-

What is the Ohio IT 941 form?

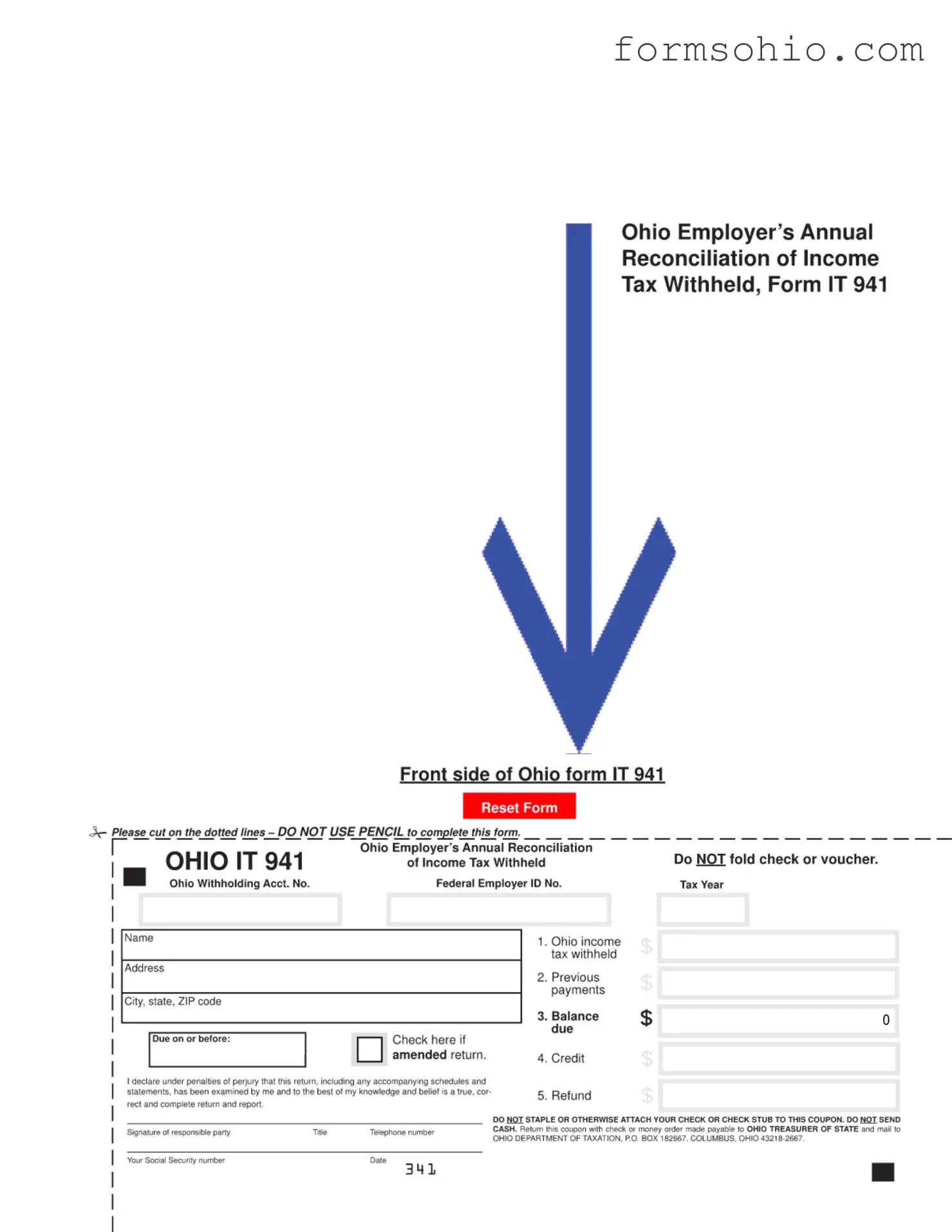

The Ohio IT 941 form is known as the Employer’s Annual Reconciliation of Income Tax Withheld. This form is used by employers in Ohio to report the total amount of income tax that has been withheld from employees' wages throughout the year. It serves as a summary of all withholding activity for the tax year.

-

Who needs to file the Ohio IT 941 form?

Any employer in Ohio who has withheld state income tax from employee wages during the year is required to file the IT 941 form. This includes businesses of all sizes, as long as they have employees subject to Ohio income tax withholding.

-

When is the Ohio IT 941 form due?

The form must be submitted annually, with a deadline typically set for January 31st of the following year. This means that for the tax year 2023, the form would be due by January 31, 2024. It is crucial to meet this deadline to avoid penalties.

-

How do I complete the Ohio IT 941 form?

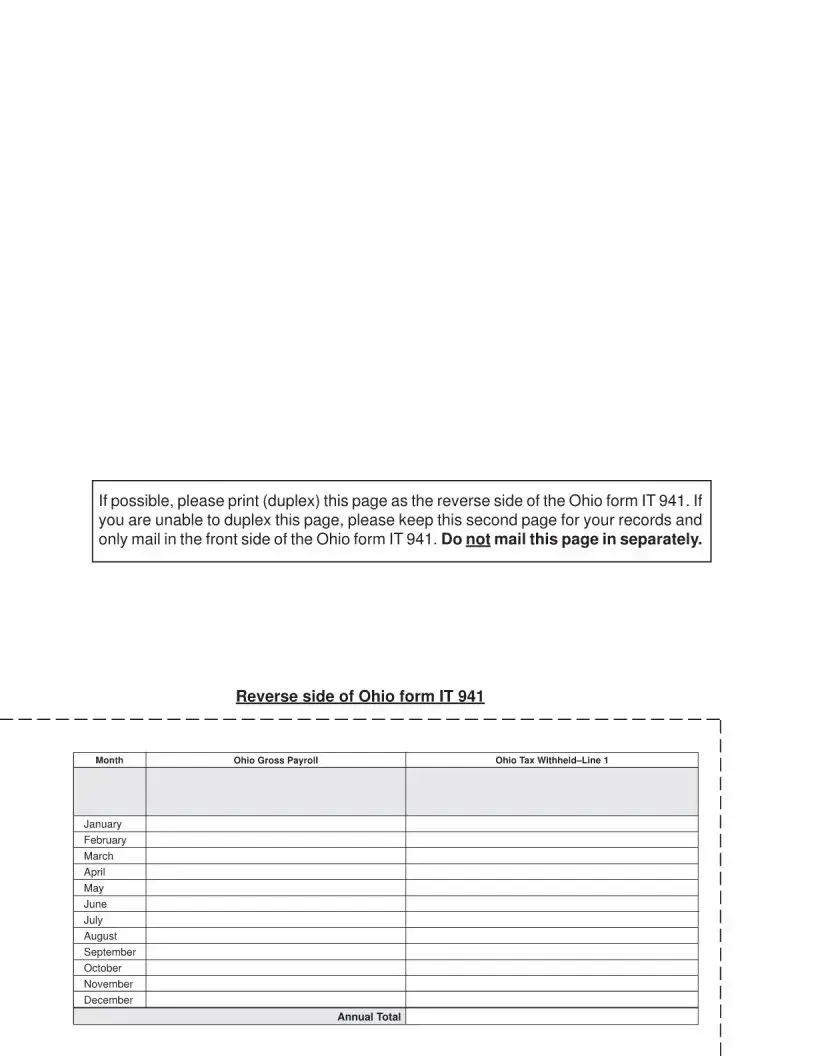

To complete the IT 941 form, employers need to accurately report the total gross payroll for each month of the year, along with the total tax withheld. The form includes specific lines for each month, culminating in an annual total. Ensure that all entries are made in ink, as pencil is not permitted.

-

What information is required on the form?

Essential information includes the Ohio Withholding Account Number, Federal Employer Identification Number (EIN), tax year, and the total amounts for gross payroll and tax withheld for each month. Additionally, the responsible party must sign the form to certify its accuracy.

-

Where do I send the completed Ohio IT 941 form?

Once completed, the IT 941 form should be mailed to the Ohio Department of Taxation at P.O. Box 182667, Columbus, Ohio 43218-2667. It is important to send it without staples or attachments, and to include any payment due, made out to the Ohio Treasurer of State.

-

What if I made an error on my Ohio IT 941 form?

If you discover an error after submitting the form, you should file an amended return. This can usually be done by submitting a corrected IT 941 form with the appropriate changes. Be sure to include a note explaining the corrections made.

-

Are there penalties for late filing or non-filing?

Yes, there are penalties for failing to file the IT 941 form on time or for not filing it at all. These penalties can include fines and interest on any unpaid taxes. It is advisable to file the form even if you cannot pay the full amount owed to minimize penalties.

-

Can I file the Ohio IT 941 form electronically?

Currently, the Ohio IT 941 form must be filed on paper. However, employers may be able to use third-party payroll services that offer electronic filing options. Always check the latest guidelines from the Ohio Department of Taxation for updates on electronic filing capabilities.

-

What should I keep for my records after filing?

After submitting the IT 941 form, it is important to retain a copy for your records. Additionally, keep documentation of all payroll records, tax withheld, and any correspondence with the Ohio Department of Taxation. This can be beneficial in case of an audit or for future reference.