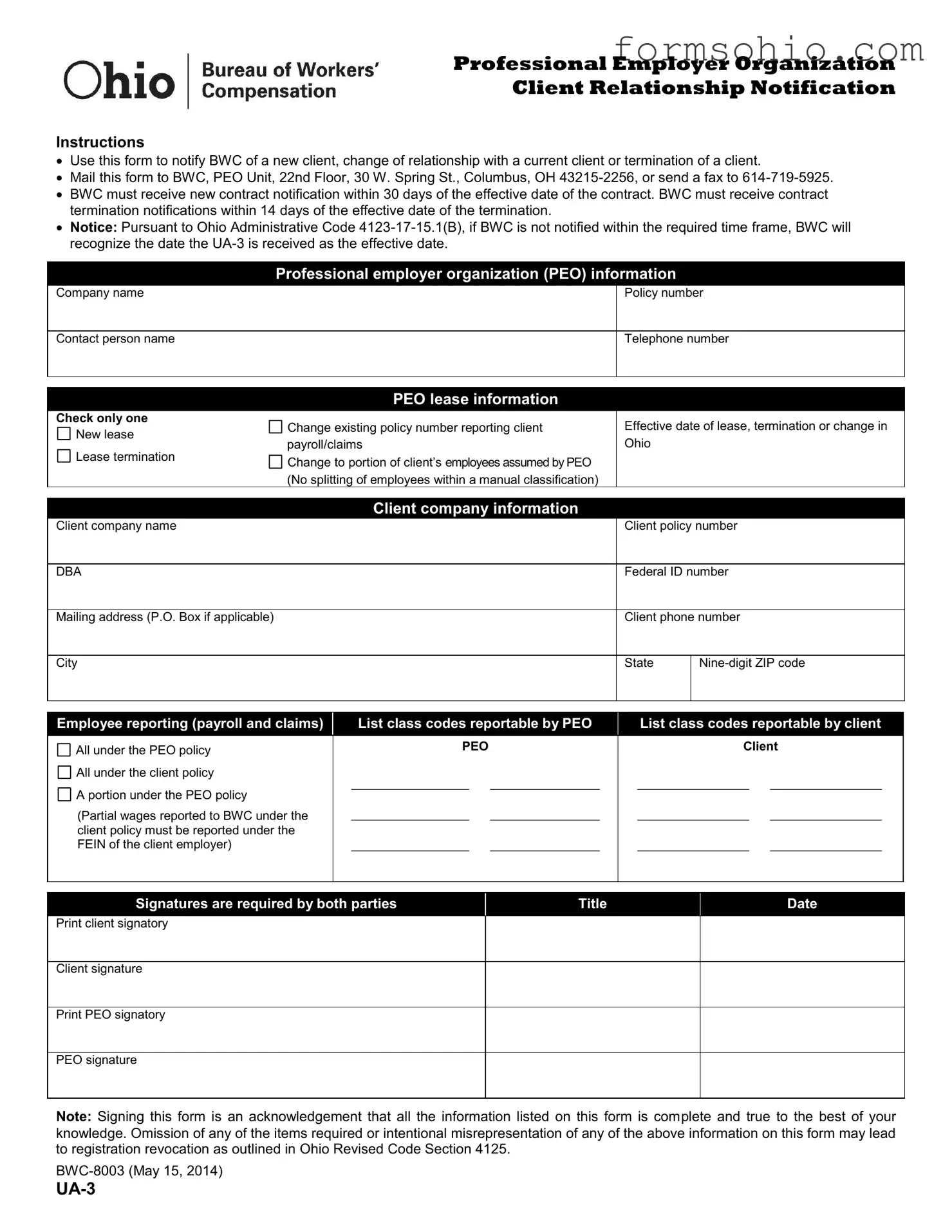

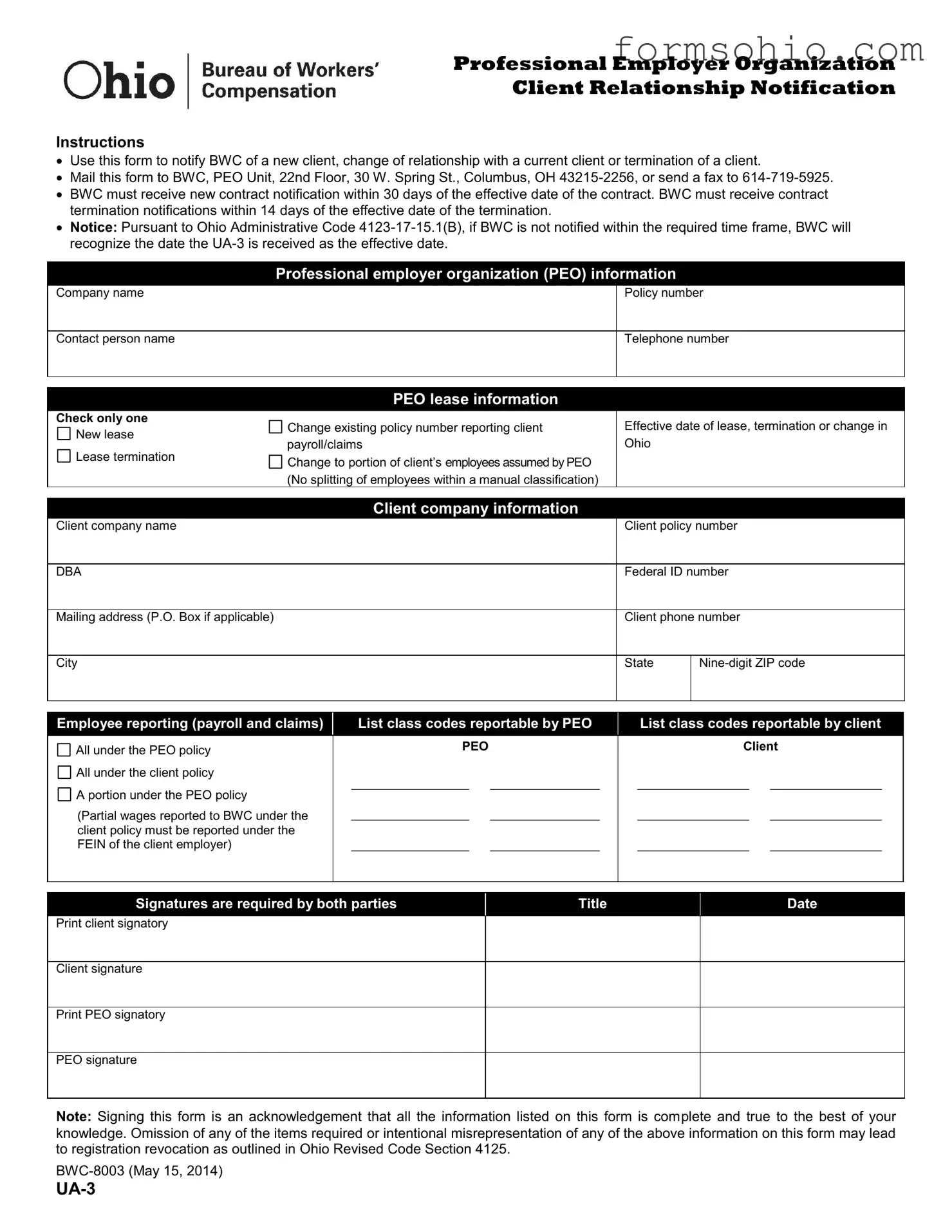

Fill a Valid Ohio Ua 3 Form

The Ohio UA-3 form is used to inform the Bureau of Workers' Compensation (BWC) about changes in the relationship between a Professional Employer Organization (PEO) and its clients. This includes notifying the BWC of new clients, changes to existing contracts, or the termination of client relationships. Timely submission of this form is crucial, as the BWC has specific deadlines for receiving notifications related to contracts.

Get This Document Online

Fill a Valid Ohio Ua 3 Form

Get This Document Online

Complete this form efficiently and quickly

Complete Ohio Ua 3 online without printing hassles.

Get This Document Online

or

Free PDF File