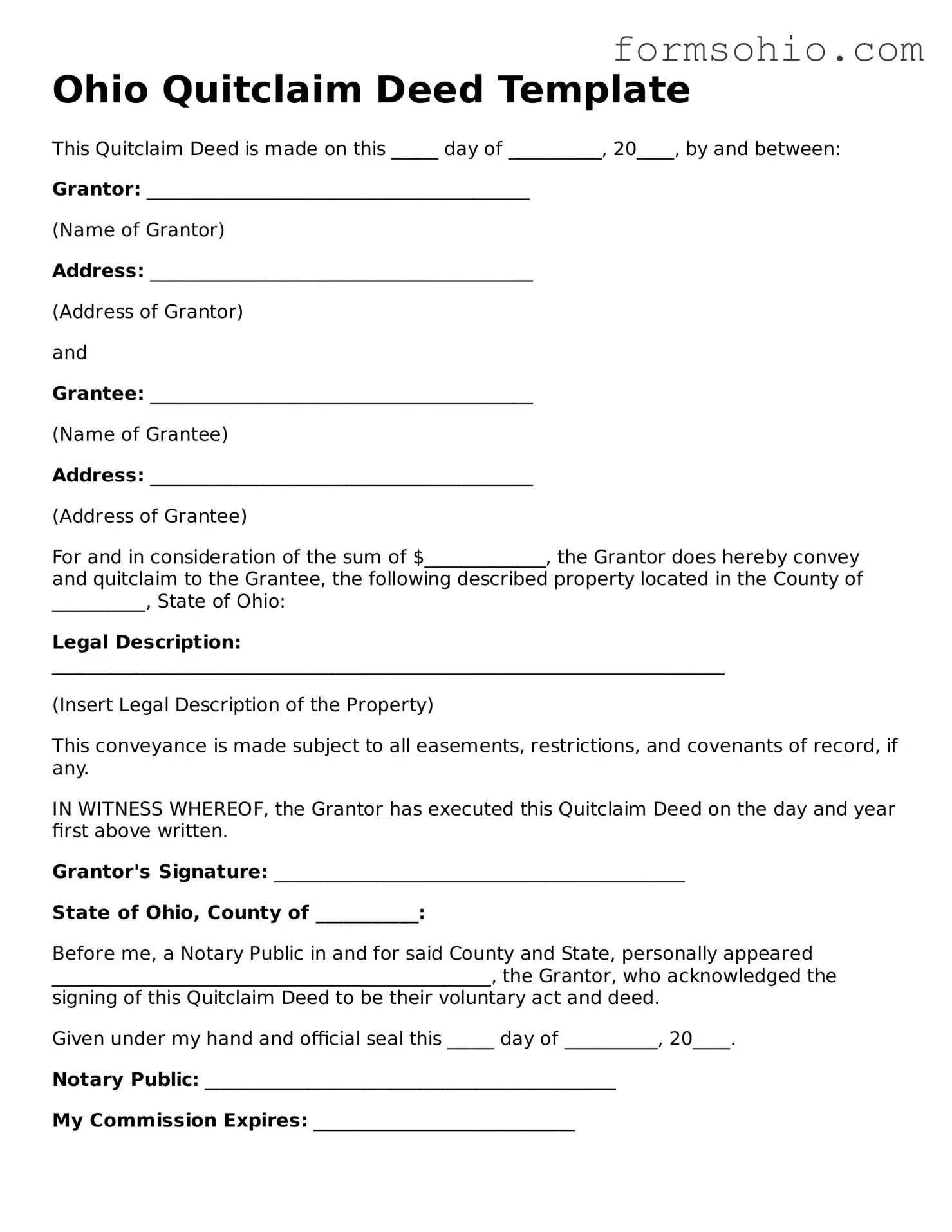

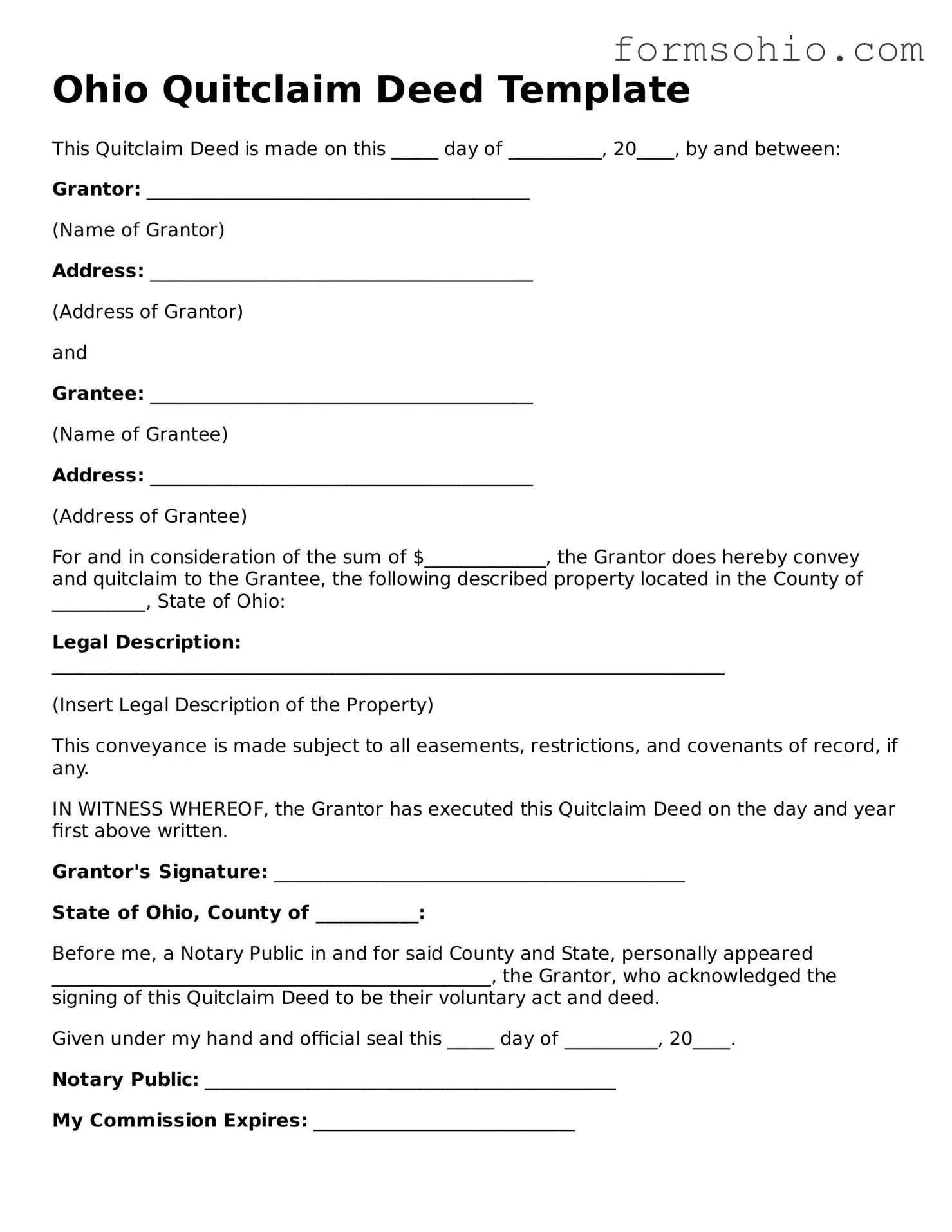

Printable Quitclaim Deed Template for the State of Ohio

A Quitclaim Deed is a legal document used in Ohio to transfer ownership of property from one party to another without guaranteeing the title's validity. This form is often used among family members or in situations where the parties know each other well. Understanding how to properly fill out and file this form is crucial for a smooth transfer of property rights.

Get This Document Online

Printable Quitclaim Deed Template for the State of Ohio

Get This Document Online

Complete this form efficiently and quickly

Complete Quitclaim Deed online without printing hassles.

Get This Document Online

or

Free PDF File