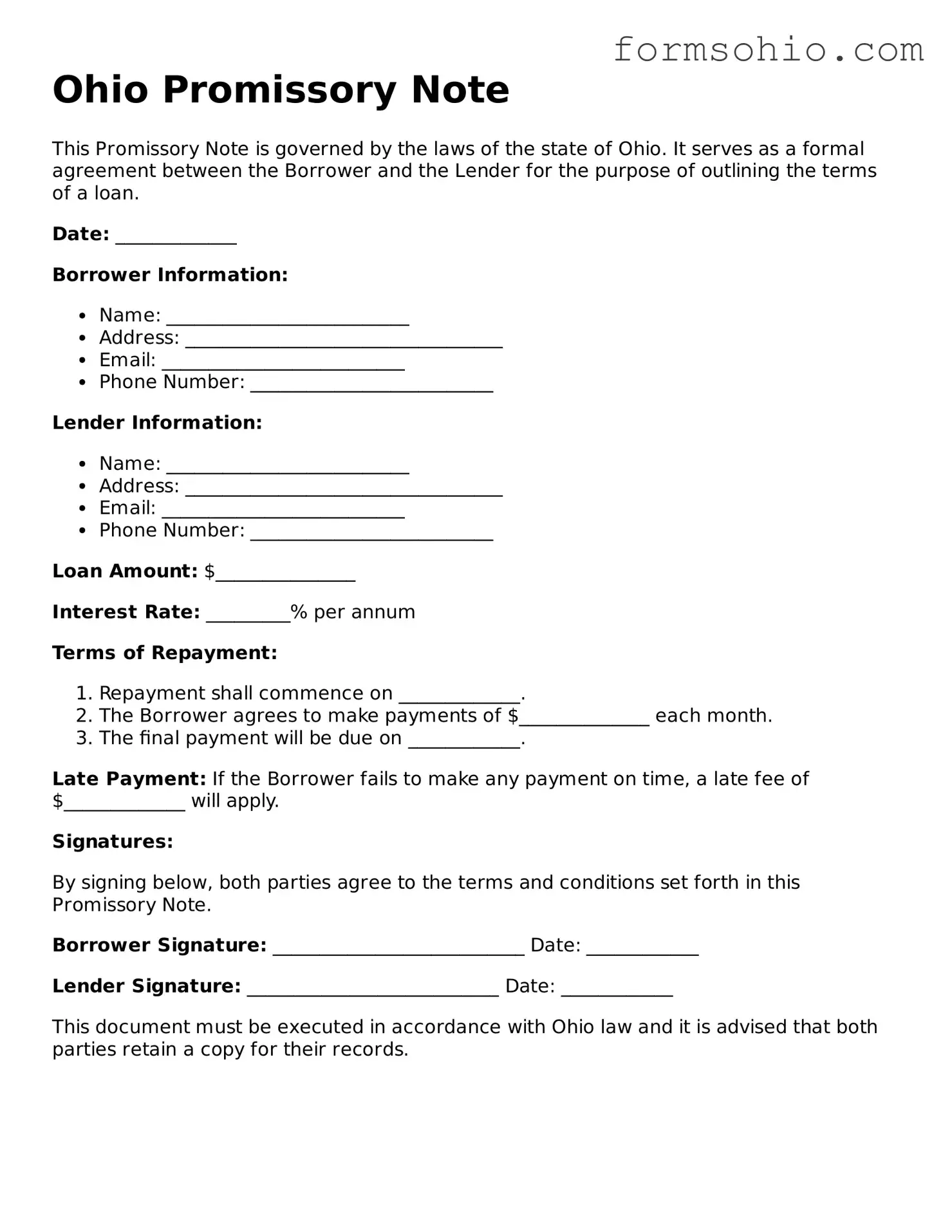

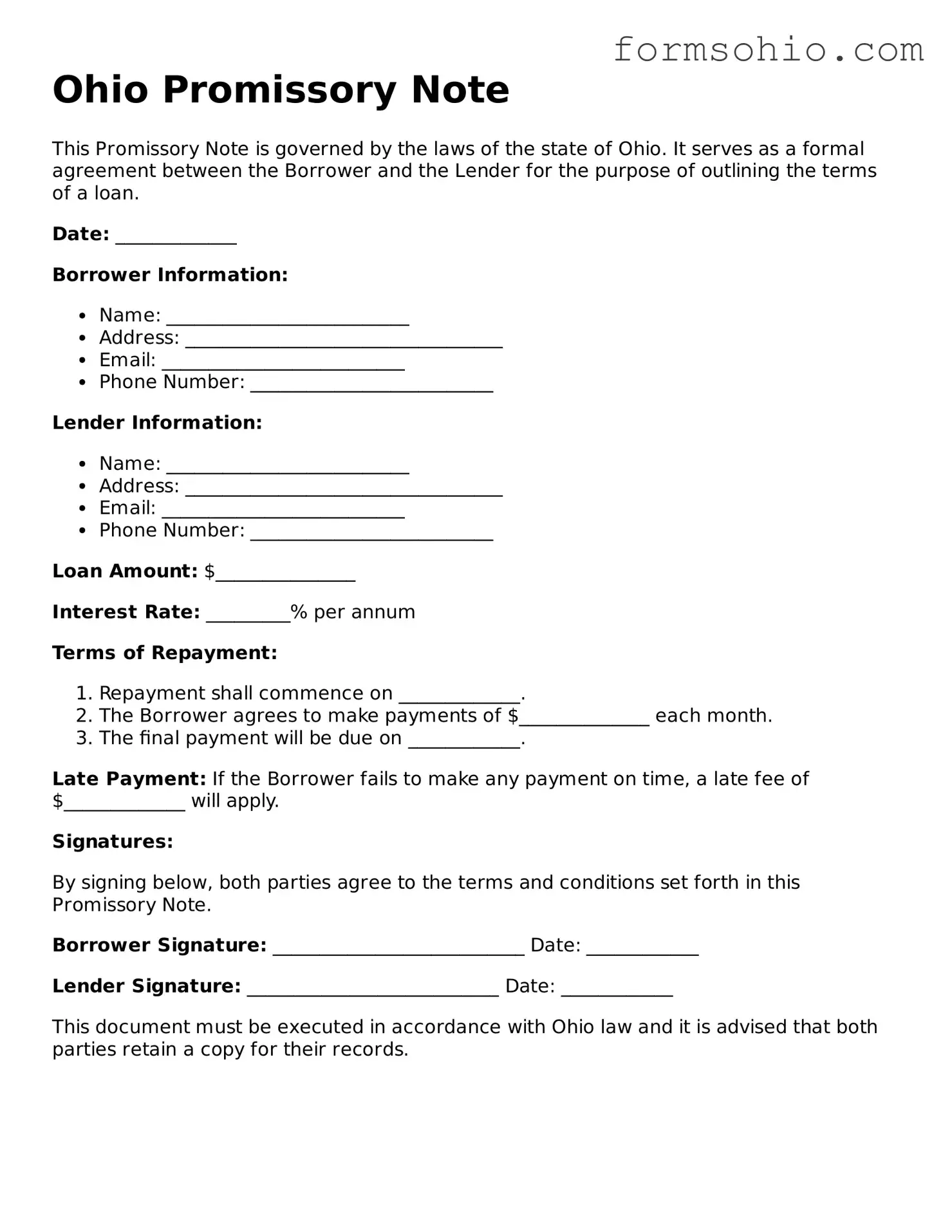

Printable Promissory Note Template for the State of Ohio

A promissory note is a written promise to pay a specified amount of money to a designated person or entity at a predetermined time. In Ohio, this legal document serves as a critical tool for individuals and businesses alike, facilitating loans and financial agreements. Understanding the nuances of the Ohio Promissory Note form can help ensure that both parties are protected and clear on their obligations.

Get This Document Online

Printable Promissory Note Template for the State of Ohio

Get This Document Online

Complete this form efficiently and quickly

Complete Promissory Note online without printing hassles.

Get This Document Online

or

Free PDF File