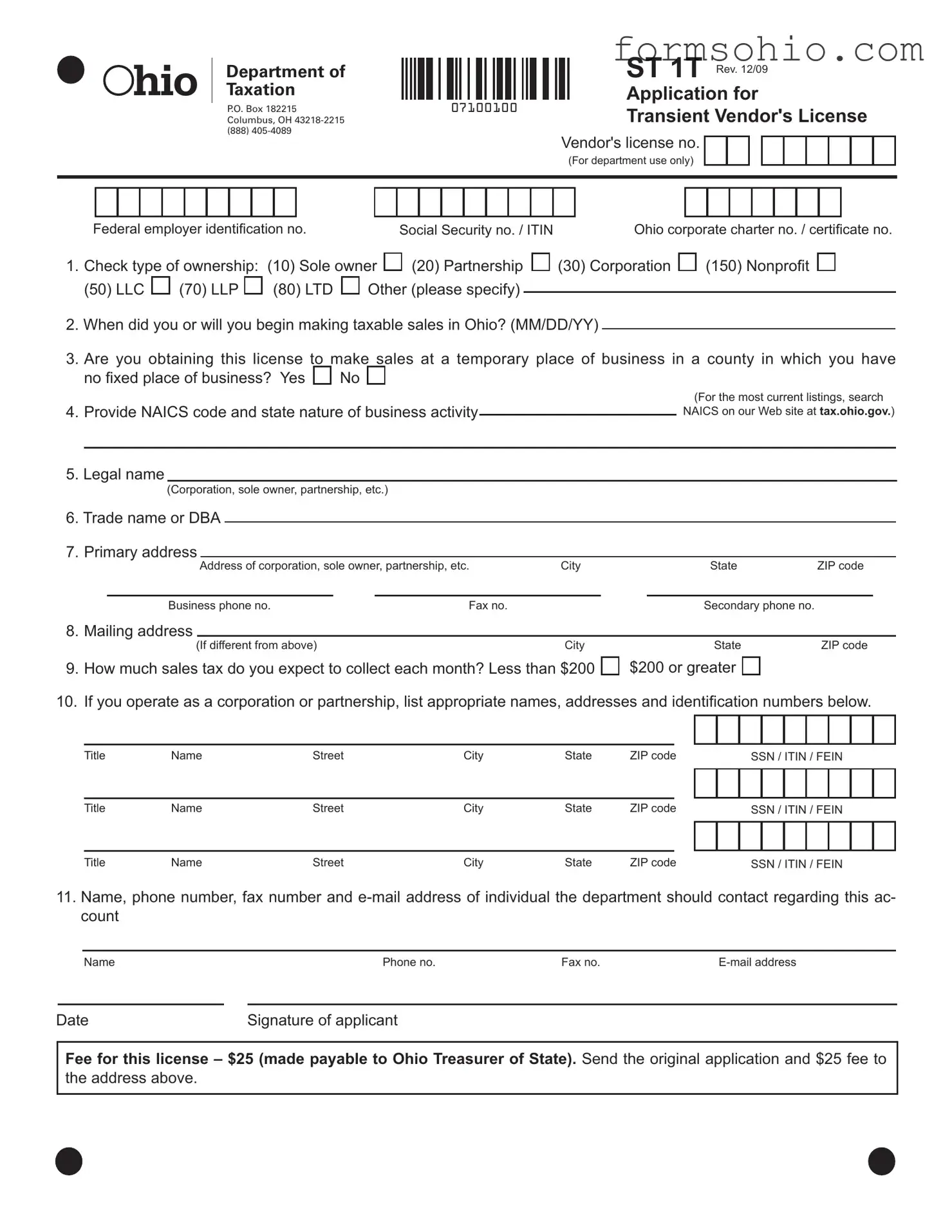

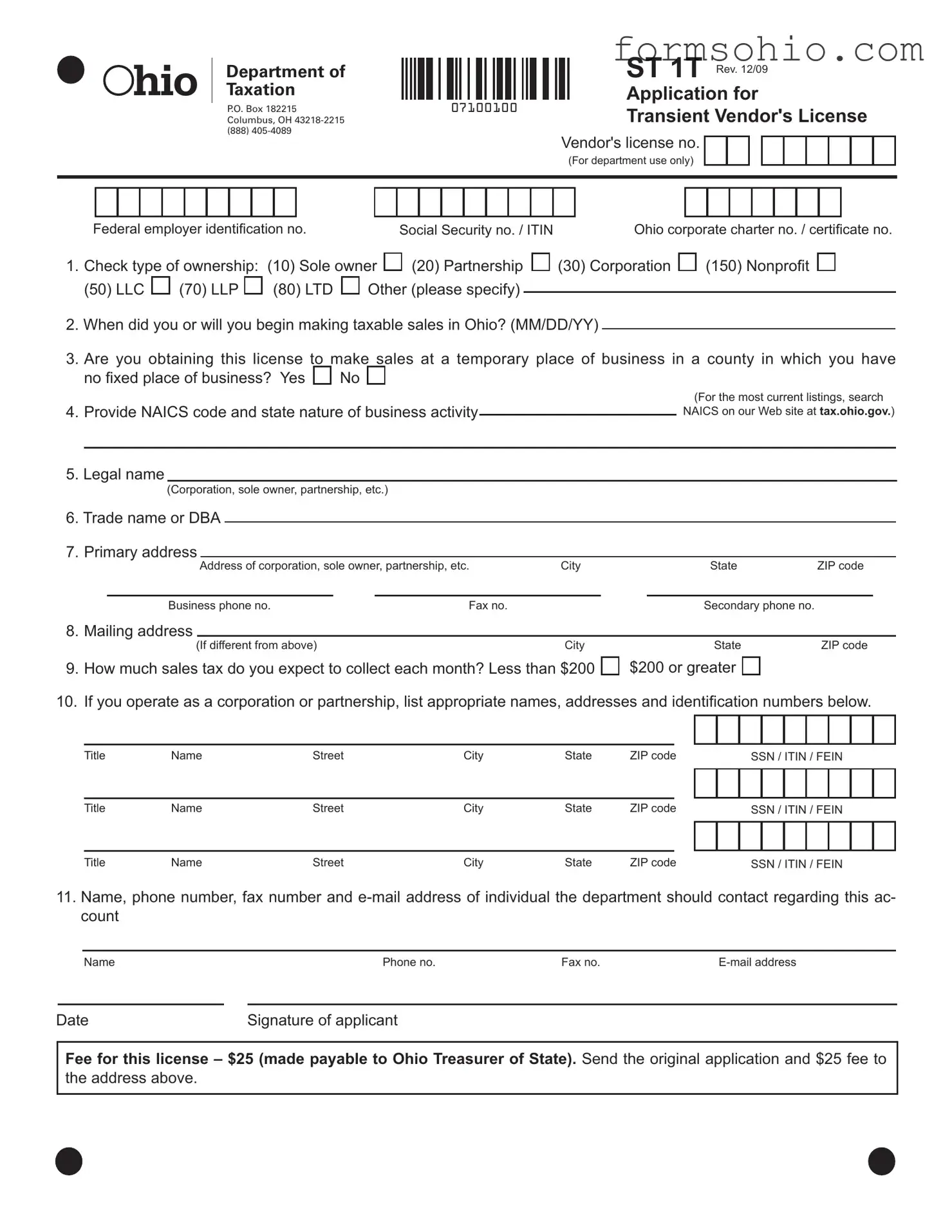

Fill a Valid Ohio St 1T Form

The Ohio St 1T form is an application for a transient vendor's license, which allows businesses to make taxable sales at temporary locations within Ohio. This form collects essential information such as ownership type, expected sales tax collection, and business identification numbers. Completing the form accurately is crucial for compliance with Ohio tax regulations.

Get This Document Online

Fill a Valid Ohio St 1T Form

Get This Document Online

Complete this form efficiently and quickly

Complete Ohio St 1T online without printing hassles.

Get This Document Online

or

Free PDF File

HIO

HIO

(20) Partnership

(20) Partnership

(30) Corporation

(30) Corporation

(150) Nonprofi t

(150) Nonprofi t

(50) LLC

(50) LLC  (70) LLP

(70) LLP  (80) LTD

(80) LTD  Other (please specify)

Other (please specify)