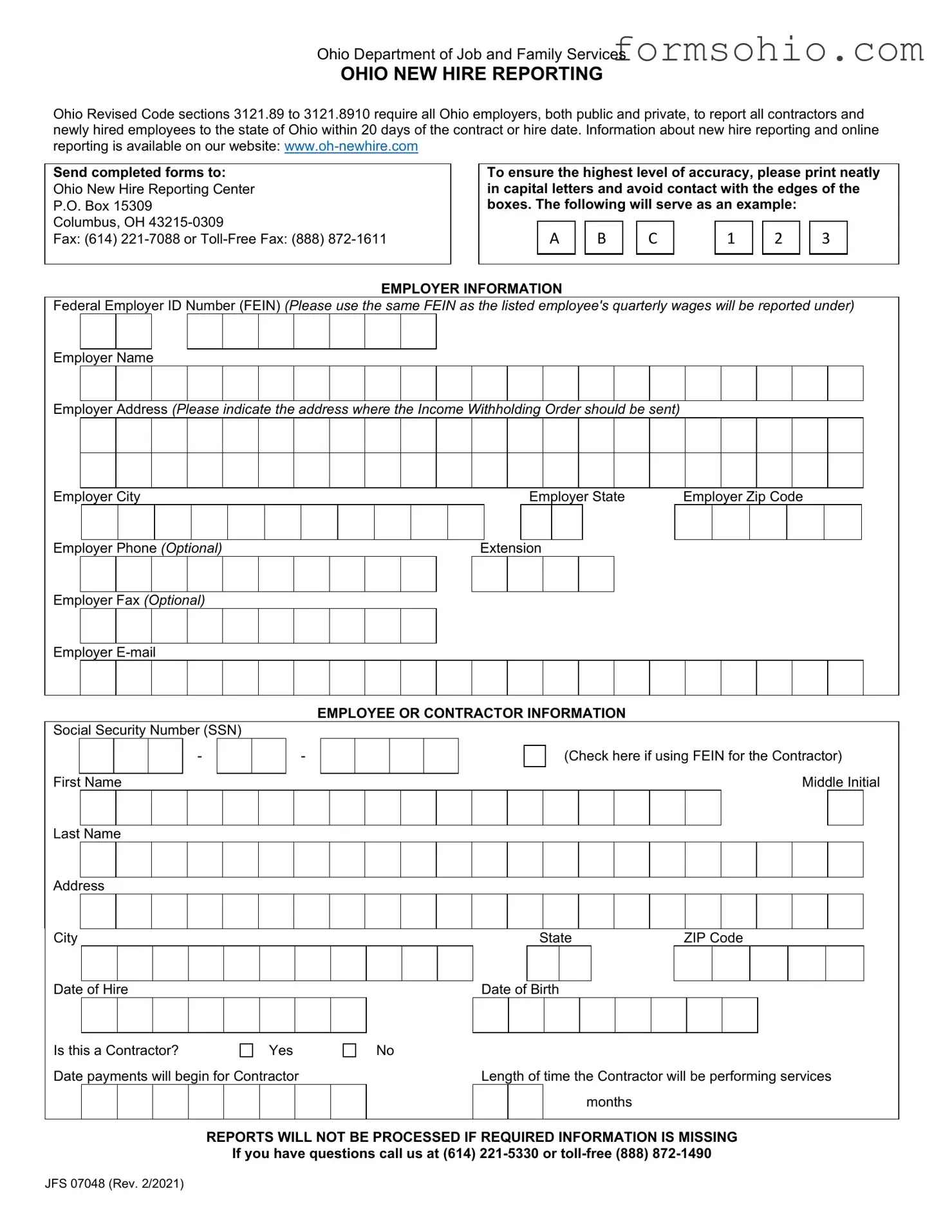

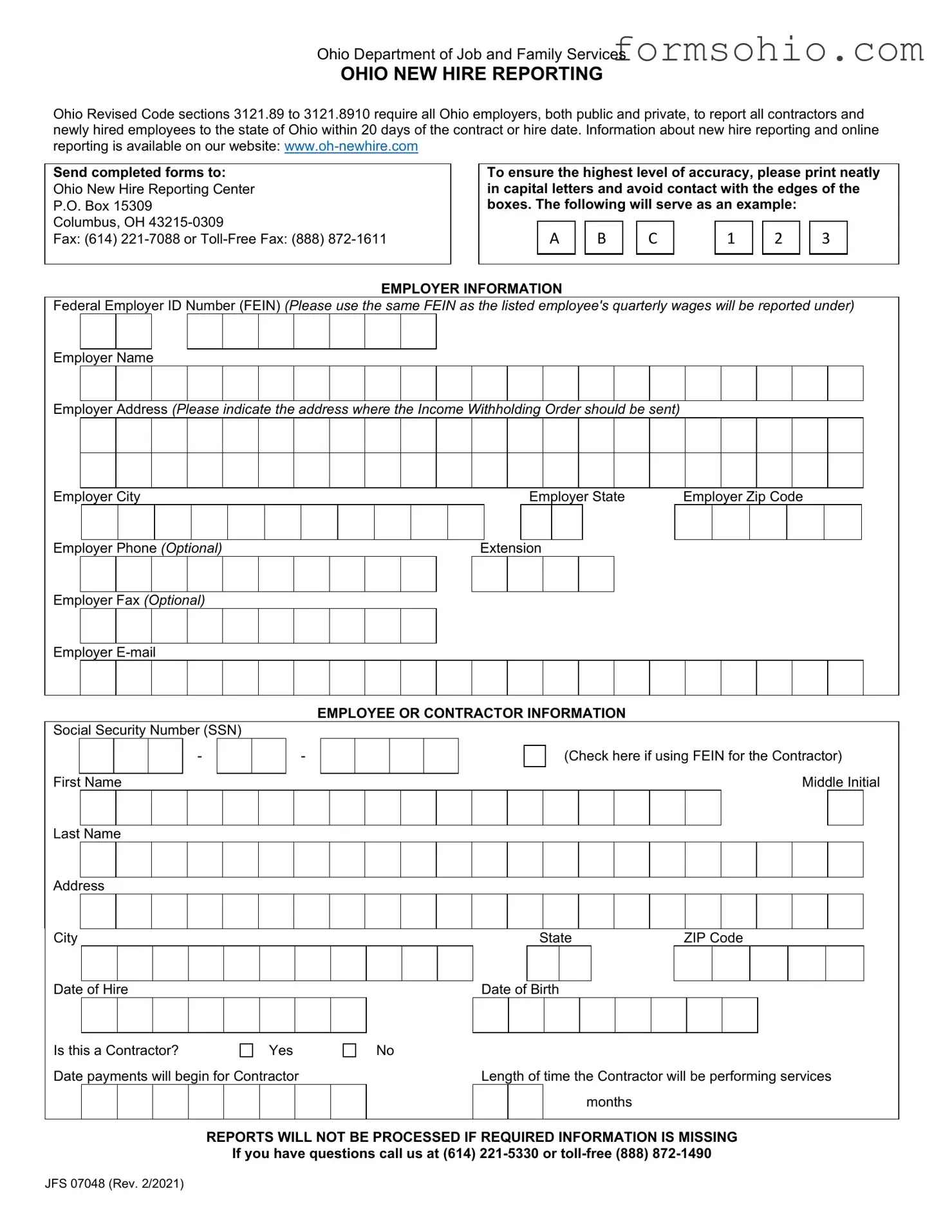

Filling out the Ohio New Hire Reporting form is a crucial step for employers, but many make common mistakes that can lead to delays or complications. One frequent error is failing to report new hires within the required 20-day window. Employers must ensure that they submit the form promptly after hiring to comply with state regulations.

Another common mistake is not using the correct Federal Employer ID Number (FEIN). This number must match the one used for reporting the employee's quarterly wages. Confusion or errors in this number can cause significant issues down the line, so double-checking it is essential.

Many people overlook the importance of providing complete employer information. Missing details such as the employer's name, address, or phone number can result in processing delays. It's vital to ensure that all sections are filled out accurately and completely.

When it comes to employee information, another mistake involves incorrectly entering the Social Security Number (SSN). An incorrect SSN can lead to problems with tax reporting and benefits. Therefore, it’s important to verify that this number is accurate before submission.

Some employers mistakenly check the box indicating that they are using the FEIN for contractors without actually providing the FEIN. This can lead to confusion and may result in the form being rejected. Always ensure that the appropriate boxes are checked based on the information provided.

Another frequent oversight is neglecting to indicate whether the new hire is a contractor. This distinction is crucial for proper classification and reporting. If this information is missing, it can complicate the processing of the form.

Employers sometimes forget to include the date of hire and the date of birth for the employee or contractor. These dates are essential for record-keeping and compliance, so they should never be overlooked.

In addition, some people fail to follow the instruction to print neatly in capital letters. Illegible handwriting can lead to misunderstandings and errors in processing. Taking the time to write clearly can save a lot of trouble later.

Lastly, not sending the completed form to the correct address is a common mistake. It’s crucial to ensure that the form is sent to the Ohio New Hire Reporting Center, as specified, to avoid any processing delays.

By being mindful of these common mistakes, employers can ensure a smoother reporting process and remain compliant with Ohio's new hire regulations.