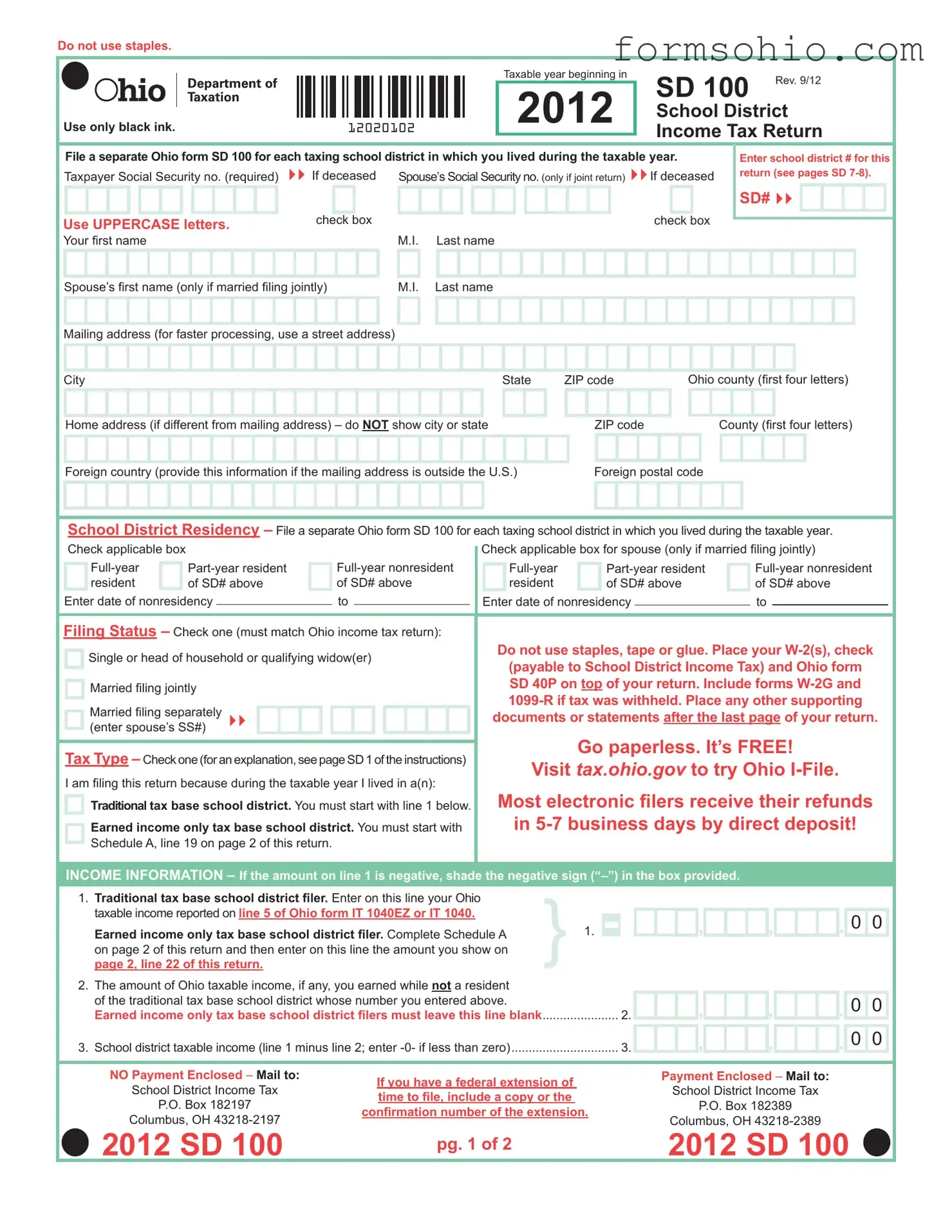

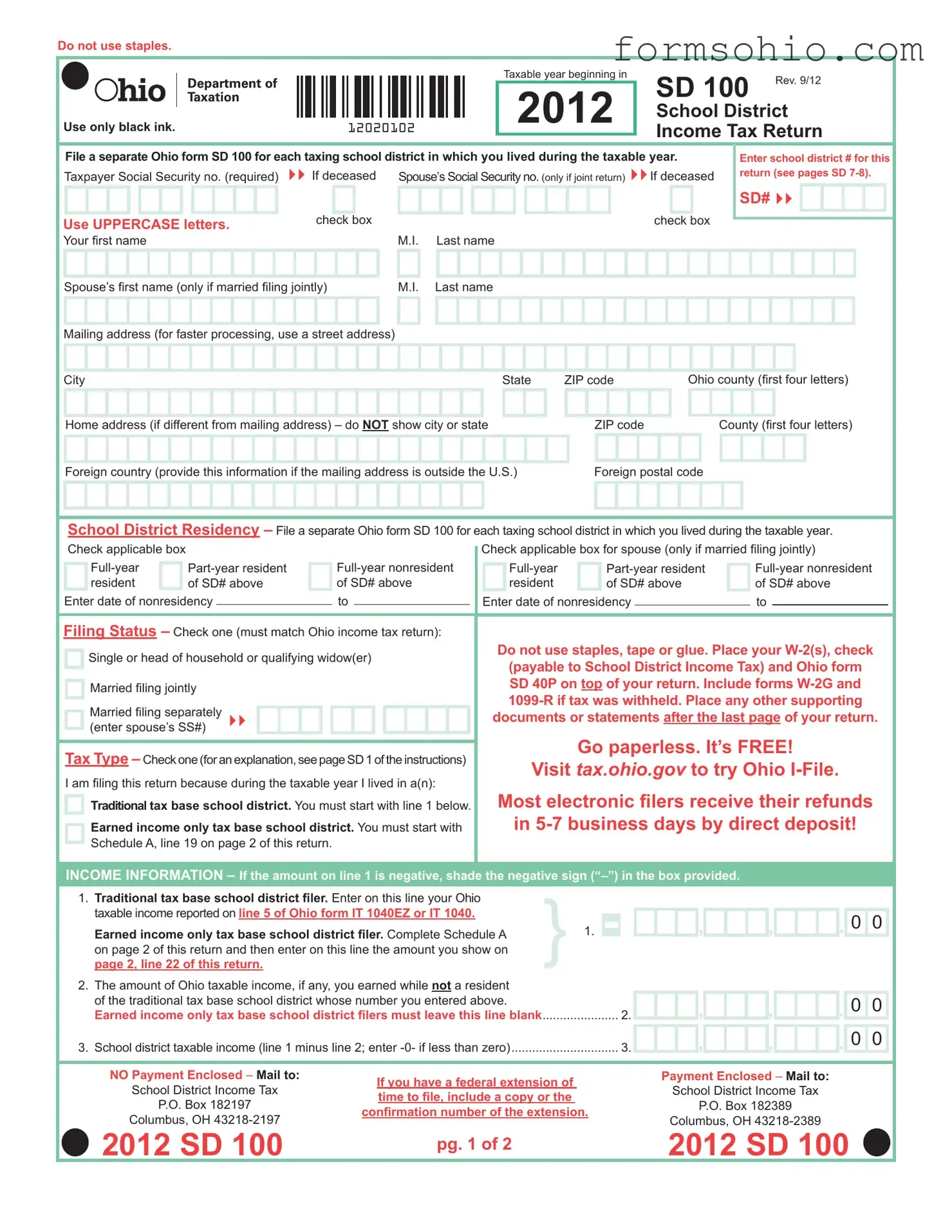

Fill a Valid Ohio Sd 100 Form

The Ohio SD 100 form is the School District Income Tax Return used by residents of Ohio to report their income and pay applicable school district taxes. Each taxpayer must file a separate SD 100 for every school district in which they resided during the taxable year. Understanding the requirements and details of this form is essential for accurate and timely tax filing in Ohio.

Get This Document Online

Fill a Valid Ohio Sd 100 Form

Get This Document Online

Complete this form efficiently and quickly

Complete Ohio Sd 100 online without printing hassles.

Get This Document Online

or

Free PDF File

2012 SD 100

2012 SD 100

,

,

,

,

.

.

,

,

,

,

.

.

,

,

Yes

Yes

No

No

,

,

,

,

2012 SD 100

2012 SD 100