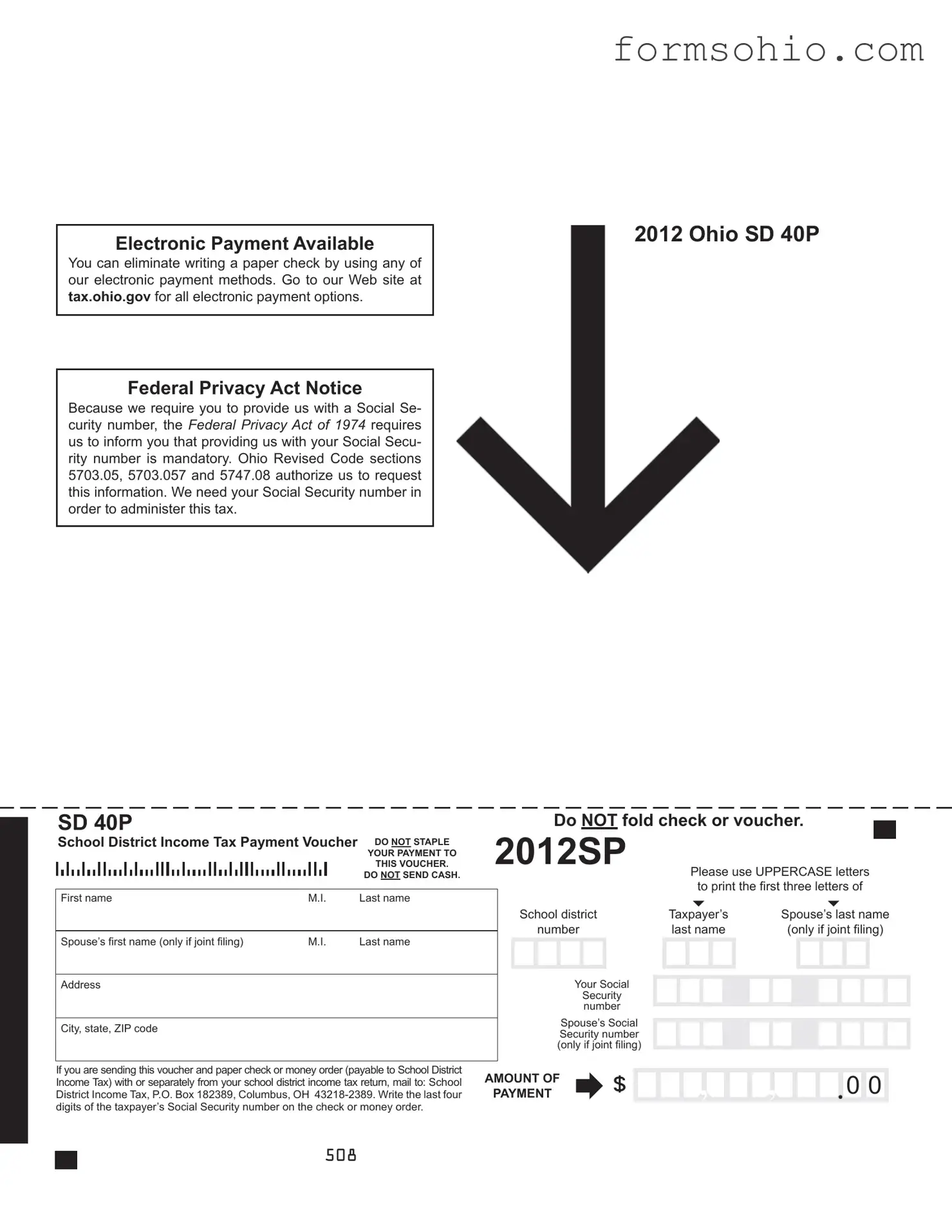

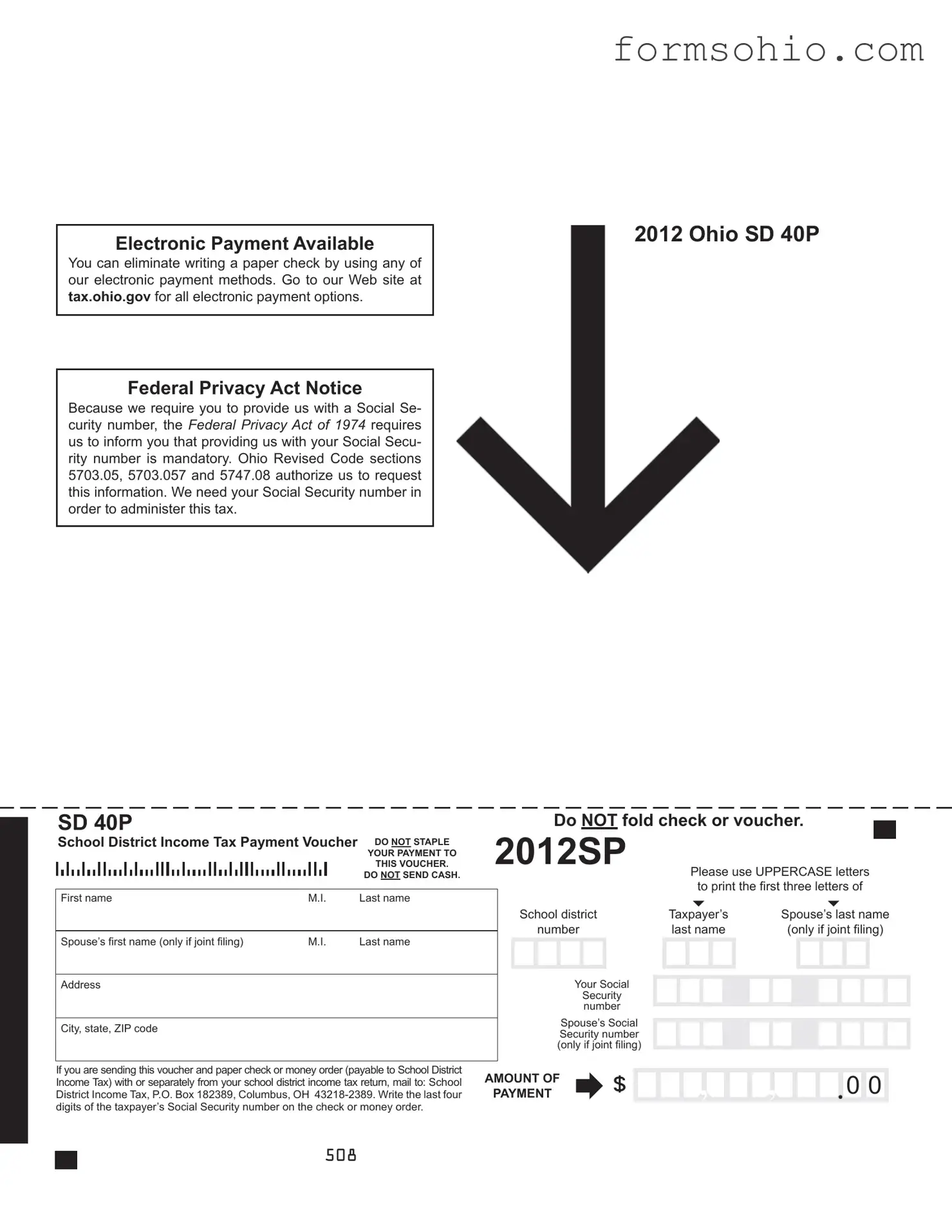

Fill a Valid Ohio Sd 40P Form

The Ohio SD 40P form is a School District Income Tax Payment Voucher used by residents to submit their income tax payments. This form requires important information, including your Social Security number, which is mandatory for processing. By using electronic payment options available on the Ohio Department of Taxation's website, you can simplify the payment process and avoid writing checks.

Get This Document Online

Fill a Valid Ohio Sd 40P Form

Get This Document Online

Complete this form efficiently and quickly

Complete Ohio Sd 40P online without printing hassles.

Get This Document Online

or

Free PDF File