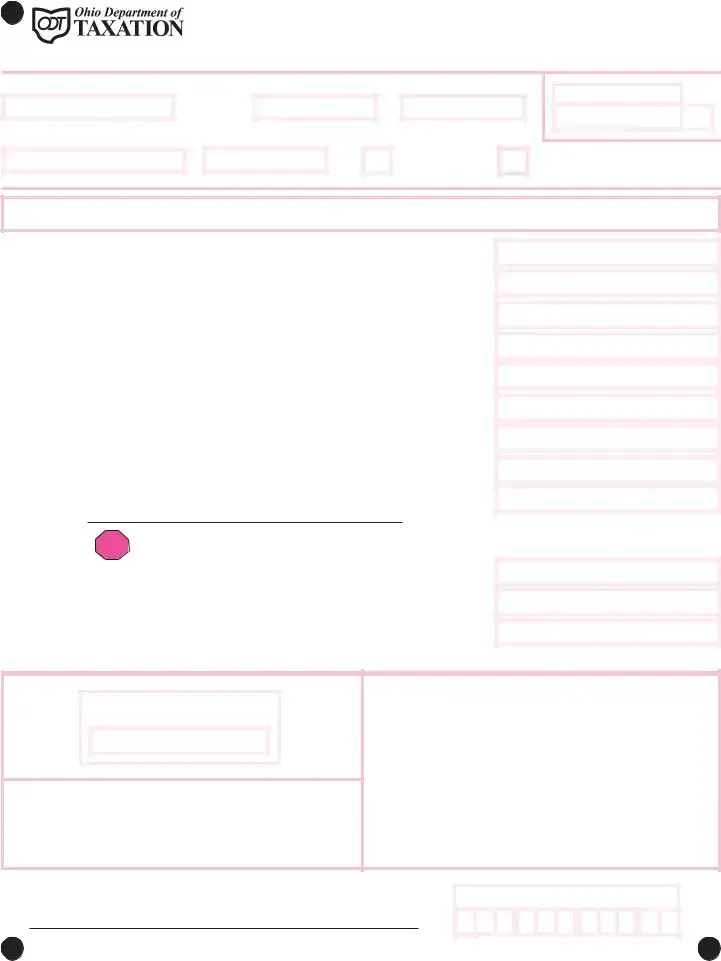

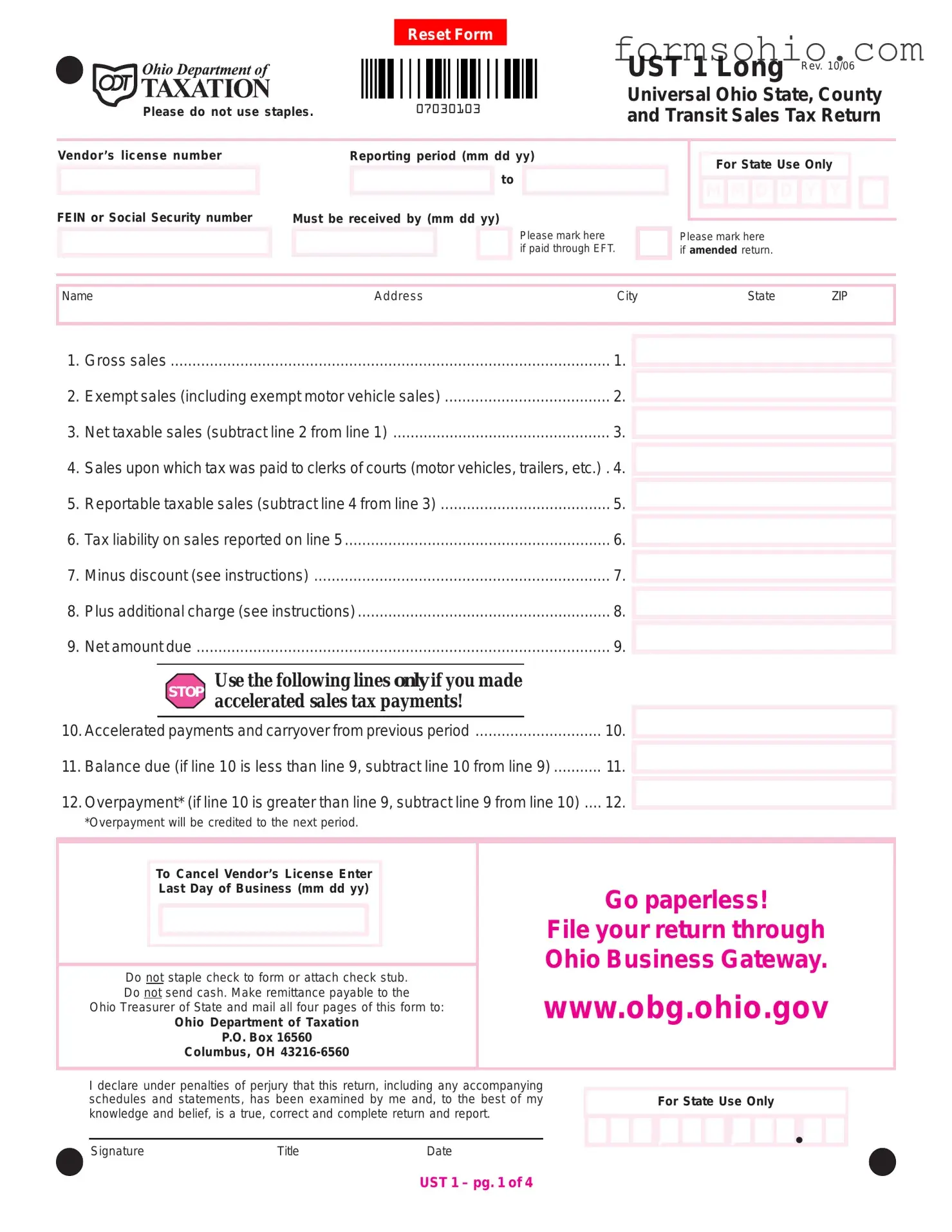

Filling out the Ohio Sales Tax UST 1 form can be straightforward, but there are common mistakes that individuals and businesses often make. One frequent error is failing to include the correct vendor's license number. This number is essential for identifying the business and ensuring that the tax return is processed accurately. If this number is missing or incorrect, it can lead to delays or issues with the return.

Another common mistake is neglecting to report the correct reporting period. Each return must specify the period for which sales are being reported. Omitting this information can result in confusion and may require additional communication with tax authorities. It is important to double-check that the dates are clearly indicated and formatted correctly.

Many people also forget to calculate their net taxable sales accurately. This is done by subtracting exempt sales from gross sales. Errors in this calculation can lead to incorrect tax liabilities. If the net taxable sales are miscalculated, it may result in either overpayment or underpayment of taxes, both of which can have consequences.

Additionally, some individuals overlook the need to report any sales upon which tax was already paid to clerks of courts. This line is crucial, especially for motor vehicles and trailers. Failing to include this information can inflate the taxable sales figure and lead to an incorrect tax liability.

Another mistake involves not properly accounting for discounts and additional charges. Line items for discounts and additional charges must be filled out based on the instructions provided. Ignoring these lines or miscalculating them can affect the final net amount due.

People sometimes forget to mark the appropriate boxes, such as indicating if the payment was made through electronic funds transfer (EFT) or if the return is amended. These markings help streamline processing and ensure that the return is handled correctly.

When it comes to the supporting schedule, some filers fail to complete it thoroughly. This schedule requires a breakdown of taxable sales and taxes on a county-by-county basis. Incomplete or incorrect information here can lead to discrepancies in the reported data.

Another common oversight is not signing the form. The declaration at the end of the return requires a signature, and failing to provide one can render the return invalid. This step is crucial, as it affirms that the information provided is accurate to the best of the filer's knowledge.

Moreover, many individuals mistakenly staple their checks or attach check stubs to the form. This is discouraged, as it can complicate processing. Instead, checks should be mailed separately to avoid any issues.

Lastly, some filers neglect to review the entire form before submission. Taking the time to review can help catch errors or omissions that might have been overlooked. A thorough check can save time and prevent potential complications with tax authorities later on.

M

M  D

D  D

D  Y

Y  Y

Y