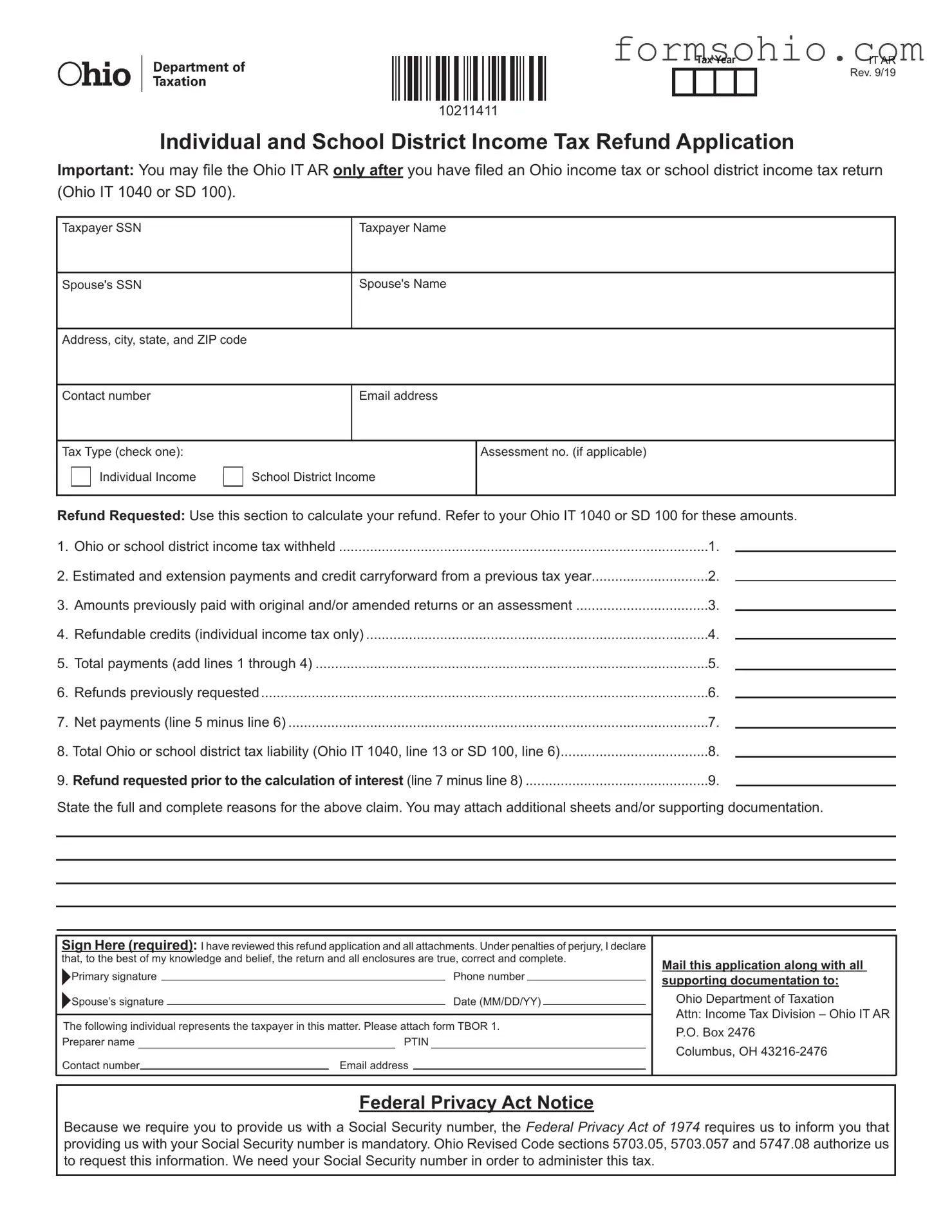

Fill a Valid Ohio It Ar Form

The Ohio IT AR form is an application used by taxpayers to request a refund of individual or school district income taxes. This form can only be submitted after filing an Ohio income tax return, such as the Ohio IT 1040 or SD 100. By completing the IT AR, taxpayers can calculate their refund amounts based on various payments and credits associated with their tax filings.

Get This Document Online

Fill a Valid Ohio It Ar Form

Get This Document Online

Complete this form efficiently and quickly

Complete Ohio It Ar online without printing hassles.

Get This Document Online

or

Free PDF File