When filling out the Ohio IT 942 form, individuals often encounter several common mistakes that can lead to delays or issues with their submissions. Understanding these pitfalls can help ensure a smoother filing process.

One significant mistake is inaccurate information entry. Many people overlook the importance of double-checking details such as the Company Name and Federal Employer Identification Number (FEIN). Even a minor typo can result in complications, such as mismatches in the state’s records. It is crucial to verify that all entries are correct before submitting the form.

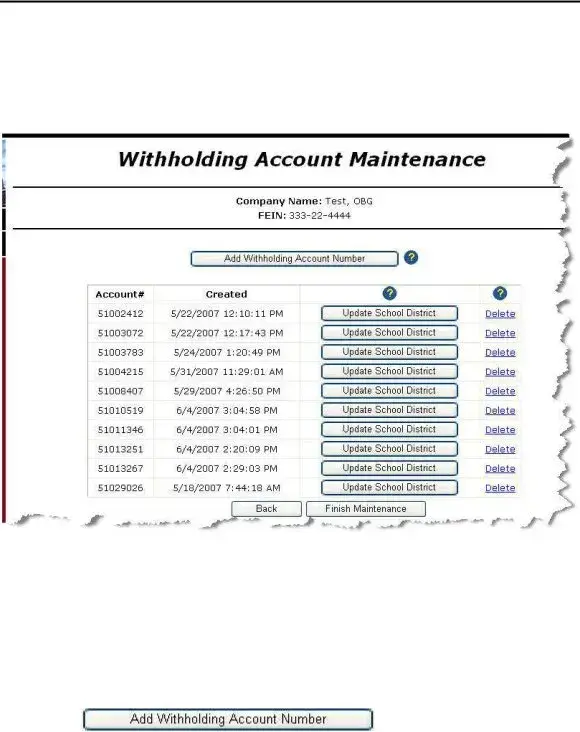

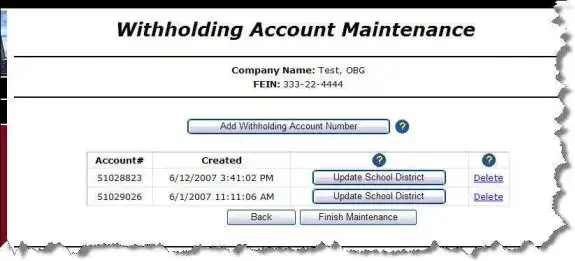

Another frequent error involves neglecting to associate accounts properly. Each Company/FEIN must have at least one withholding account linked to it. Failing to do so can prevent the filing of withholding reports, which could lead to penalties. Ensure that every company has the appropriate account number associated with it.

Some individuals also make the mistake of not following the specific instructions provided in the form. The Ohio IT 942 form contains detailed guidelines for completing each section. Skipping over these instructions can lead to incomplete or incorrect submissions. Take the time to read through the instructions carefully to avoid unnecessary errors.

Moreover, forgetting to save changes before exiting the form is another common oversight. Many users assume that their information is automatically saved, but this is not always the case. Always look for a confirmation that your changes have been saved before leaving the page.

Another mistake is inadequate documentation. Some filers fail to include necessary supporting documents or details that might be required for a complete submission. It is essential to gather all relevant paperwork and ensure that everything needed is included with the form to avoid processing delays.

Lastly, individuals often miss deadlines for filing the Ohio IT 942 form. Being aware of the due dates and planning ahead can prevent last-minute rushes and potential errors. Setting reminders can be an effective way to ensure timely submissions.

By being mindful of these common mistakes, individuals can enhance their experience when completing the Ohio IT 942 form, leading to a more efficient filing process and peace of mind.

to display the

to display the  to display the

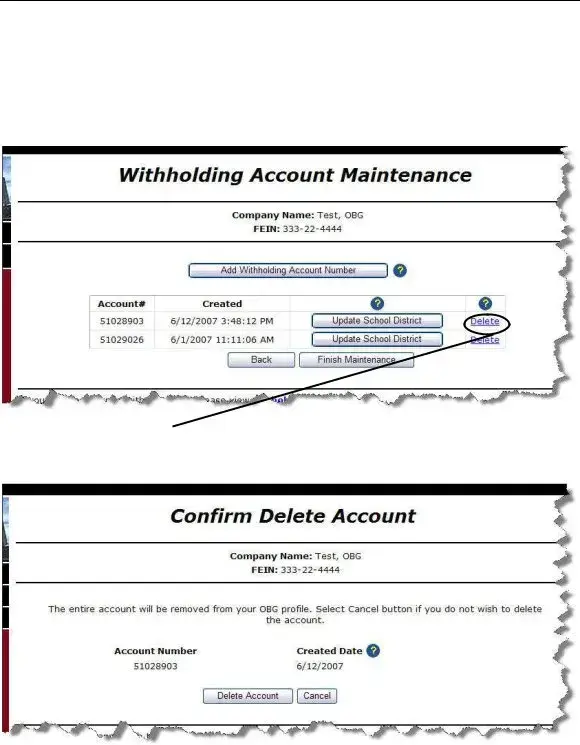

to display the  . The system saves the information and returns to the

. The system saves the information and returns to the

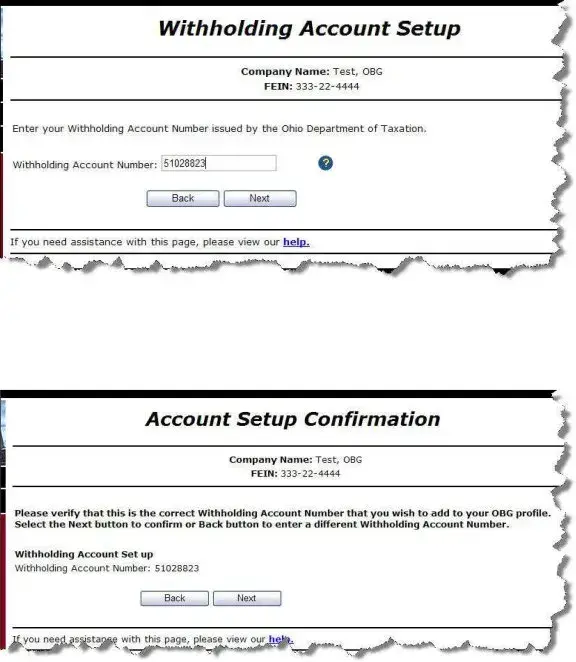

. The system displays the

. The system displays the

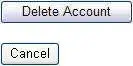

. The system asks you to verify that you want to add this account number to your profile.

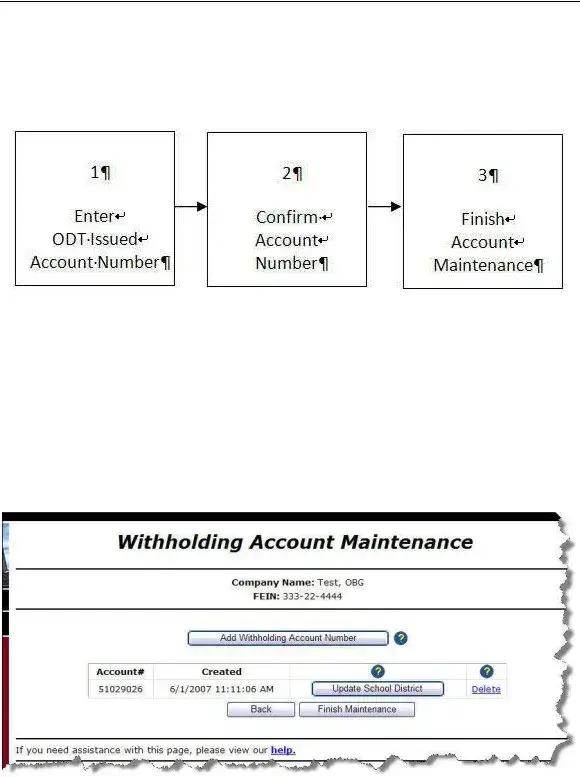

. The system asks you to verify that you want to add this account number to your profile. to verify that you want to add this account number to your profile. The system returns to the Withholding Account Maintenance page and displays the added account number in your list of profile accounts.

to verify that you want to add this account number to your profile. The system returns to the Withholding Account Maintenance page and displays the added account number in your list of profile accounts.

to return to the

to return to the