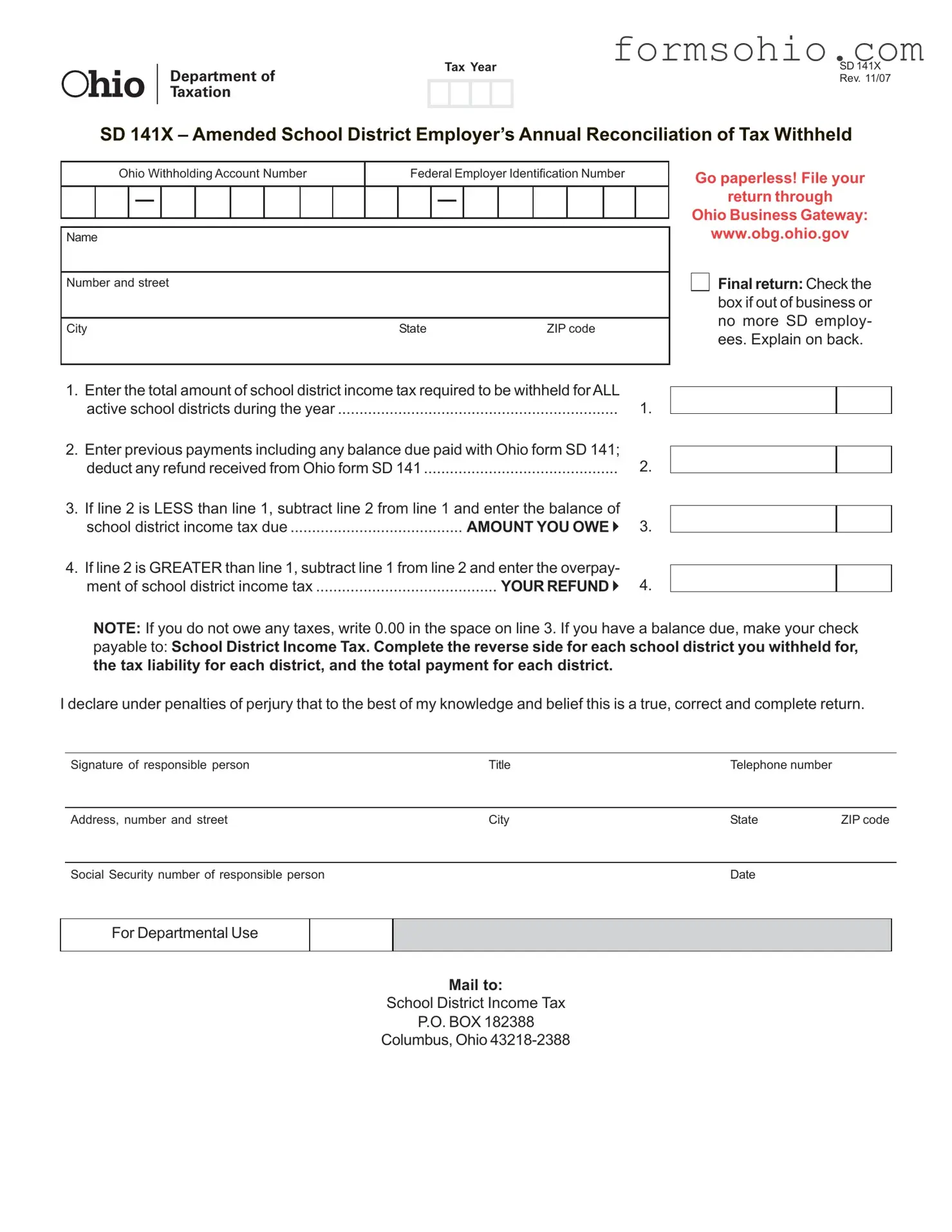

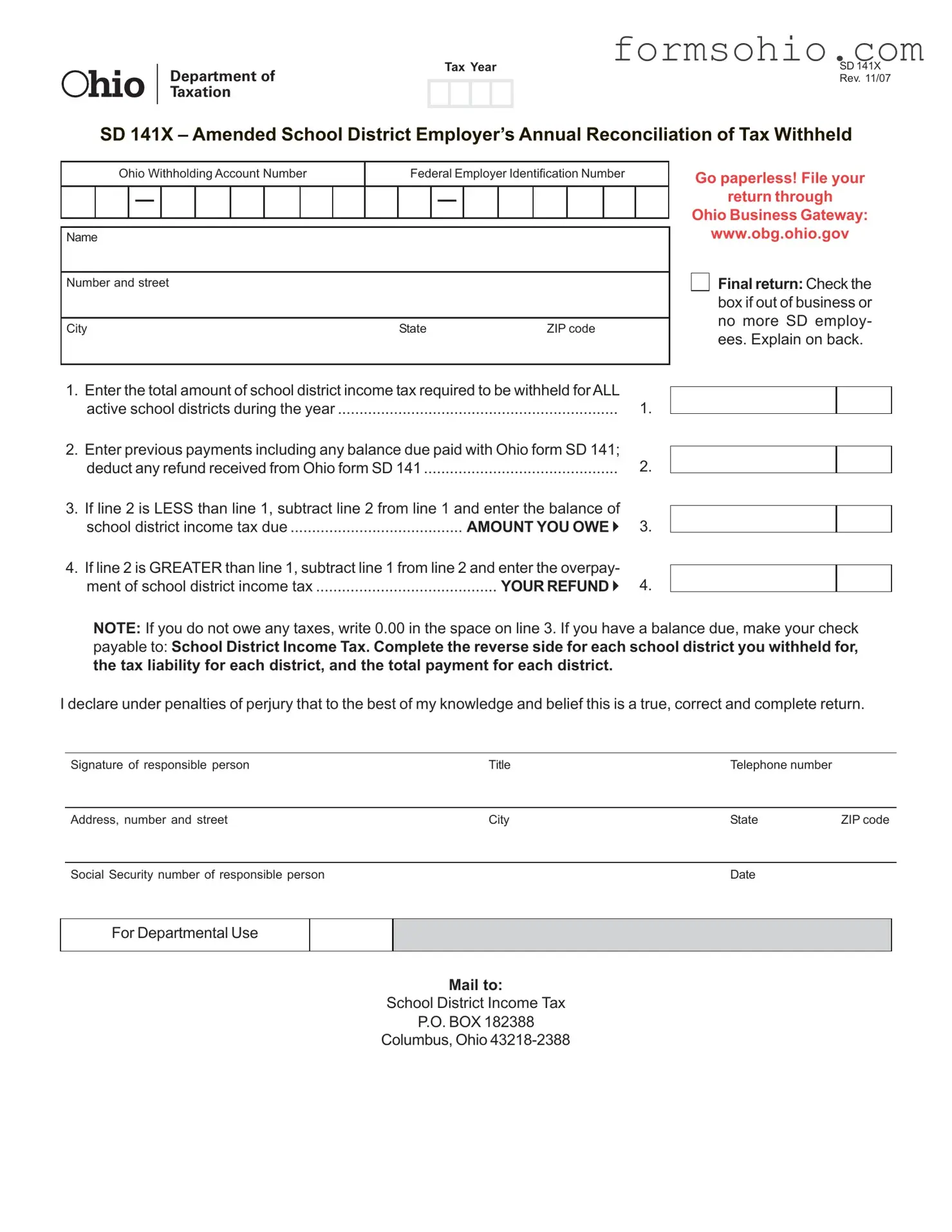

Filling out the Ohio SD 141X form can be a straightforward task, but many individuals make common mistakes that can lead to complications. One frequent error is failing to accurately report the total amount of school district income tax required to be withheld for all active school districts. This figure must reflect the cumulative total for the year, and any oversight can result in discrepancies.

Another mistake involves miscalculating previous payments. Line 2 requires individuals to enter all previous payments, including any balance due from the Ohio form SD 141. Some people neglect to deduct any refunds they received, leading to an inflated amount on this line. This miscalculation can throw off the entire reconciliation process.

People often confuse the instructions regarding lines 3 and 4. If the amount on line 2 is less than that on line 1, the individual should subtract line 2 from line 1 to determine the balance owed. Conversely, if line 2 exceeds line 1, the individual must calculate the overpayment. Failing to follow these instructions can result in incorrect amounts being reported, creating unnecessary confusion.

Another common error is neglecting to check the "Final return" box when applicable. If a business is out of operation or has no more employees subject to school district income tax, this box must be checked. Not doing so can lead to further inquiries from the tax department.

Many individuals also overlook the instruction to write "0.00" on line 3 if they do not owe any taxes. This seemingly minor detail is crucial for clarity and ensures that the form is processed correctly. Omitting this can suggest that the form is incomplete.

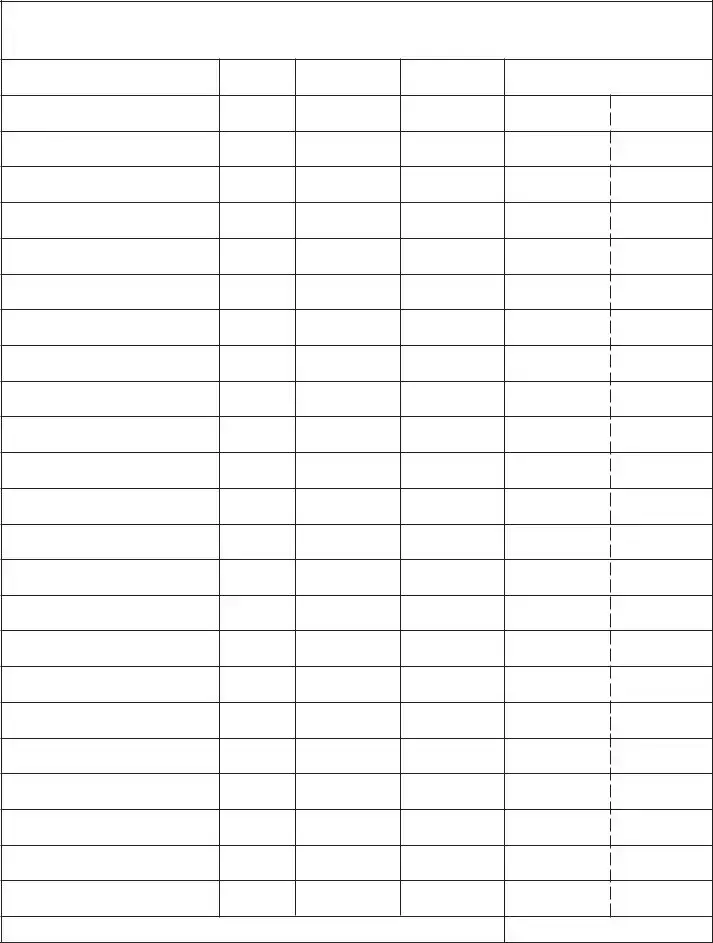

Completing the reverse side of the form is essential for those who have withheld for multiple school districts. Failing to list the total tax liability and payment for each district can lead to significant delays in processing. Each district's information must align with the totals on the front side of the return.

Signature errors frequently occur as well. The responsible person must sign the form, and it should include their title, telephone number, and address. Omitting any of this information can cause the form to be rejected or delayed.

Finally, individuals often forget to mail the form to the correct address. The School District Income Tax must be sent to P.O. BOX 182388 in Columbus, Ohio. Sending it to the wrong location can result in missed deadlines and penalties.

By being aware of these common mistakes, individuals can navigate the Ohio SD 141X form more effectively, ensuring a smoother reconciliation process and compliance with state requirements.

HIO

HIO