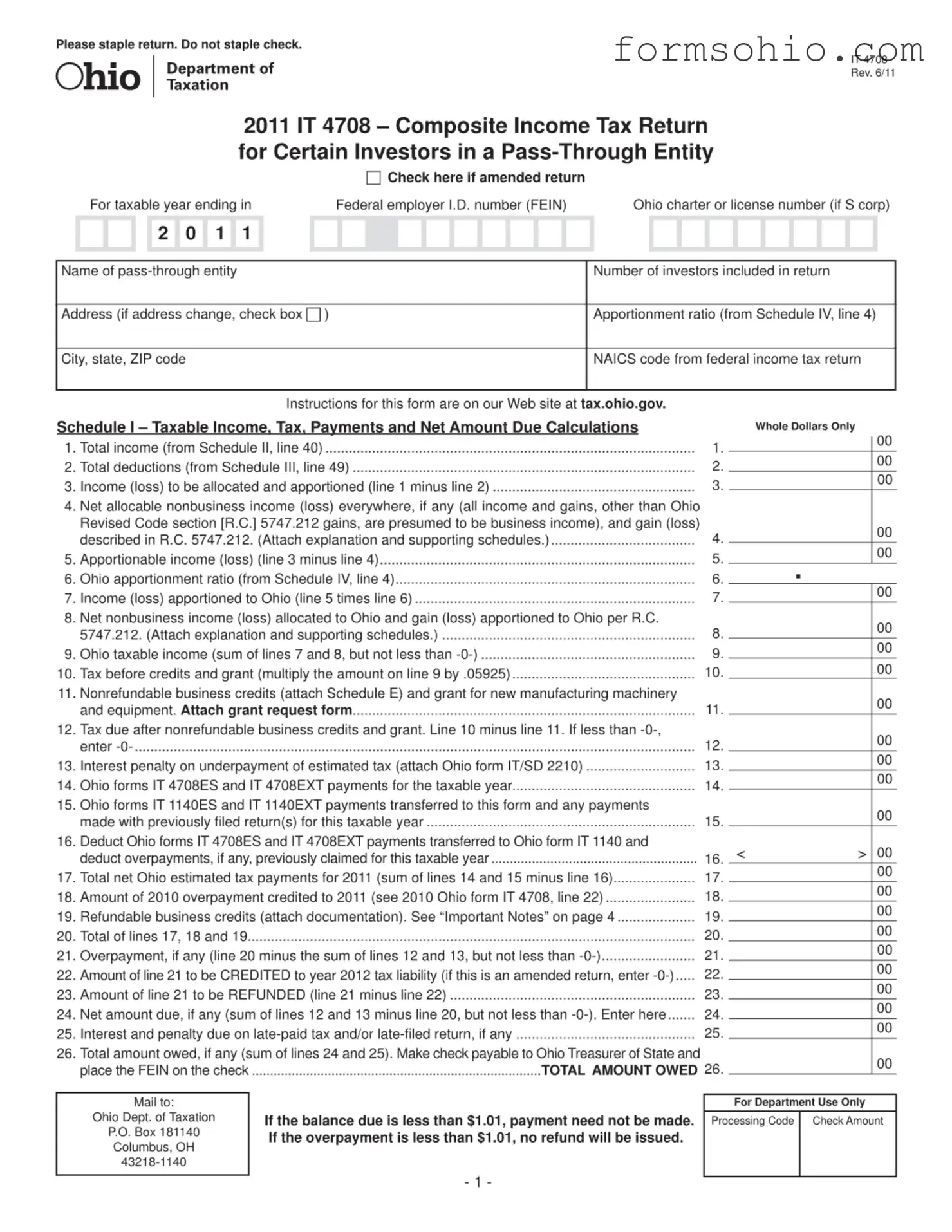

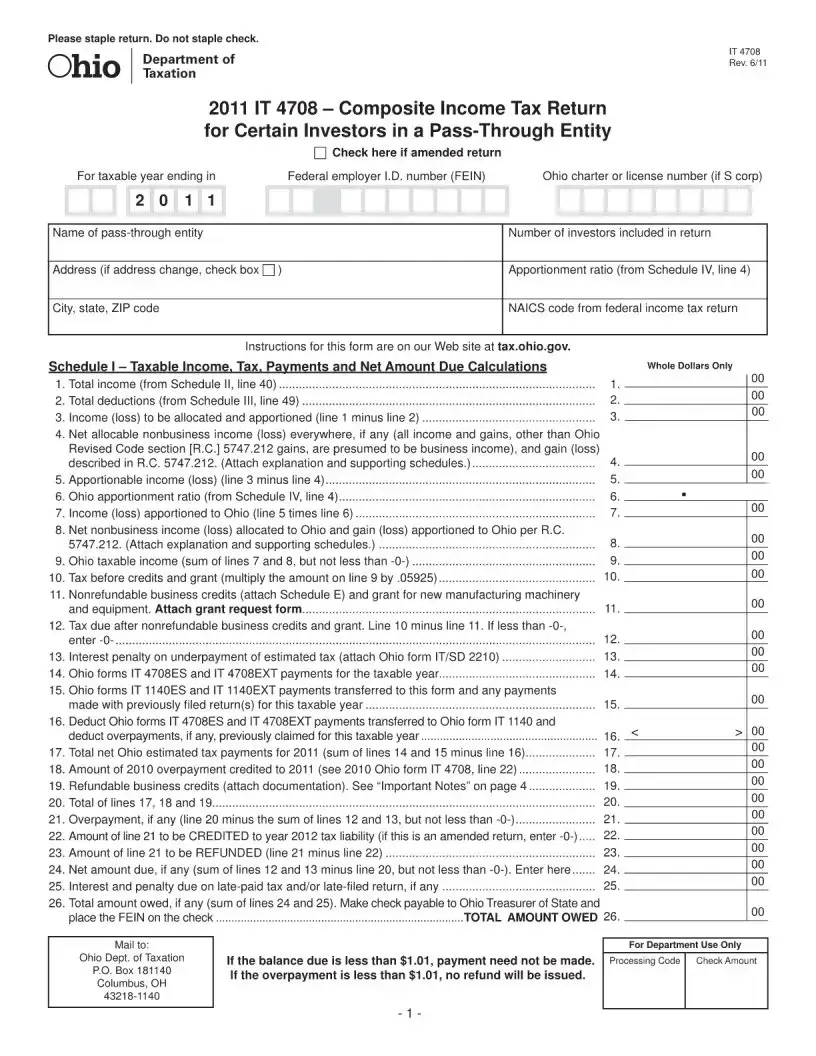

Fill a Valid Ohio It 4708 Form

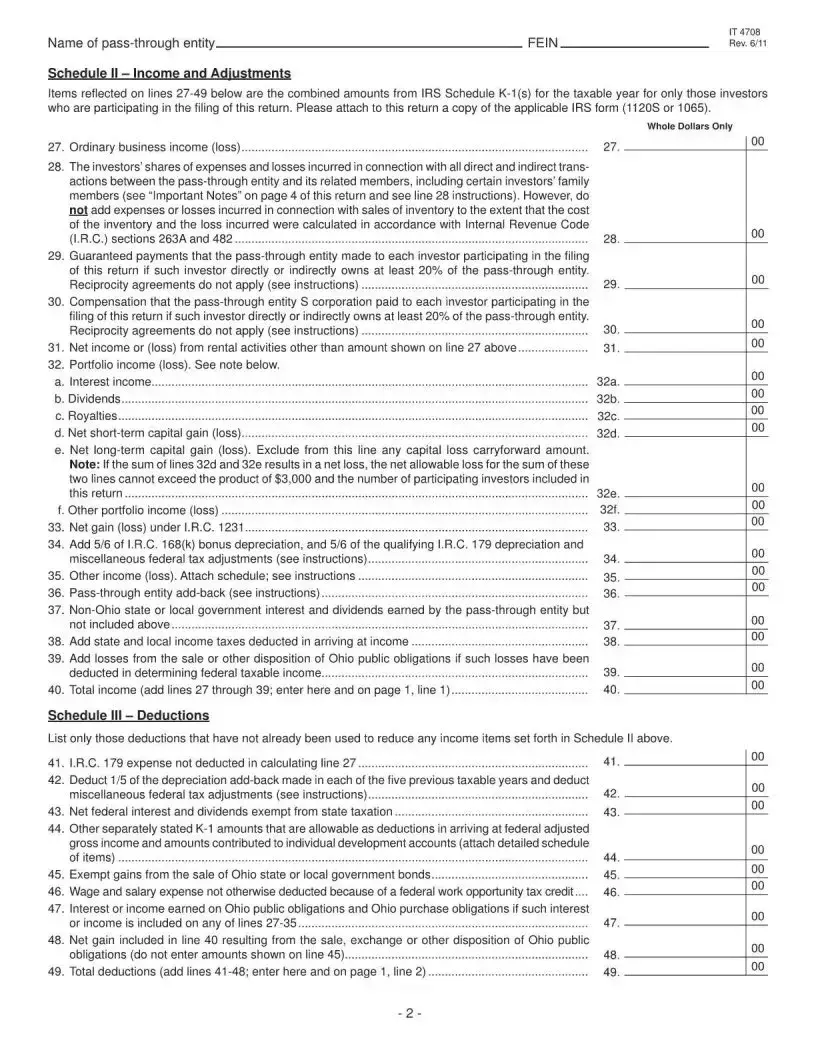

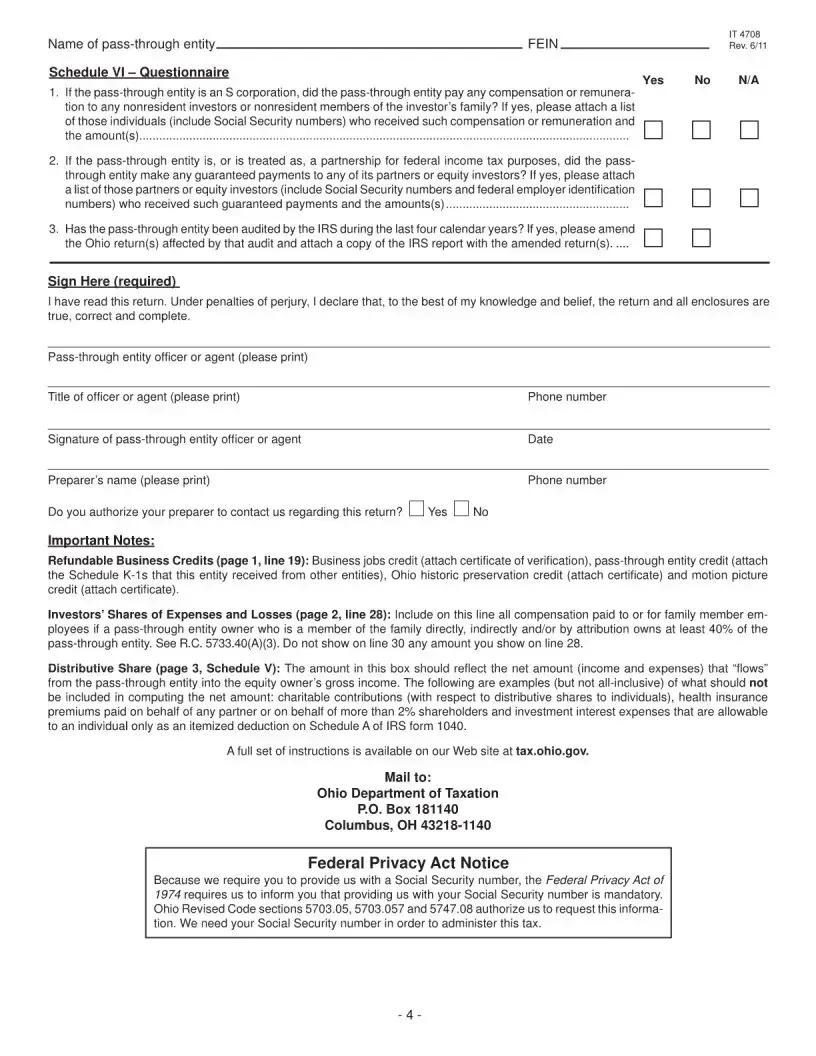

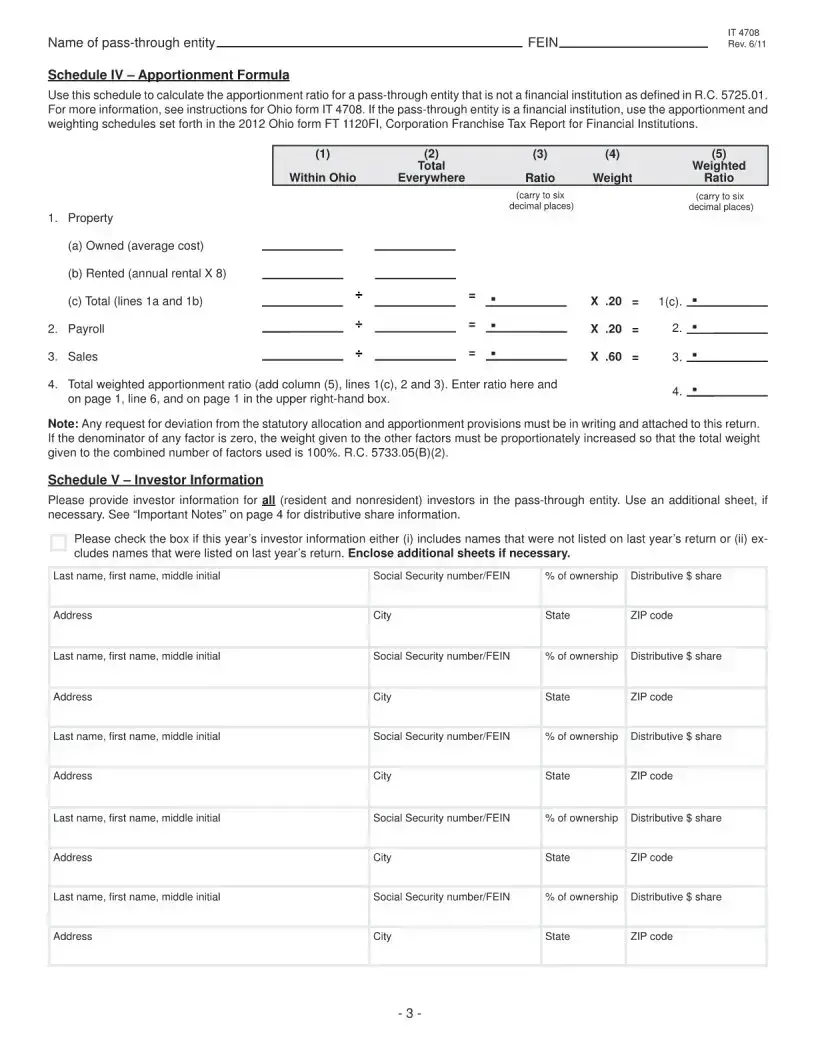

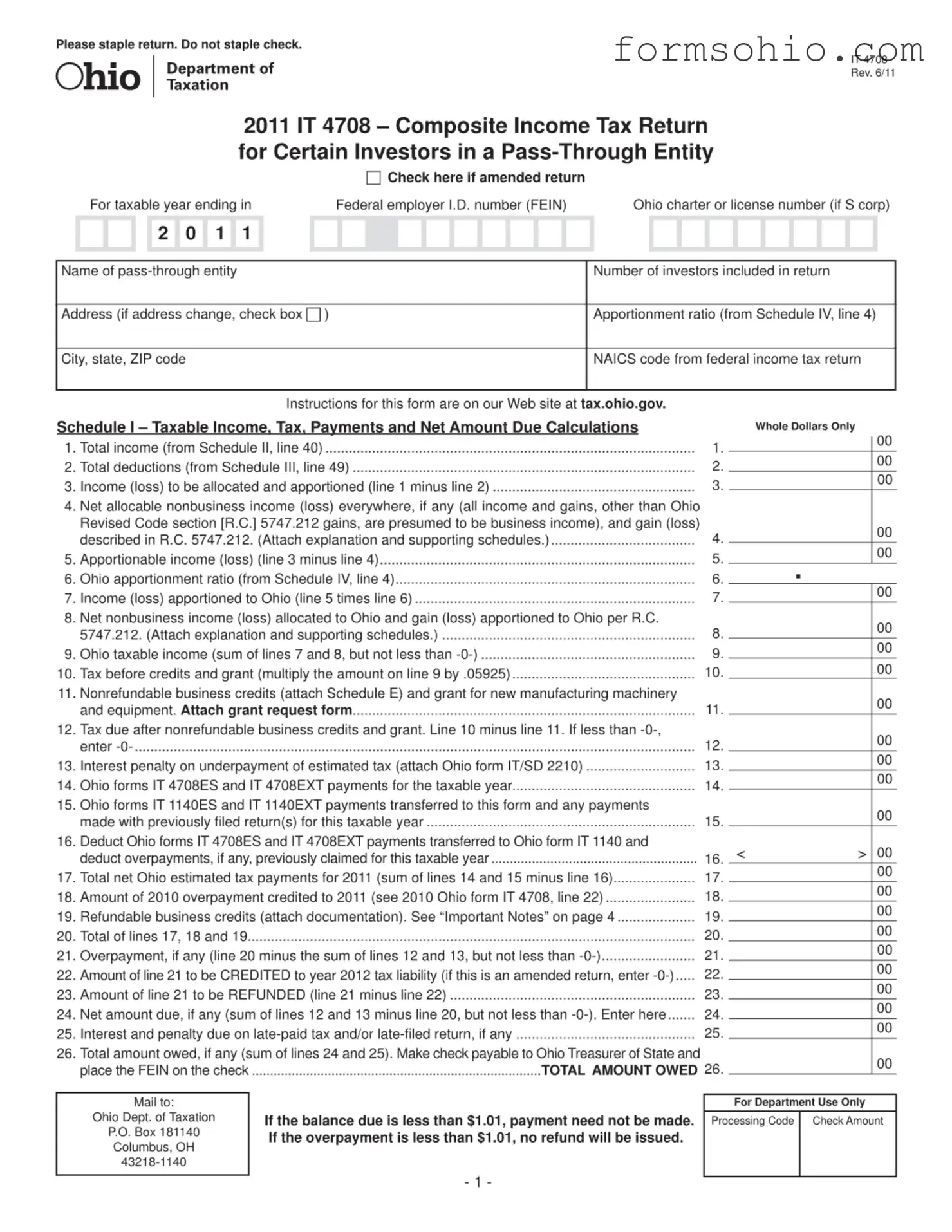

The Ohio IT 4708 form is a composite income tax return designed for certain investors in a pass-through entity. This form allows multiple investors to file a single return, simplifying the tax process for those involved. Understanding how to complete the IT 4708 is essential for ensuring compliance and maximizing potential tax benefits.

Get This Document Online

Fill a Valid Ohio It 4708 Form

Get This Document Online

Complete this form efficiently and quickly

Complete Ohio It 4708 online without printing hassles.

Get This Document Online

or

Free PDF File