Ohio IRP Application Instruction Page

1.Account Number : Enter the number assigned by the IRP processing center to the account. Leave BLANK if the carrier does not yet have an IRP account number

2.Fleet number: Enter the 3-digit fleet number (one or more vehicles that all travel in the same states)

3.Supplement number: Leave blank

4.Expiration date: Leave blank

5.Name of Registrant: Enter the name of the person, firm or corporation in which the vehicles are to be registered

6.DBA: (if any) Enter the registrant’s business name, if applicable. Do not enter the name of the company the registrant is leased to

7.Ohio business location: Enter the physical location of the business. Business location must be in Ohio and cannot be a post office box

8.City: Enter the registrant’s city

9.State: Ohio

10.Zip Code : Enter the registrant’s zip code

11.TIN: Enter the registrant’s tax identification number (federal employee identification number FEIN)

12.Mailing address : Enter the registrant’s mailing address for all correspondence and credential mailings. Post office boxes and out of state addresses are acceptable (If address is the same as business location enter SAME)

13.SSN : Enter social security number if you do not have a tax id number (line 11)

14.City : Enter mailing city

15.State : Enter mailing state

16.Zip code : Enter mailing zip code

17.US DOT number : Enter registrant’s United States Department of Transportation Number (US DOT) All IRP registrants are required to obtain a US DOT Number.

18.Contact person : Enter the name of the person to contact concerning this account

19.Contact phone : Enter the phone number of contact person if different from Ohio telephone number (line 21)

20.E-mail : Enter the e-mail address of the contact person for this account

21.Ohio telephone Number : Enter the OHIO telephone number. The registrant must provide a photocopy of the phone bill showing registrant's name, Ohio street address and Ohio phone number. This number can be either a cell phone or a land line.

22.Fax number : Enter the business fax number

23.IFTA number : Enter registrant’s International Fuel Tax Agreement number- Ohio motor fuel number from the department of taxation

24.MC number : Enter registrant’s motor carrier number

25.Type of application : Check the category that applies

26.Type of operation : Check the appropriate box as described below:

·Private Carrier = hauls only the registrant’s own product

·Rental Company = rents vehicles or fleets without drivers

·Haul for Hire = is paid to haul freight or passengers

·Household Goods Mover = hauls only personal household items

·Exempt Commodities = hauls only commodities that are exempt from regulation by the PUCO

·Type = Write the commodity being hauled

27.Replacement Credentials: Check the item that applies.

28. CO: For fleets that apportion to Colorado: Enter an "N" if the vehicle travels 10,000 miles or less nationally in a year. If the vehicle travels more than 10,000 miles nationally, no notation is required.

29.Unit #: Enter the equipment or unit number assigned by the applicant. Be sure to use a different unit number for each vehicle.

30.Weight Group: Leave blank

31.Vehicle Identification #: Enter the complete serial (VIN) number as listed on the title.

32.Year: Enter the model year of the vehicle.

33.Make of Vehicle: Enter the trade name of each vehicle. (MACK, FRHT, FRUE, ect.)

34.Vehicle Type: TR-Tractor, TK-Truck, TT-Truck Tractor, RT-Road Tractor (Wrecker or Mobile Home Toter), ST-Semi Trailer, FT-Full Trailer, BS-Bus

35.Axles (Bus: Seats): Number of axles on power unit only.

36.Combined Axles: Combined number of axles on power unit and trailer(s)

37.Fuel Type: Enter the type of fuel used by the vehicle. D-Diesel, G-gasoline, P-Propane.

38.Unladen Weight: The empty weight of the vehicle fully equipped for service.

39.Combined or Gross Weight: The combined weight of the vehicle and the maximum load to be carried on the combination of vehicle(s).

40.Purchase Price: The price of the vehicle including trade-ins, but excluding sales or use tax or finance charges. Don not show cents. When payments are "taken-over", the purchase price is equity paid plus the amount of principal still owed.

Ohio IRP Application Instruction Page

41.Factory Price:

42.2290: Leave blank

43.Power of Attorney: Leave blank

44.Y/N: Will the control and responsibility for the safety of this vehicle be assigned to a different motor carrier during the registration year by lease?

45.Date of Purchase: Enter the month, date and year the vehicle was purchased.

46.Date of Lease: Enter the month, date and year the vehicle was leased.

47.Name of Owner (as it appears on the vehicle Title): Show the name of the owner as it appears on the title.

48.Bus:HP: Enter the total horsepower of the bus.

49.Company US DOT #: Enter the US DOT Number of the motor carrier responsible for the safety of the vehicle if different than the registrant US DOT number.

50.Company TIN #: Enter the TIN Number of the motor carrier responsible for the safety of the vehicle if different than the registrant TIN number.

51.Plate # Replace Transfered: Enter the most recent plate number or if replacing the plate in # 63 then write replace.

52.Ohio County: Enter the Ohio County where the vehicle is garaged.

53.Municipality or Township where the vehicle is garaged: Enter the Municipality or Township where the vehicle is garaged.

54.County Code: Leave blank

55.Lease Agreement: Leave Blank

56.Are you an Owner Operator leased onto a motor carrier?: Enter yes or no. If yes is entered, you must provide a photocopy of your lease agreement!

57.Unit #: Enter the equipment or unit number assigned by the applicant of the vehicle being deleted.

58.Vehicle Identification #: Enter the complete serial (VIN) number as listed on the title of the vehicle being deleted.

59.Year: Enter the model year of the vehicle being deleted.

60.Make of Vehicle: Enter the trade name of each vehicle. (MACK, FRHT, FRUE, ect.) being deleted.

61.Combined or Gross Weight: The combined weight of the vehicle and the maximum load to be carried on the combination of vehicle(s) being deleted.

62.Reason Removed: Enter the reason the vehicle was removed from service (i.e. sold, junked, lease broken, etc.)

63.Transfered Plate #: Enter the complete number of the license plate being transfered.

64.Cab Card/Affidavit: Leave blank

|

|

|

|

|

|

|

|

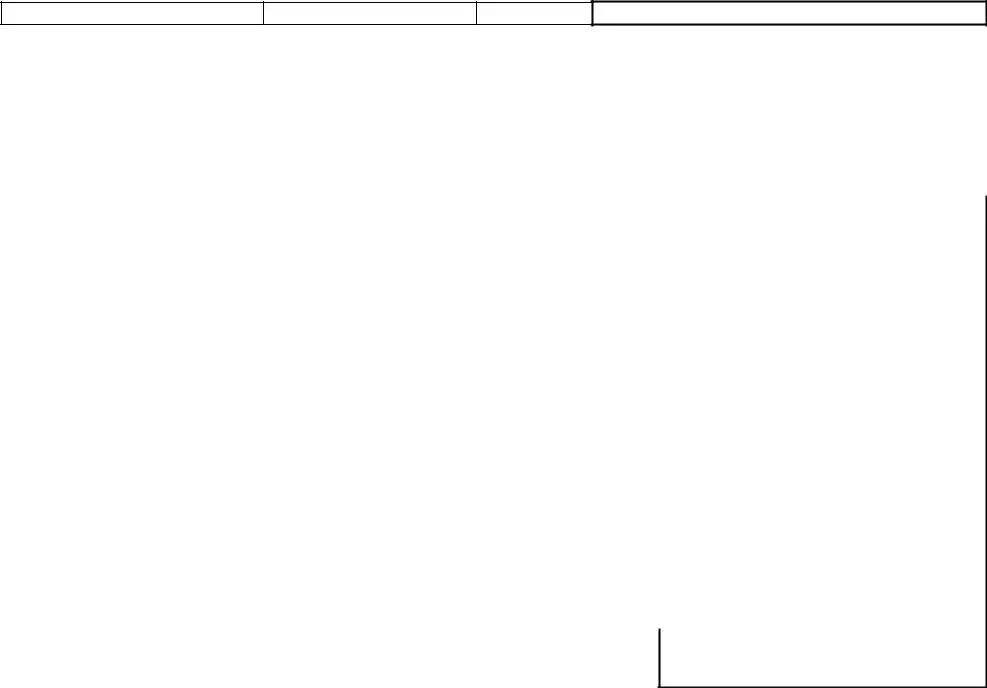

OHIO IRP APPLICATION |

|

26 TYPE OF |

|

27 TYPE OF |

1 ACCT # |

2 FLEET # |

|

3 SUPP # |

|

4 Registration Months |

(Page 1 of 3) Carrier Information |

APPLICATION |

|

OPERATION |

|

|

|

|

|

|

|

|

OHIO IRP PROCESSING CENTER |

□ Original |

|

|

□ Private Carrier(PC) |

5 NAME OF REGISTRANT |

|

|

|

|

|

2222 DIVIDEND DRIVE |

|

□ Renewal |

|

|

□ Rental Company(RC) |

|

|

|

|

|

|

|

|

COLUMBUS, OH 43228 |

|

□ Add Fleet |

|

|

□ Haul for Hire(HH) |

|

|

|

|

|

|

|

|

PHONE 800-477-0007 |

|

|

|

6 DBA(if any) |

|

|

|

|

|

|

|

□ Add Jurisdiction |

|

□ Household Goods |

|

|

|

|

|

614-777-8400 |

Leave |

|

7 OHIO BUSINESS LOCATION |

|

|

|

|

□ Add Vehicle |

|

Mover(HC) |

|

|

|

|

all shaded areas blank Please Type or |

|

(DO NOT USE PO BOX) |

|

|

|

|

|

Print With Ink |

|

□ Plate Transfer |

|

□ Exempt Commodities |

|

|

|

|

|

|

|

|

|

|

□ Weight Increase |

|

(EX) |

8 CITY |

|

8 STATE- OH |

10 ZIP CODE |

11 |

TIN |

|

□ Change Information |

|

Type_______________ |

|

|

|

|

|

|

|

|

|

|

□ Base Plate Conversion |

|

|

|

|

|

|

|

|

|

|

□ Fleet to Fleet Transfer |

12 |

MAILING ADDRESS |

|

|

|

|

13 |

SSN |

|

From: |

To: |

|

|

|

|

|

|

|

|

|

|

|

□ Renewal/Transfer/Replace Plate |

|

|

|

|

|

|

|

|

|

|

□ Renewal/Replace Plate |

14 |

CITY |

|

15 STATE |

16 ZIP CODE |

17 |

US DOT # |

|

□ Plate Transfer/Replace |

18 |

CONTACT PERSON |

|

|

19 CONTACT PHONE |

20 |

E-mail |

|

28 REPLACEMENT CREDENTIALS |

|

|

|

|

|

|

|

|

|

|

□ CAB CARD |

|

REASON |

|

|

|

|

|

|

|

|

|

|

|

21 |

OHIO TELEPHONE # |

|

|

22 FAX # |

23 |

IFTA # |

|

□ PLATE |

|

|

□ LOST |

24 |

□ Check this box if this carrier has intrastate Authority in Wyoming |

|

|

|

□ STICKER |

|

|

□ STOLEN |

|

|

|

|

|

|

|

25 |

MC # |

|

□ PLATE/STICKER |

|

□ OPTIONAL |

YOU WILL LOSE YOUR DRIVER LICENSE IF YOU DRIVE WITHOUT INSURANCE OR OTHER ACCEPTABLE FINANCIAL RESPONSIBILITY COVERAGE

* In Ohio, it is illegal to drive any motor vehicle without insurance or other financial responsibility (FR) coverage.

* It is also illegal for any motor vehicle owner to allow anyone else to drive the owner's vehicle without FR coverage.

* PROOF OF COVERAGE IS REQUIRED: ● Whenever a police officer issues a traffic ticket ● At all vehicle inspection stops ● Upon traffic court appearances and ● Upon random checks by the Registrar of Motor Vehicles

* ANY DRIVER OR OWNER WHO FAILS TO SHOW PROOF OF INSURANCE OR OTHER COVERAGE WILL: ● Lose his or her driver license until requirements are met on first offense and ONE YEAR on second offense and TWO YEARS on additional offenses ● Lose his or her license plates and vehicle registration ● Pay reinstatement fees of $100.00 first offense, $300.00 second offense, and $600.00 any additional offense ● Pay a $50.00 penalty for any failure to surrender his or her driver license, license plates, or registration AND ● Be required to maintain special FR coverage ("High-Risk" insurance or equivalent) on file with the Bureau of Motor Vehicles (BMV) for THREE or FIVE YEARS.

* |

ONCE THIS SUSPENSION IS IN EFFECT: Any driver or owner who violates the suspension will have his or her vehicle immobilized and his or her license plates confiscated for at least 30 DAYS first offense and 60 DAYS second |

offense. For a third or subsequent offenses, the vehicle will be forfeited and sold and the person will not be permitted to register any motor vehicle in Ohio for FIVE YEARS. |

* |

IF YOU ARE INVOLVED IN AN ACCIDENT WITHOUT INSURANCE OR OTHER FR COVERAGE: In addition to all the penalties listed above you may have ● A SECURITY SUSPENSION for TWO YEARS or more and ● A |

JUDGMENT SUSPENSION INDEFINITELY (until all damages have been satisfied). |

* |

THESE PENALTIES ARE IN ADDITION TO ANY FINES OR PENALTIES IMPOSED BY A COURT OF LAW. |

* |

WARNING: THESE LAWS DO NOT PREVENT THE POSSIBILITY THAT YOU MAY BE INVOLVED IN AN ACCIDENT WITH A PERSON WHO HAS NO INSURANCE OR OTHER FR COVERAGE. |

* |

WHEN REQUIRED, PROOF OF COVERAGE MAY BE SHOWN BY ANY OF THE FOLLOWING: ● AN INSURANCE POLICY showing automobile liability insurance of at least $12,500 bodily injury per person, $25,000 injury two or more |

persons, and $7,500 property damage ● AN INSURANCE IDENTIFICATION CARD (same coverage) ● A SURETY BOND OF $30,000 issued by any authorized surety company or insurance company ● A BMV BOND SECURED BY REAL ESTATE having equity of at least $60,000 ● A BMV CERTIFICATE FOR MONEY OR GOVERNMENT BONDS in the amount of $30,000 on deposit with the Ohio Treasurer of State ● A BMV CERTIFICATE OF SELF-INSURANCE, available only to companies or persons who own at least twenty-six motor vehicles.

I affirm that all owners (or lessees of a leased vehicle) now have insurance or other FR coverage and will not operate or permit the operation of this motor vehicle without FR coverage.

Reviewed |

Date |

Input |

Date |

Invoice Review |

Date |

Cab Cards Verified |

Date |

Received |

|

|

|

|

|

|

|

|

|

OH-F5-NOV/12 (page1of3)

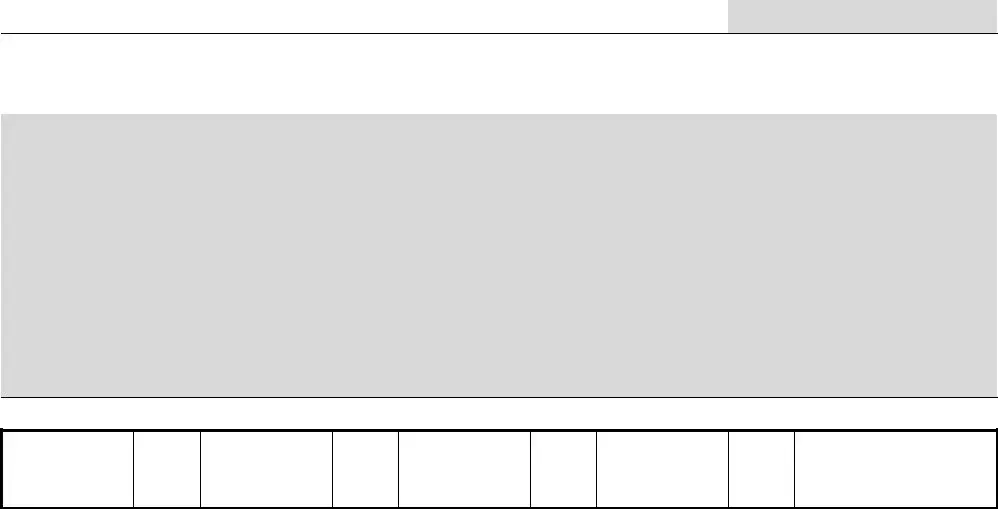

TOTAL MILES:

ACCOUNT # |

FLEET # |

SUPP # |

Ohio IRP Application (page 3 of 3) Distance and Weight Schedule |

|

|

|

|

Y/N - Mark column with a 'Y' in the jurisdiction where IRP registration is desired or 'N' in which actual distance is shown but registration is not desired. A/E - Mark column with 'E' for Estimated Distance and 'A' for Actual Distance.

Distance - List distance accrued in each jurisdiction in which this fleet traveled during the period July 1 through June 30 of the year preceding the license year for which you are applying.

Weight - Units listed on this application will be authorized to operate in the IRP jurisdictions and at the weights listed below. You must provide a letter of if there is a 10% weight variance.

A CARRIER STATEMENT OF PROPOSED ESTIMATED MILEAGE may be required with all original applications, and any renewal or supplemental applications containing questionable estimated distance. The registrar of motor vehicles may adjust estimated distance determined to be below the acceptable minimum as shown on the estimated mileage chart.

WEIGHT AND DISTANCE INFORMATION BY JURISDICTION

Y/N |

JURISDICTION |

A/E |

DISTANCE |

WEIGHT |

Y/N |

JURISDICTION |

A/E |

DISTANCE |

WEIGHT |

Y/N |

JURISDICTION |

A/E |

DISTANCE |

WEIGHT |

|

OH Ohio |

|

|

|

|

MA Massachusetts |

|

|

|

|

OK Oklahoma |

|

|

|

|

AB Alberta |

|

|

|

|

MB Manitoba |

|

|

|

|

ON Ontario |

|

|

|

|

AL Alabama |

|

|

|

|

MD Maryland |

|

|

|

|

OR Oregon |

|

|

|

|

AK Alaska |

|

|

|

|

ME Maine |

|

|

|

|

PA Pennsylvania |

|

|

|

|

AR Arkansas |

|

|

|

|

MI Michigan |

|

|

|

|

PE Prince Edward Is. |

|

|

|

|

AZ Arizona |

|

|

|

|

MN Minnesota |

|

|

|

|

QC Quebec |

|

|

|

|

BC British Columbia |

|

|

|

|

MO Missouri |

|

|

|

|

RI Rhode Island |

|

|

|

|

CA California |

|

|

|

|

MS Mississippi |

|

|

|

|

SC South Carolina |

|

|

|

|

CO Colorado |

|

|

|

|

MT Montana |

|

|

|

|

SD South Dakota |

|

|

|

|

CT Connecticut |

|

|

|

|

NB New Brunswick |

|

|

|

|

SK Saskatchewan |

|

|

|

|

DC Dist. Of Col. |

|

|

|

|

NC North Carolina |

|

|

|

|

TN Tennessee |

|

|

|

|

DE Delaware |

|

|

|

|

ND North Dakota |

|

|

|

|

TX Texas |

|

|

|

|

FL Florida |

|

|

|

|

NE Nebraska |

|

|

|

|

UT Utah |

|

|

|

|

GA Georgia |

|

|

|

|

NL Newfoundland |

|

|

|

|

VA Virginia |

|

|

|

|

IA Iowa |

|

|

|

|

NH New Hampshire |

|

|

|

|

VT Vermont |

|

|

|

|

ID Idaho |

|

|

|

|

NJ New Jersey |

|

|

|

|

WA Washington |

|

|

|

|

IL Illinois |

|

|

|

|

NM New Mexico |

|

|

|

|

WI Wisconsin |

|

|

|

|

IN Indiana |

|

|

|

|

NS Nova Scotia |

|

|

|

|

WV West Virginia |

|

|

|

|

KS Kansas |

|

|

|

|

NT Northwest Terr. |

|

|

|

|

WY Wyoming |

|

|

|

|

KY Kentucky |

|

|

|

|

NV Nevada |

|

|

|

|

YT Yukon |

|

|

|

|

LA Louisiana |

|

|

|

|

NY New York |

|

|

|

|

MX Mexico |

|

|

|

Do not show 0 (zero) actual miles for any jurisdiction you wish to have on your cab card. To estimate your mileage, you may use the Ohio estimated mileage chart or use your own calculations based on the methods provided below

Method A - Submit estimated miles for the fleet, for each jurisdiction(s) using the estimated mileage (chart miles x number of vehicles in the fleet = total mileage) Method B - Submit estimated miles for the fleet, for each jurisdiction(s) and complete a carrier statement of proposed estimated mileage following the instructions on the Carrier Statement of Proposed Estimated Mileage sheet.

OH-F5-NOV/12 (page3of3)