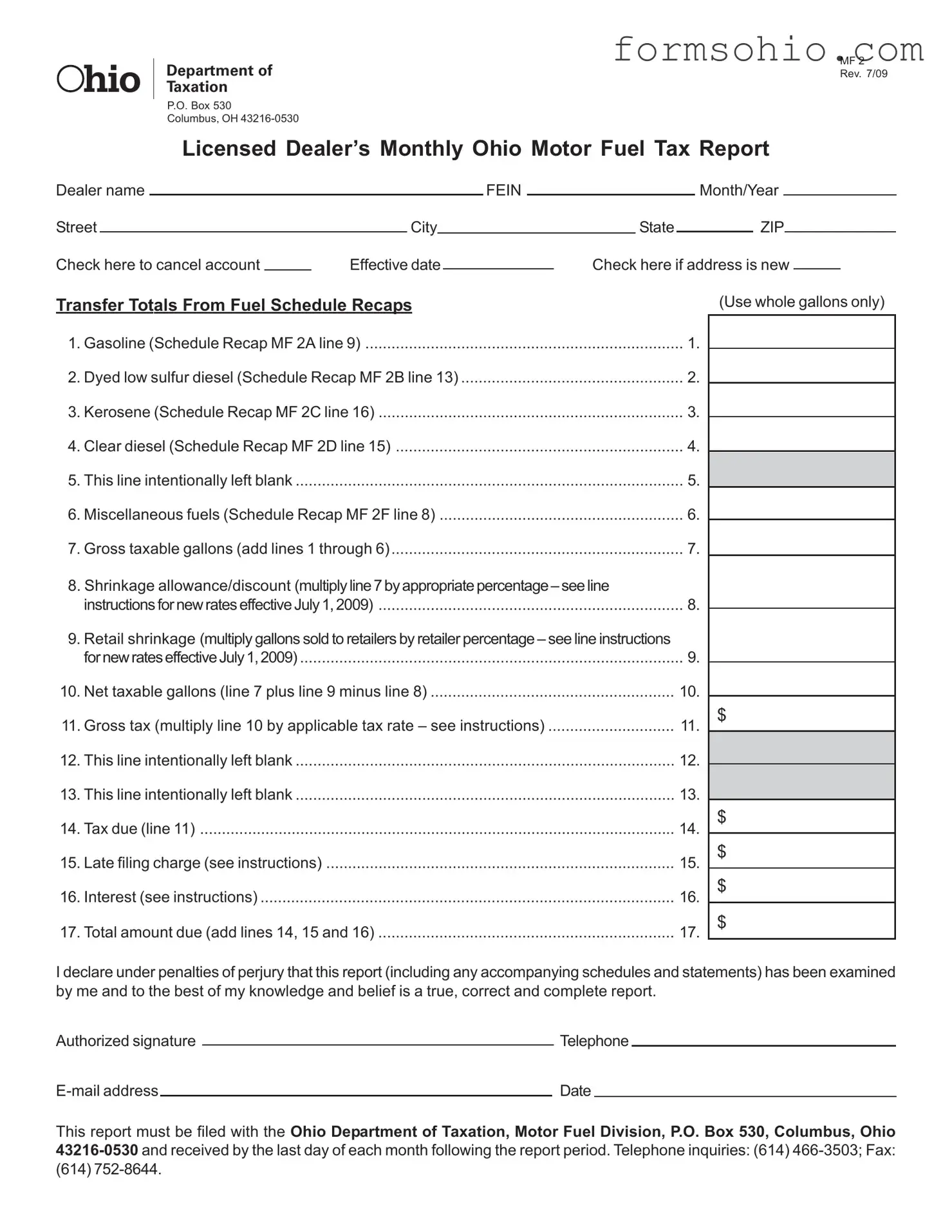

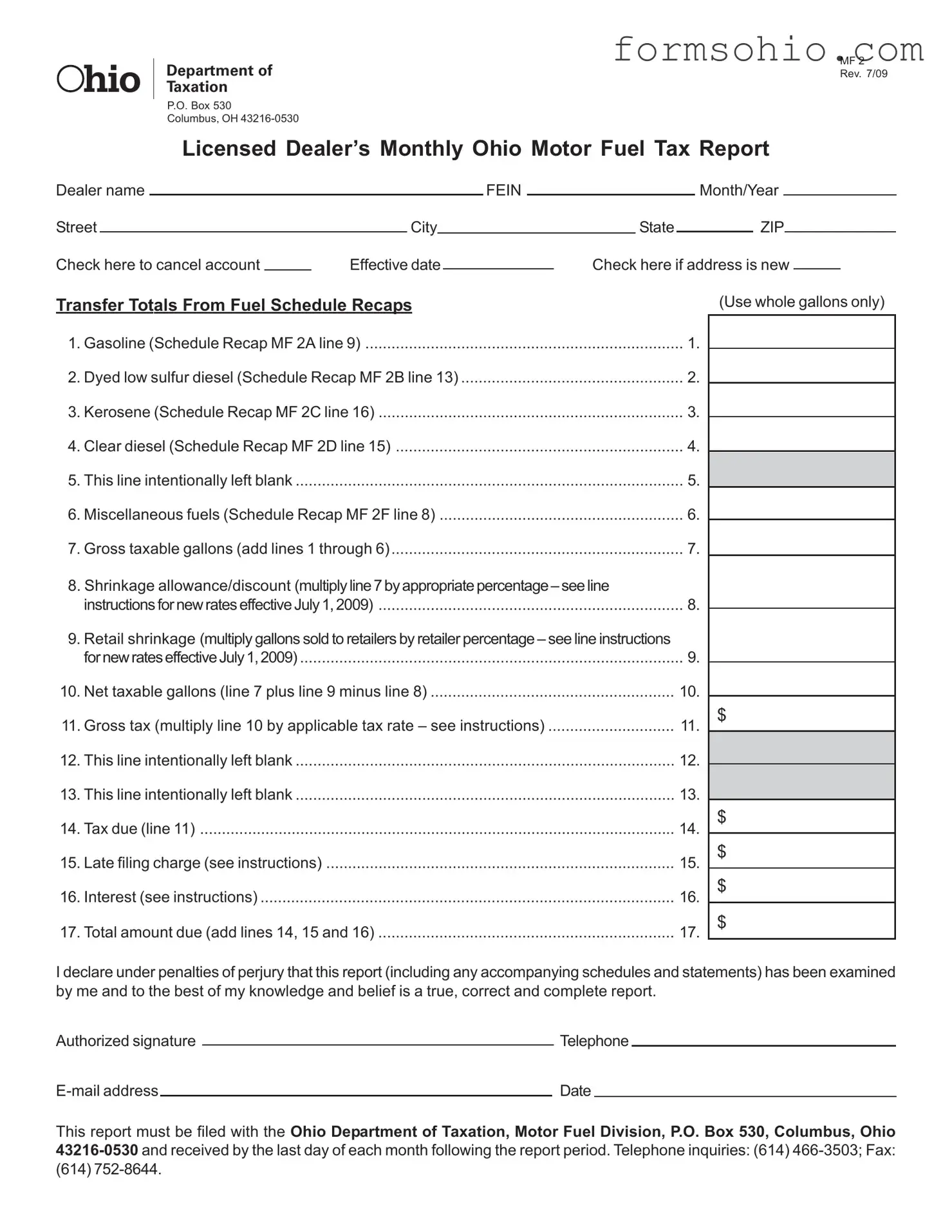

Filling out the Ohio MF 2 form can be a daunting task, and many individuals make mistakes that can lead to complications down the line. One common error is failing to accurately report the total gallons of fuel sold. It’s essential to ensure that each line corresponds to the correct schedule recap. For instance, if you report gasoline on line 1, but mistakenly reference a different line from another schedule, it can create discrepancies that may attract scrutiny.

Another frequent mistake involves the shrinkage allowance. Many people overlook the fact that this allowance only applies if the report is filed and paid on time. If you miss the deadline, you forfeit this benefit. Understanding the specific percentages that apply to your reporting period is critical. Miscalculating the shrinkage can lead to an inflated tax liability, which is something no one wants to face.

Additionally, individuals often neglect to include the retail shrinkage correctly. This is a percentage of the gallons sold to retail dealers, and it’s crucial to note that it should not include gallons sold to retail dealers licensed under your FEIN. Misunderstanding this requirement can lead to significant errors in the total taxable gallons reported.

Another area of concern is the tax rate applied to the gallons sold. Tax rates can change based on the reporting period, and failing to use the correct rate can result in underpayment or overpayment. It’s vital to double-check the current rates against the reporting period to ensure compliance.

People also frequently make the mistake of not signing the form. The declaration at the end of the form is not just a formality; it confirms that the information provided is accurate to the best of your knowledge. An unsigned form can lead to delays or rejections, causing unnecessary headaches.

Moreover, some individuals forget to check for any changes in their dealer information, such as a new address or account cancellation. This oversight can lead to miscommunication and further complications with the Department of Taxation.

Finally, failing to submit the form on time is perhaps the most critical mistake. The deadline is the last day of the month following the report period. Missing this deadline not only incurs late fees and interest but can also complicate future filings. Awareness of these common pitfalls can save you time, money, and stress in the long run.

HIO

HIO