Filling out the Ohio SD 101 form can be a straightforward process, but many individuals make common mistakes that can lead to delays or complications. Understanding these pitfalls can help ensure a smoother submission. Here are eight frequent errors to avoid.

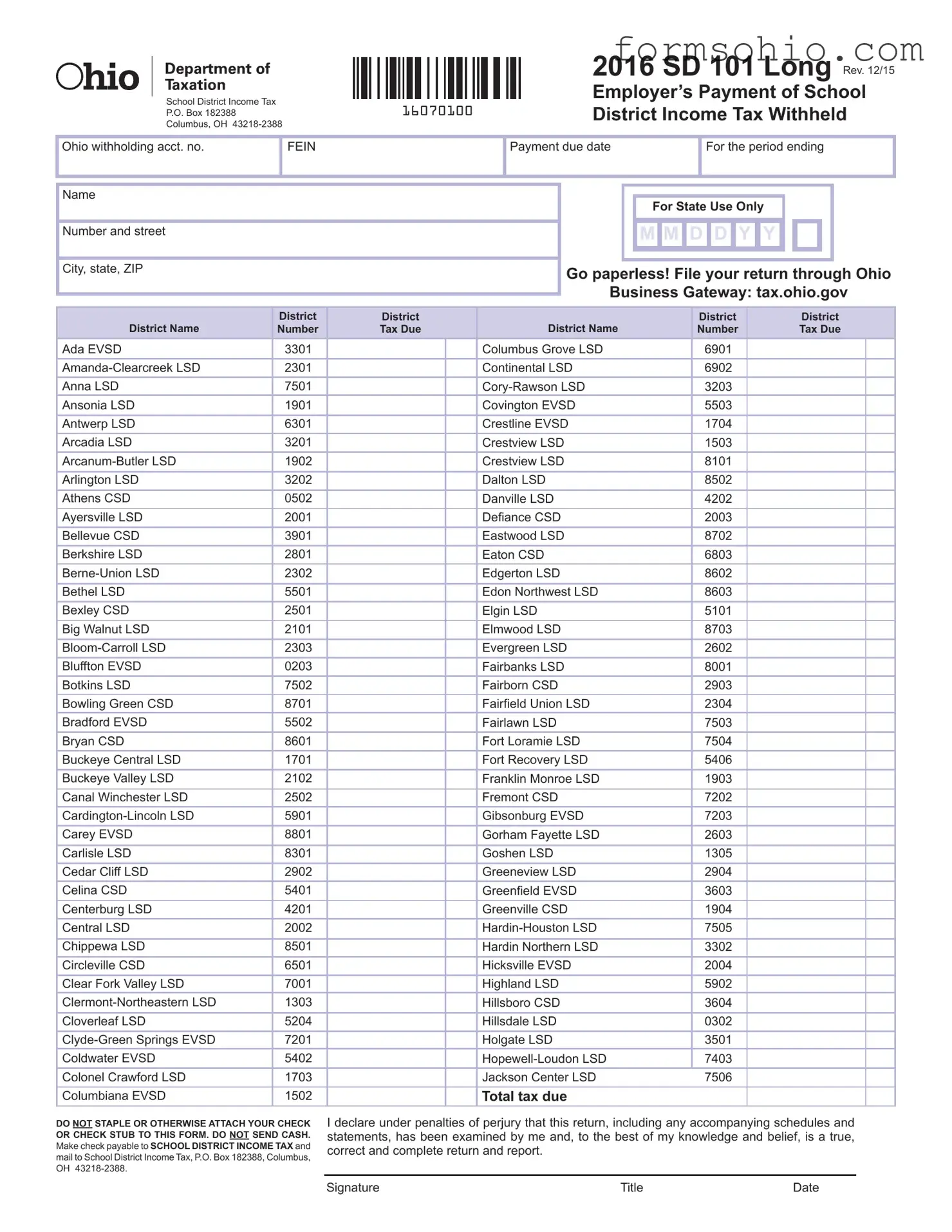

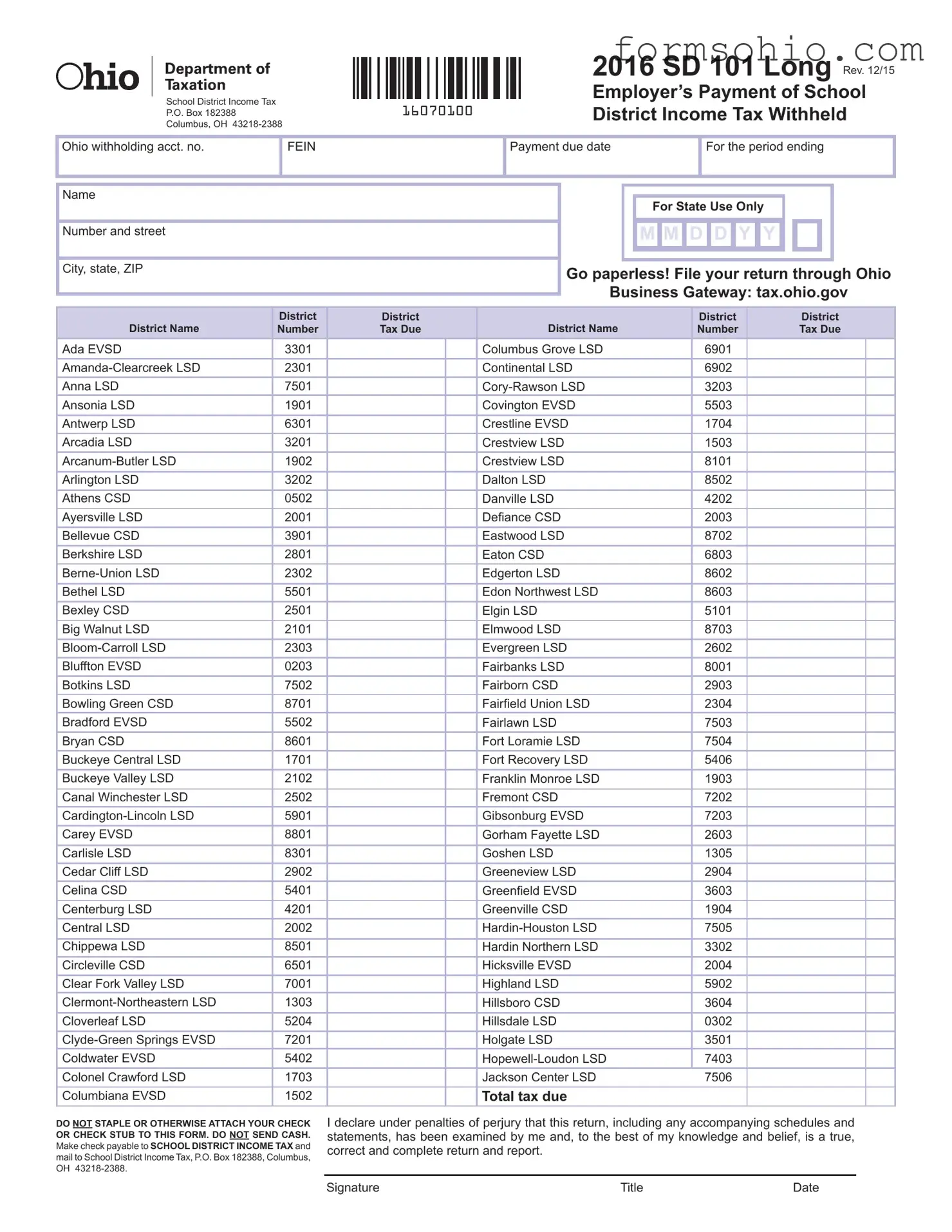

First, one of the most common mistakes is failing to provide accurate personal information. This includes the name, address, and Ohio withholding account number. If any of these details are incorrect, it can cause significant delays in processing the form. Always double-check this information before submitting.

Second, many people overlook the importance of selecting the correct school district. The form requires you to specify the district from which your income tax is withheld. Failing to do so can result in misallocated funds, which may lead to further complications in your tax records.

Another frequent error is neglecting to calculate the total tax due accurately. Some individuals may rush through this calculation or misinterpret the tax rates. Ensure that you take your time to verify your figures, as incorrect totals can lead to penalties or additional fees.

Additionally, individuals often forget to sign the form. The declaration at the end of the form is a crucial component. Without a signature, the form may be deemed incomplete, leading to delays in processing your return.

Moreover, some people mistakenly attach their payment to the form. The instructions clearly state that checks should not be stapled or attached in any manner. This oversight can result in the return being rejected or returned to the sender.

Another common mistake involves submitting the form late. Each year has specific deadlines for submission, and failing to meet these deadlines can result in penalties. Mark your calendar with important dates to avoid this issue.

Furthermore, many individuals do not keep copies of their submitted forms. It is essential to maintain a record of your submission for future reference. This practice can be invaluable if any discrepancies arise or if you need to provide proof of submission.

Lastly, some people disregard the option to file electronically through the Ohio Business Gateway. While paper submissions are still accepted, e-filing can be more efficient and may reduce the chances of errors. Consider this option to simplify the process.