|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

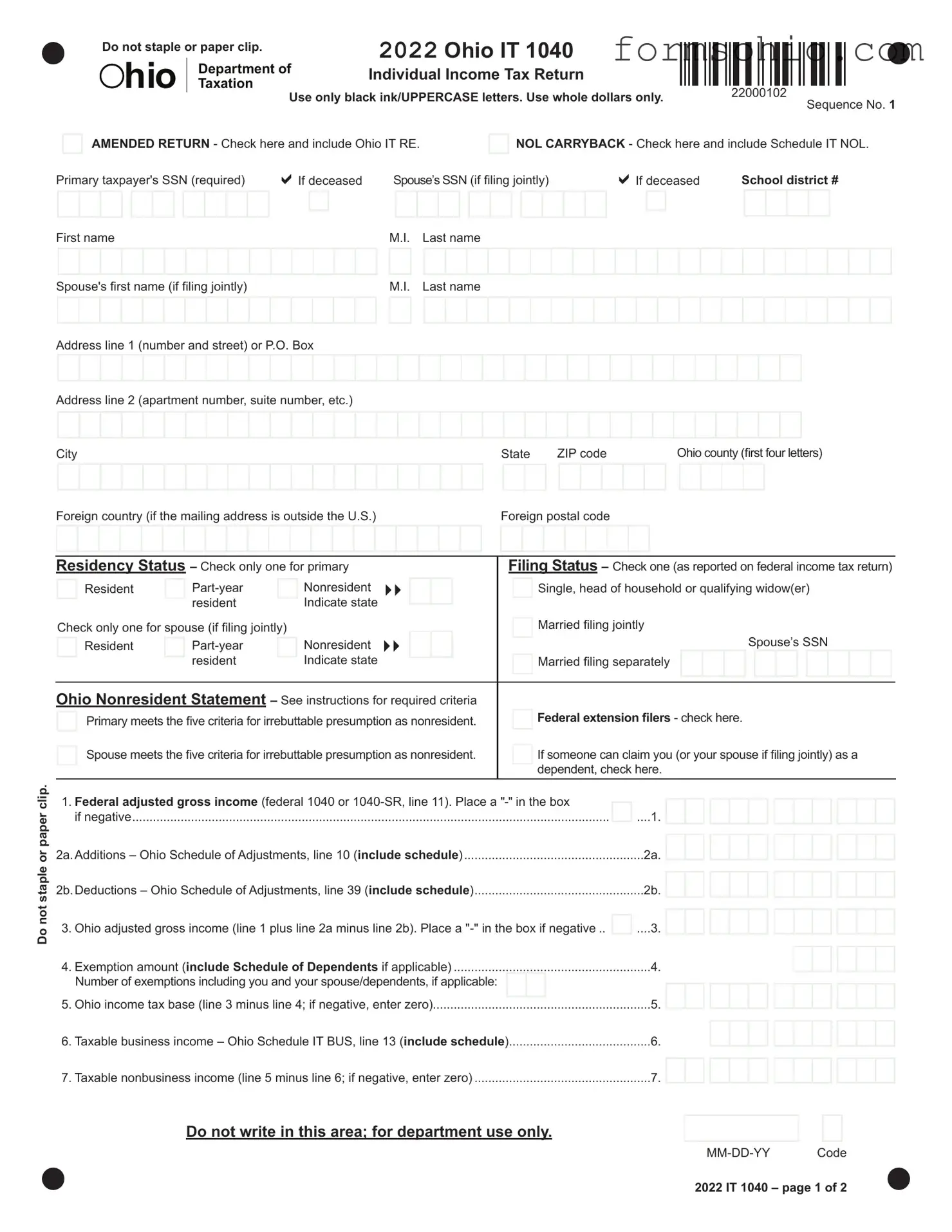

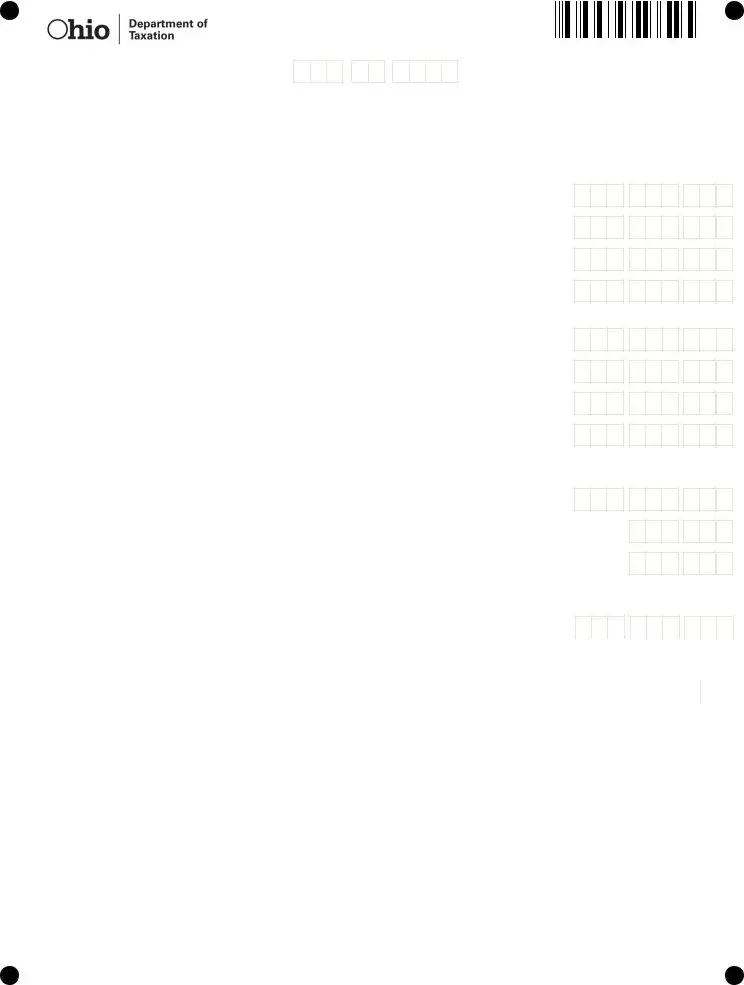

2022 Ohio IT 1040 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SSN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Individual Income Tax Return |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

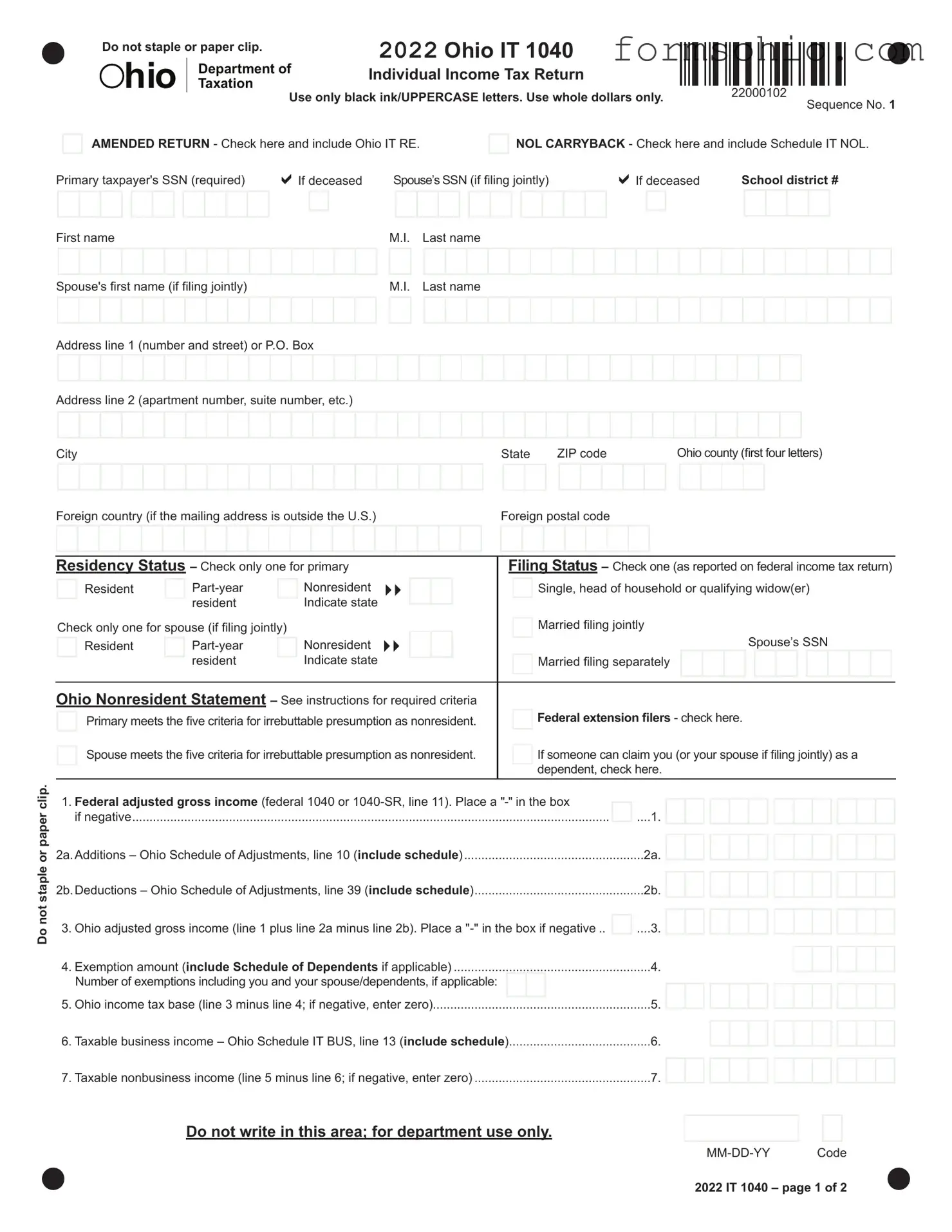

7a.Amount from line 7 on page 1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7a. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8a.Nonbusiness income tax liability on line 7a (see instructions for tax tables) |

|

|

|

|

|

8a. |

8b.Business income tax liability – Ohio Schedule IT BUS, line 14 (include schedule) |

|

|

|

|

|

8b. |

8c. Income tax liability before credits (line 8a plus line 8b) |

|

|

|

|

|

|

|

|

|

|

|

|

8c. |

9. Ohio nonrefundable credits – Ohio Schedule of Credits, line 35 (include schedule) |

9. |

10.Tax liability after nonrefundable credits (line 8c minus line 9; if negative, enter zero) |

10. |

11. Interest penalty on underpayment of estimated tax (include Ohio IT/SD 2210) |

11. |

12.Unpaid use tax (see instructions) |

............................................................................................................................ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12. |

13.Total Ohio tax liability before withholding or estimated payments (add lines 10, 11 and 12) |

13. |

14.Ohio income tax withheld – Schedule of Ohio Withholding, part A, line 1 (include schedule and |

|

|

|

|

|

|

|

|

|

|

income statements) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14. |

15.Estimated and extension payments (from Ohio IT 1040ES and IT 40P), and credit carryforward |

|

|

|

|

|

|

|

|

|

|

from last year's return |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15. |

16.Refundable credits – Ohio Schedule of Credits, line 41 (include schedule) |

16. |

17. Amended return only – amount previously paid with original and/or amended return |

17. |

18. Total Ohio tax payments (add lines 14, 15, 16 and 17) |

|

|

|

|

|

|

|

18. |

19.Amended return only – overpayment previously requested on original and/or amended return |

19. |

20.Line 18 minus line 19. Place a "-" in the box if negative |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

......20. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

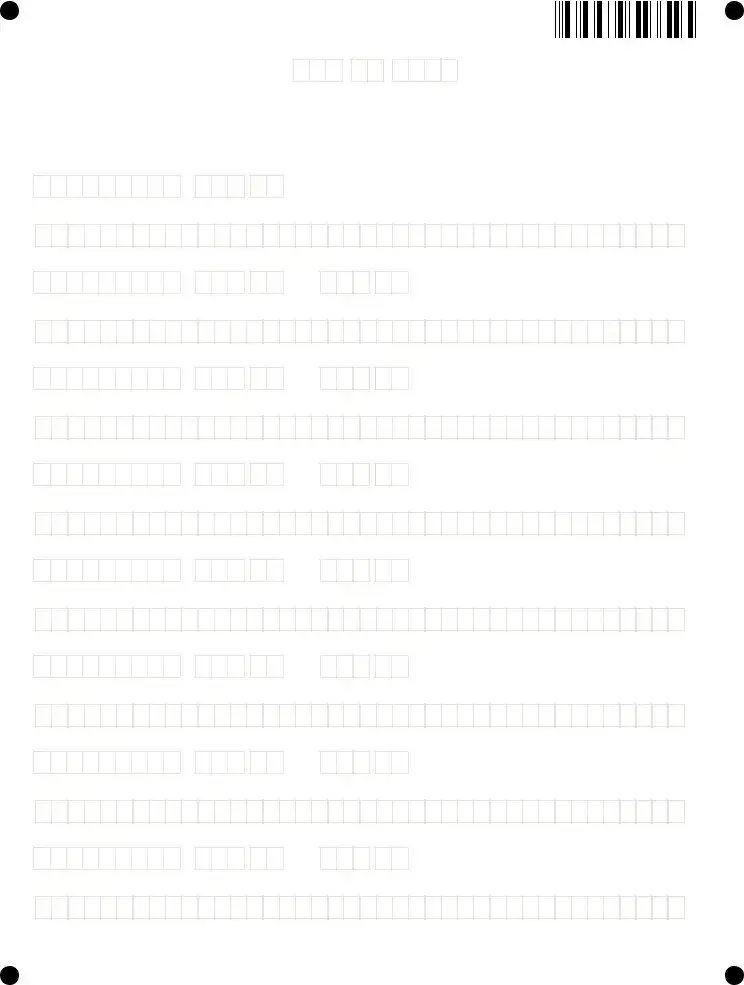

If line 20 is MORE THAN line 13, skip to line 24. OTHERWISE, continue to line 21. |

|

|

|

|

|

|

|

|

|

21.Tax due (line 13 minus line 20). If line 20 is negative, ignore the "-" and add line 20 to line 13 |

21. |

22.Interest due on late payment of tax (see instructions) |

|

|

|

|

|

|

|

22. |

23.TOTAL AMOUNT DUE (line 21 plus line 22). Include Ohio IT 40P (if original return) or |

|

|

|

|

|

|

|

|

|

|

|

IT 40XP (if amended return) and make check payable to “Ohio Treasurer of State” |

AMOUNT DUE23. |

24.Overpayment (line 20 minus line 13) |

|

|

|

|

|

|

|

24. |

25. Original return only – portion of line 24 carried forward to next year’s tax liability |

25. |

26. Original return only – portion of line 24 you wish to donate: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a. Wildlife Species |

|

b. Military Injury Relief |

c. Ohio History Fund |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total....26g. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d. Nature Preserves/Scenic Rivers |

|

e. Breast/Cervical Cancer |

f. Wishes for Sick Children |

|

|

|

|

|

|

|

|

|

hio

hio