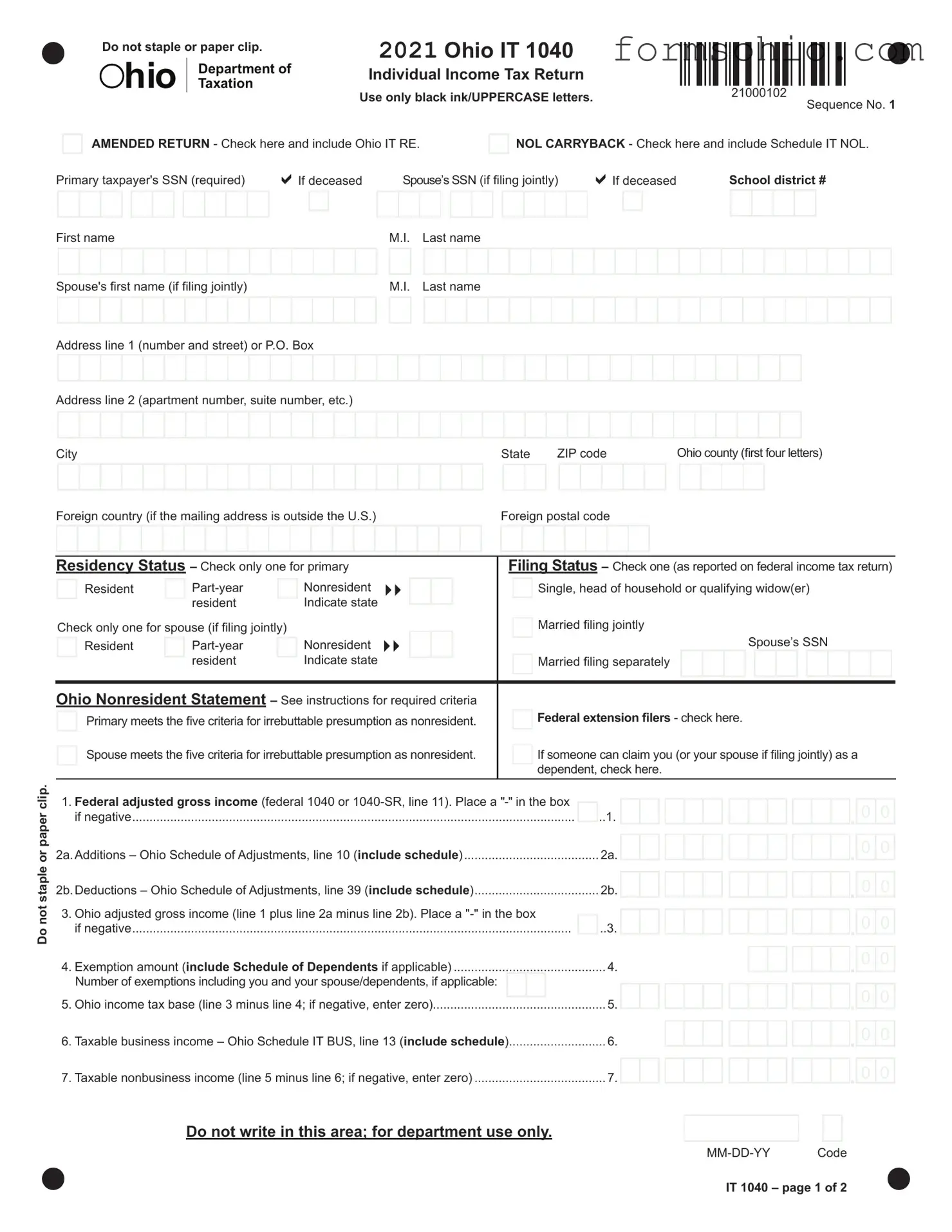

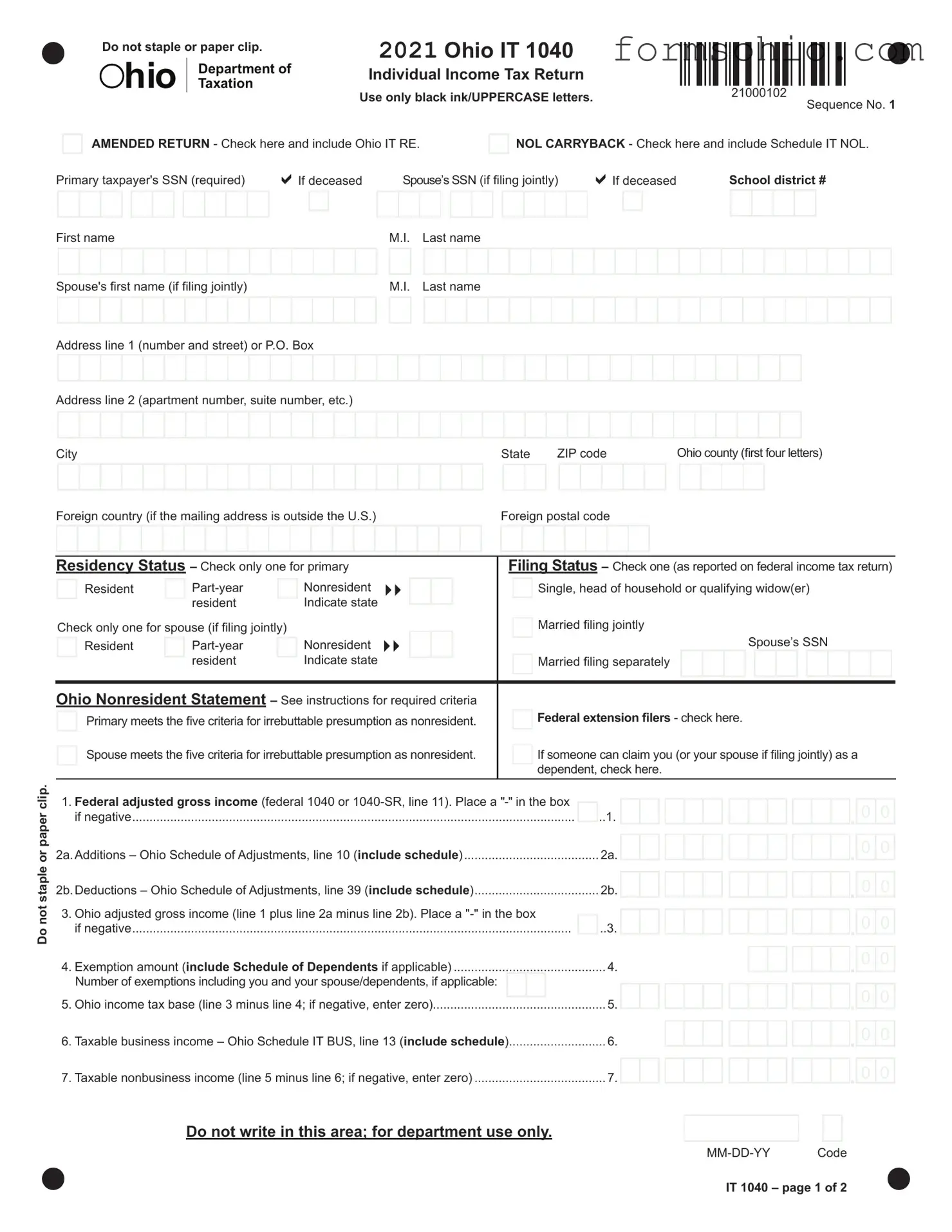

Fill a Valid Ohio It 1040 Form

The Ohio IT 1040 form is the official document used by residents of Ohio to report their individual income tax. This form is essential for calculating the amount of tax owed or the refund due based on your income and any applicable credits or deductions. Completing the IT 1040 accurately ensures compliance with state tax regulations and helps in managing your financial obligations effectively.

Get This Document Online

Fill a Valid Ohio It 1040 Form

Get This Document Online

Complete this form efficiently and quickly

Complete Ohio It 1040 online without printing hassles.

Get This Document Online

or

Free PDF File

0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0

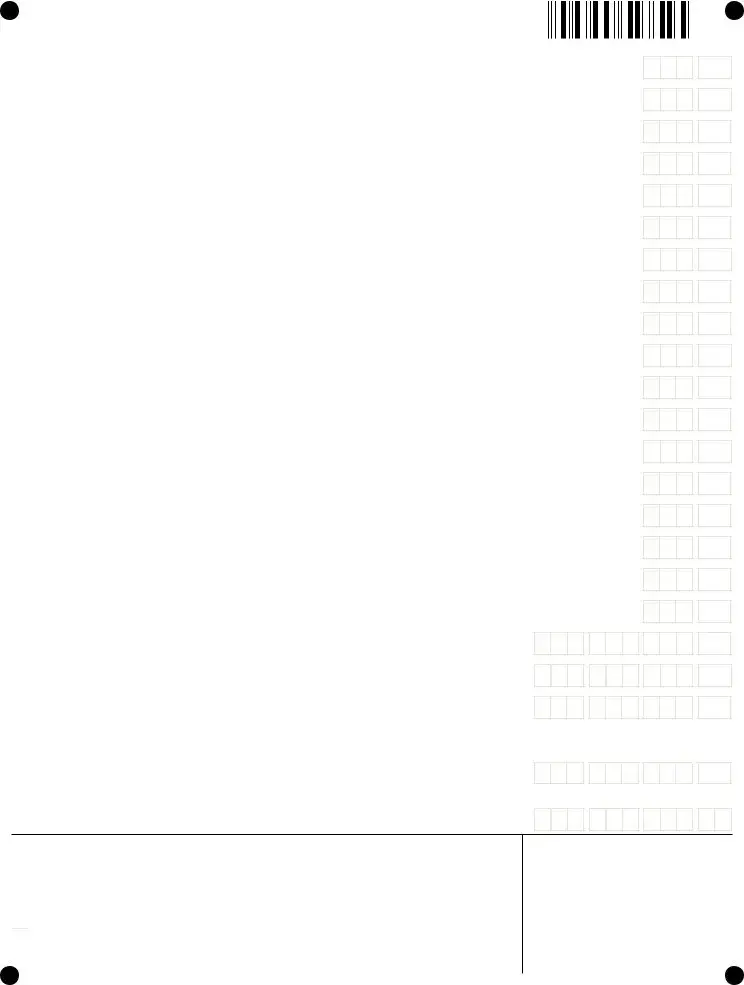

Check here to authorize your preparer to discuss this return with the Department.

Check here to authorize your preparer to discuss this return with the Department.