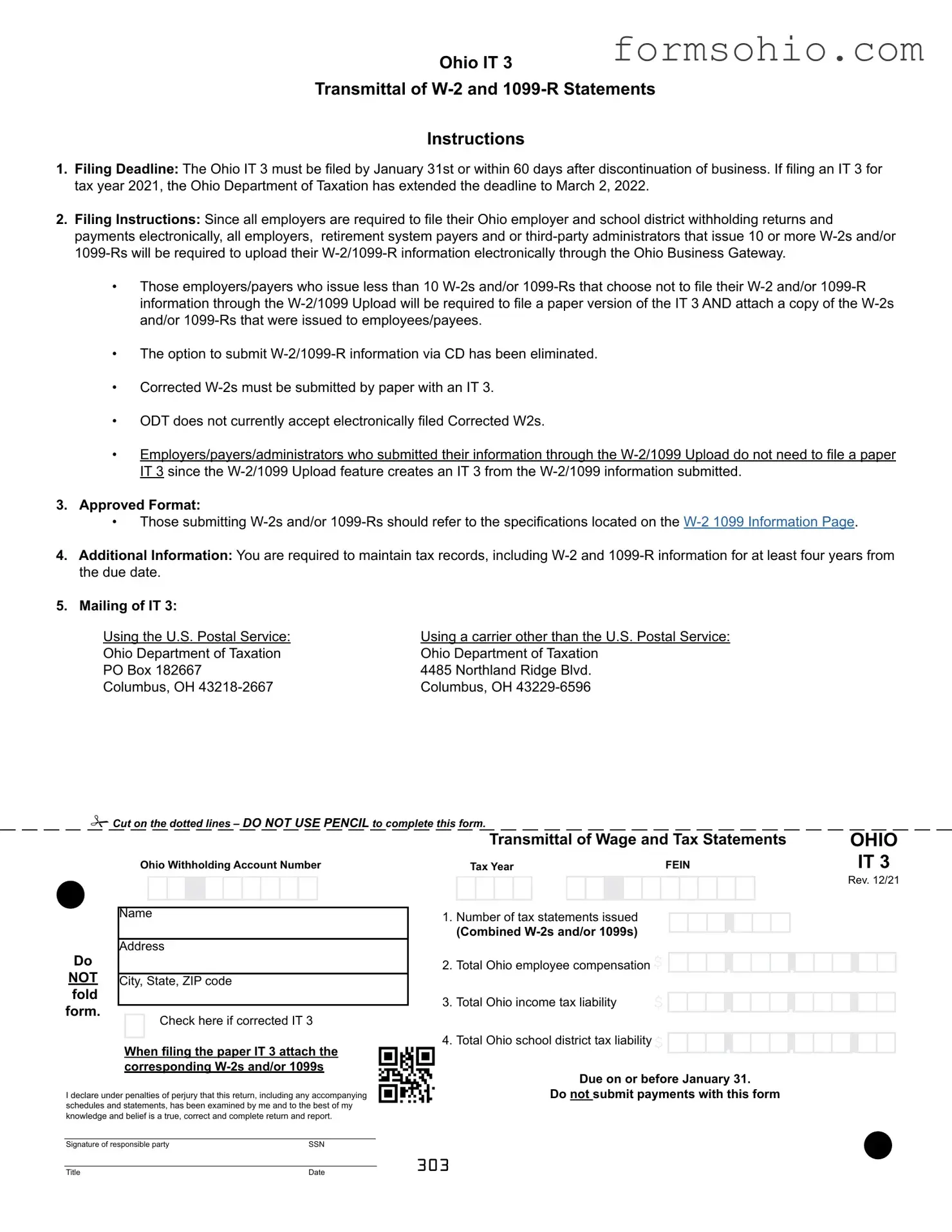

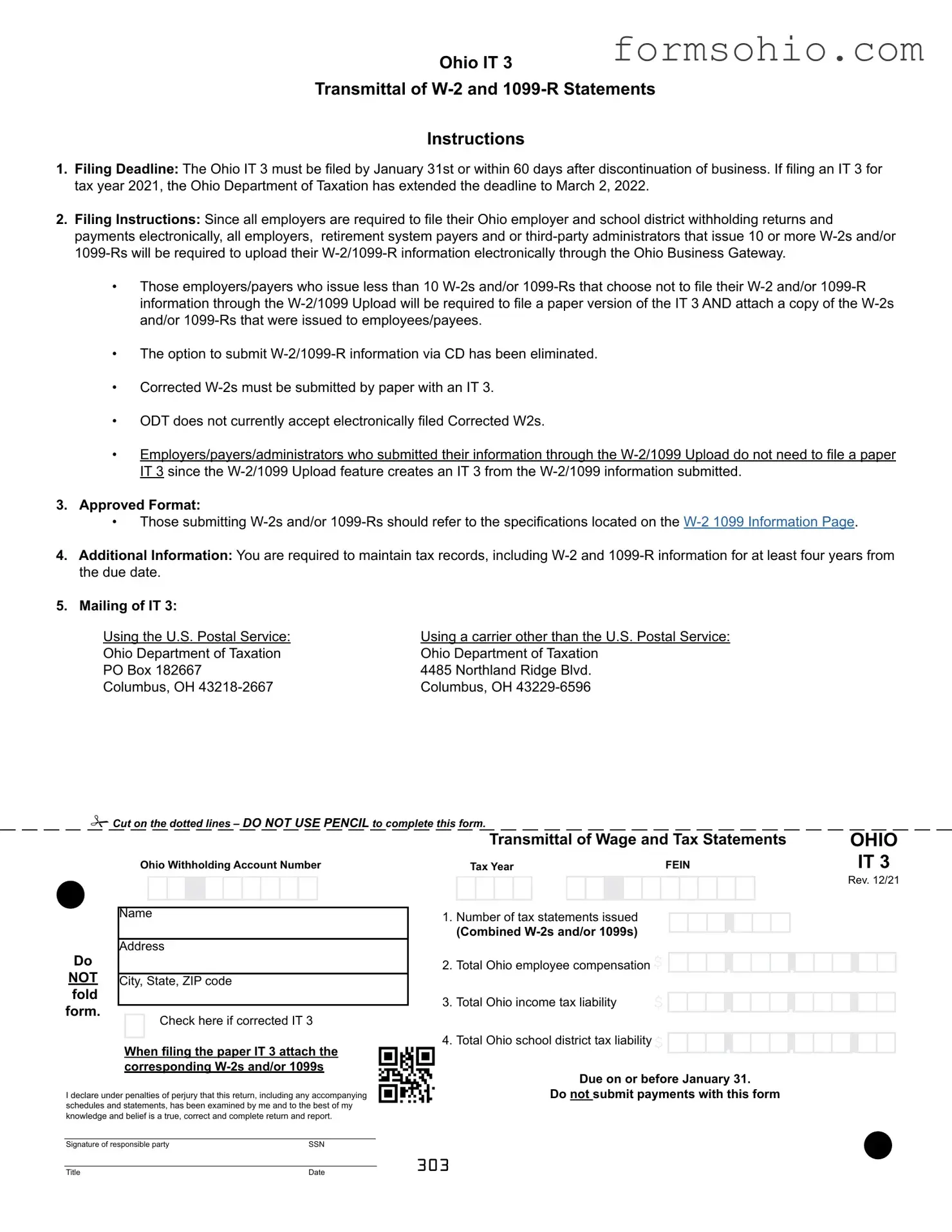

Ohio IT 3

Transmittal of W-2 and 1099-R Statements

Instructions

1.Filing Deadline: The Ohio IT 3 must be filed by January 31st or within 60 days after discontinuation of business. If filing an IT 3 for tax year 2021, the Ohio Department of Taxation has extended the deadline to March 2, 2022.

2.Filing Instructions: Since all employers are required to file their Ohio employer and school district withholding returns and payments electronically, all employers, retirement system payers and or third-party administrators that issue 10 or more W-2s and/or 1099-Rs will be required to upload their W-2/1099-R information electronically through the Ohio Business Gateway.

•Those employers/payers who issue less than 10 W-2s and/or 1099-Rs that choose not to file their W-2 and/or 1099-R information through the W-2/1099 Upload will be required to file a paper version of the IT 3 AND attach a copy of the W-2s and/or 1099-Rs that were issued to employees/payees.

•The option to submit W-2/1099-R information via CD has been eliminated.

•Corrected W-2s must be submitted by paper with an IT 3.

•ODT does not currently accept electronically filed Corrected W2s.

•Employers/payers/administrators who submitted their information through the W-2/1099 Upload do not need to file a paper IT 3 since the W-2/1099 Upload feature creates an IT 3 from the W-2/1099 information submitted.

3.Approved Format:

•Those submitting W-2s and/or 1099-Rs should refer to the specifications located on the W-2 1099 Information Page.

4.Additional Information: You are required to maintain tax records, including W-2 and 1099-R information for at least four years from the due date.

5.Mailing of IT 3:

Using the U.S. Postal Service: |

Using a carrier other than the U.S. Postal Service: |

Ohio Department of Taxation |

Ohio Department of Taxation |

PO Box 182667 |

4485 Northland Ridge Blvd. |

Columbus, OH 43218-2667 |

Columbus, OH 43229-6596 |

Cut on the dotted lines – DO NOT USE PENCIL to complete this form.

|

|

Ohio Withholding Account Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

Do |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NOT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City, State, ZIP code |

fold |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

form. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check here if corrected IT 3 |

|

|

|

|

|

|

|

|

|

When filing the paper IT 3 attach the |

|

corresponding W-2s and/or 1099s |

I declare under penalties of perjury that this return, including any accompanying schedules and statements, has been examined by me and to the best of my knowledge and belief is a true, correct and complete return and report.

Signature of responsible party |

SSN |

|

|

Title |

Date |

|

|

Transmittal of Wage and Tax Statements |

|

|

|

|

OHIO |

|

Tax Year |

|

|

FEIN |

|

|

|

|

|

|

IT 3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rev. 12/21 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

Number of tax statements issued |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Combined W-2s and/or 1099s) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

Total Ohio employee compensation $ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

, |

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

Total Ohio income tax liability |

$ |

|

|

|

|

|

|

|

, |

|

|

|

|

, |

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

Total Ohio school district tax liability$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

, |

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Due on or before January 31.

Do not submit payments with this form

303