Fill a Valid Ohio Unclaimed Form

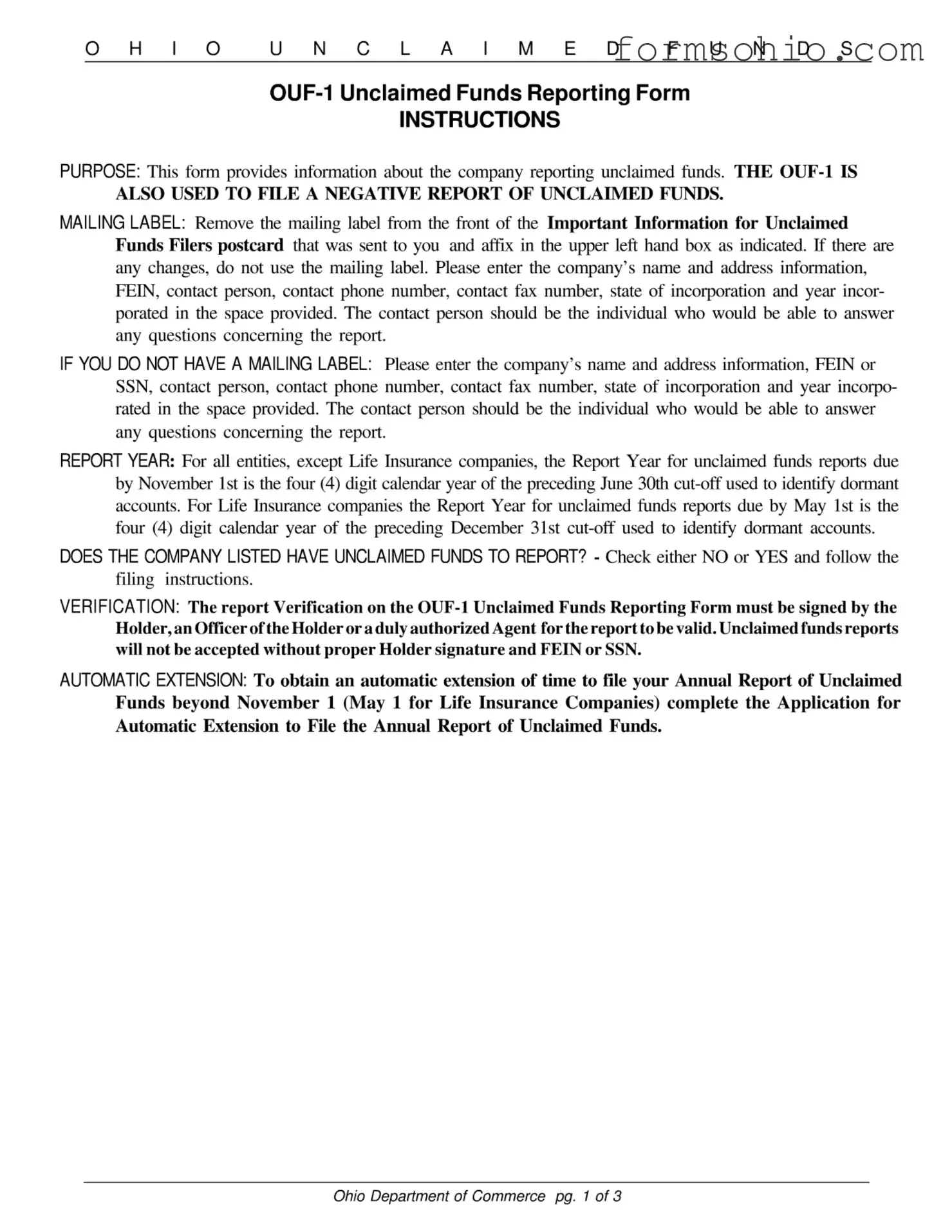

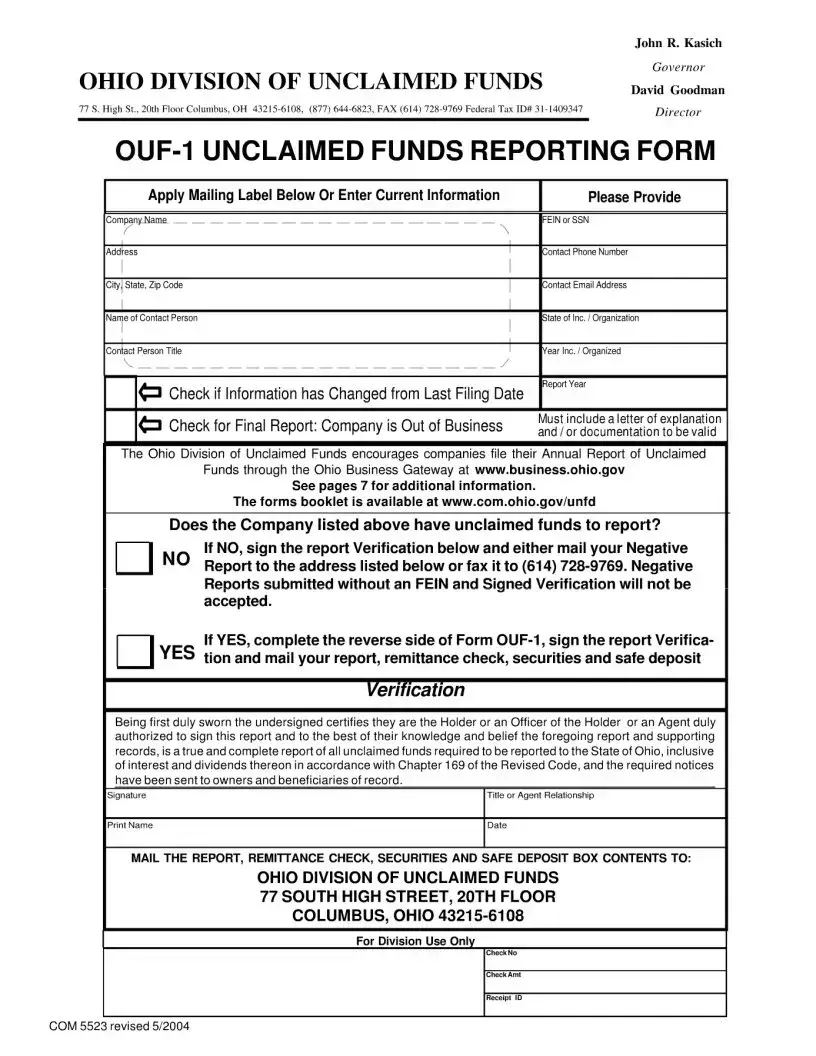

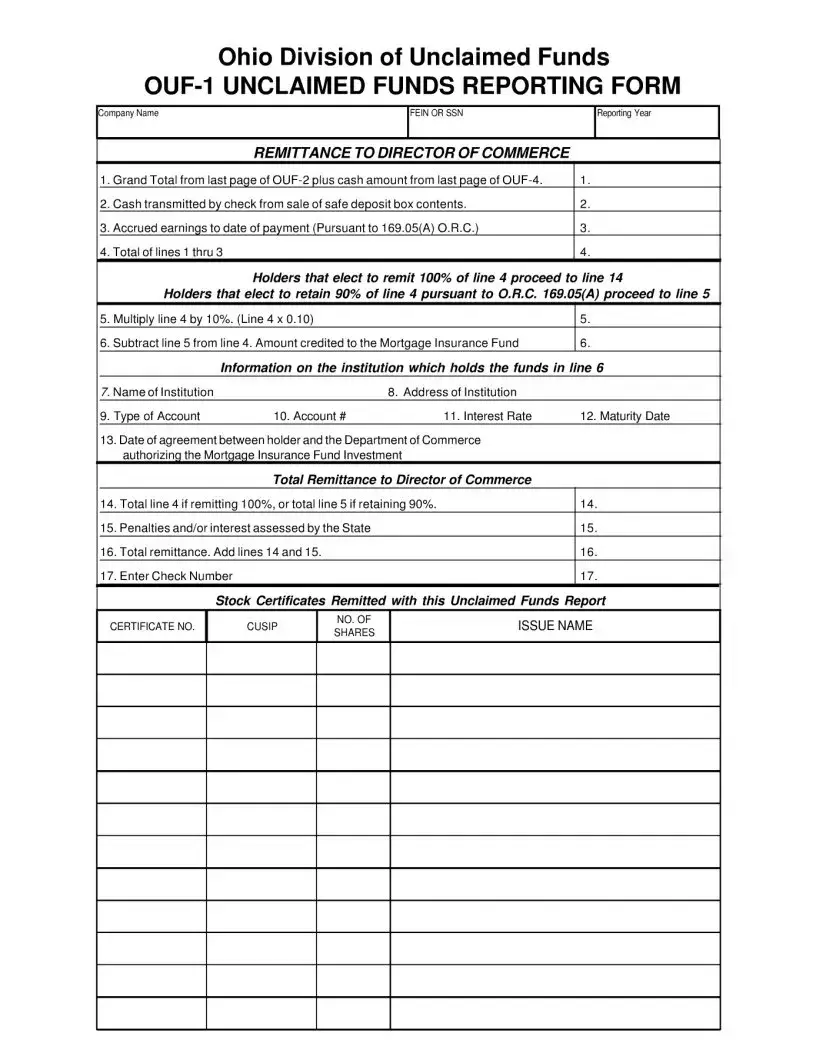

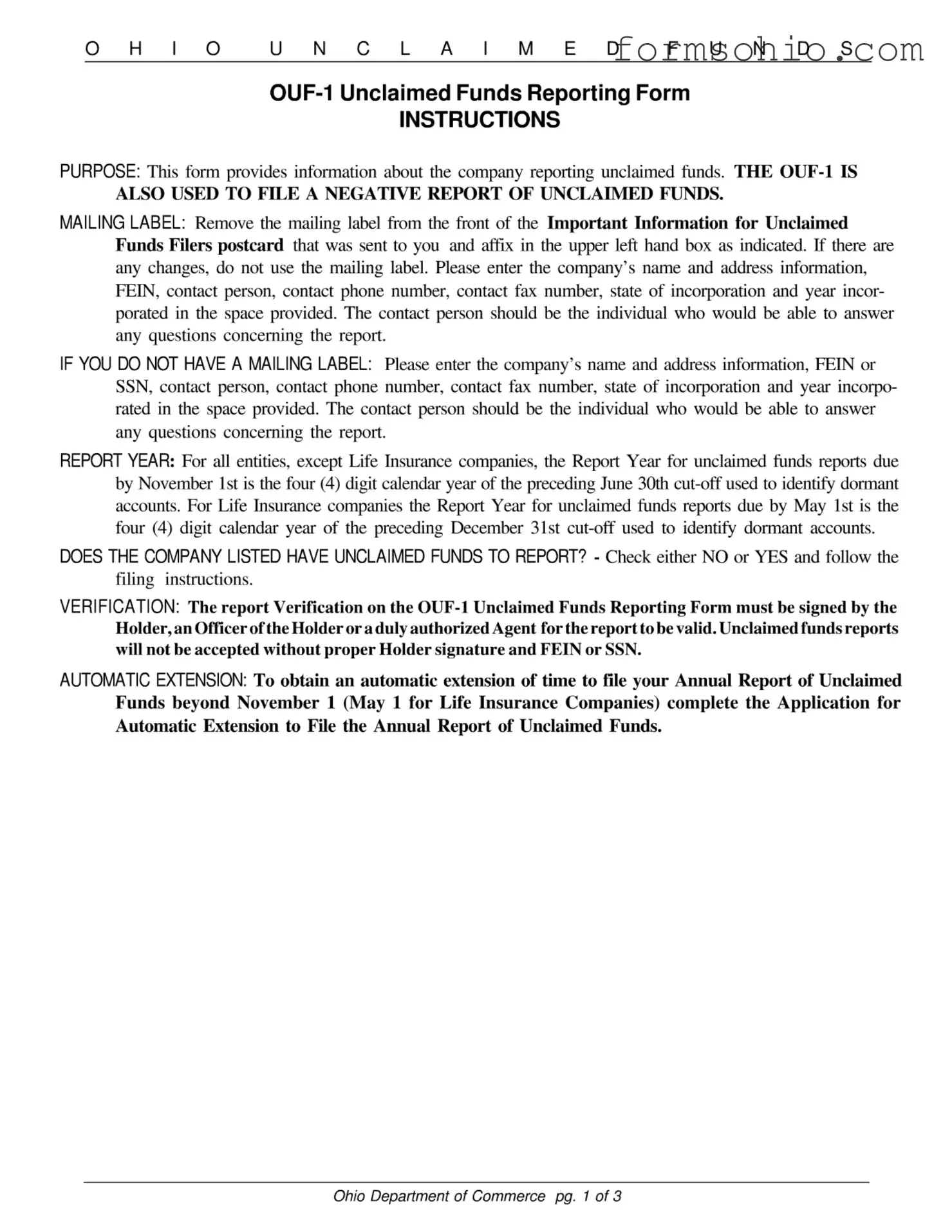

The Ohio Unclaimed Funds Reporting Form, also known as the OUF-1, is a vital document that companies use to report unclaimed funds to the state. This form not only serves as a means to disclose any unclaimed funds held by a business but also allows for the filing of negative reports when no unclaimed funds exist. Understanding the requirements and process for completing this form is essential for compliance and to avoid penalties.

Get This Document Online

Fill a Valid Ohio Unclaimed Form

Get This Document Online

Complete this form efficiently and quickly

Complete Ohio Unclaimed online without printing hassles.

Get This Document Online

or

Free PDF File