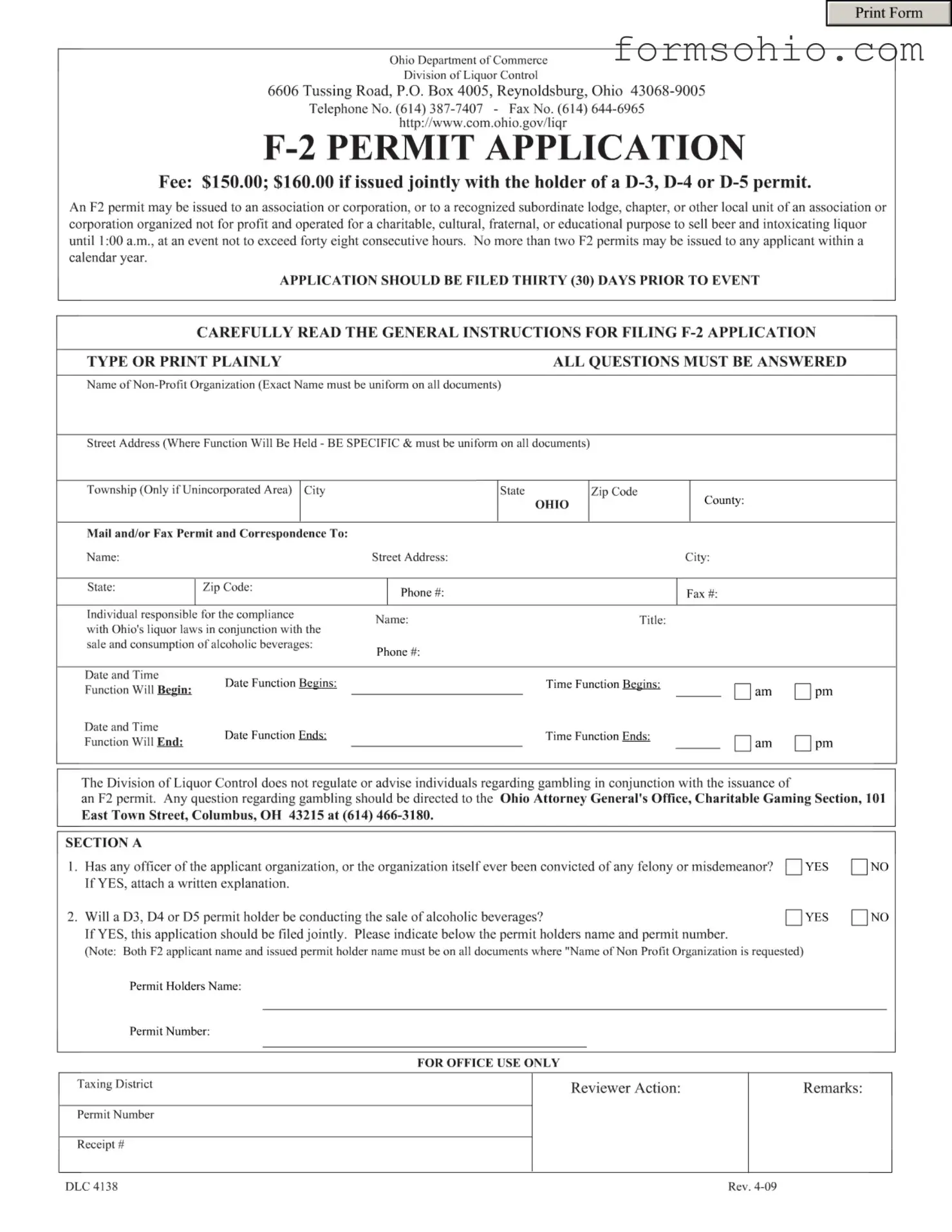

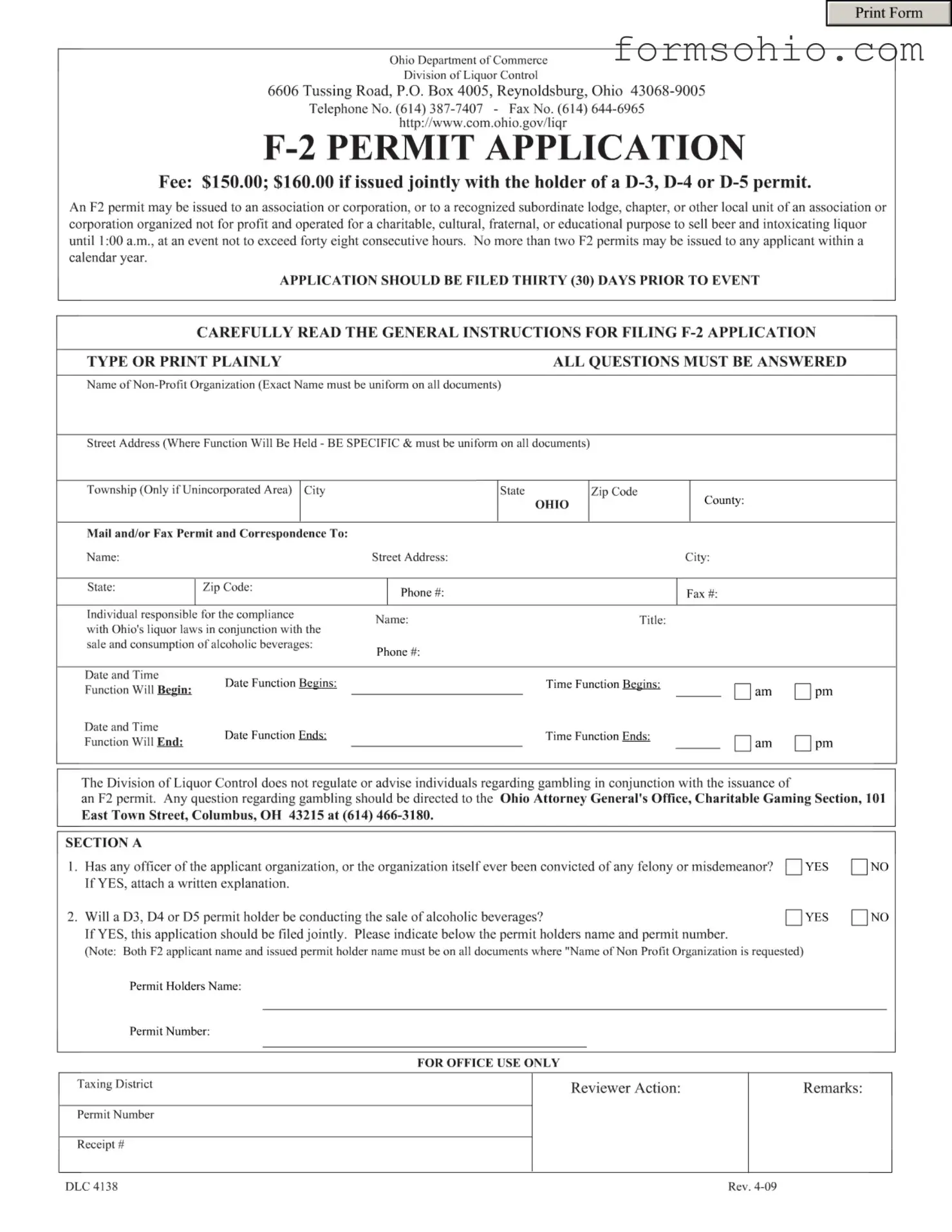

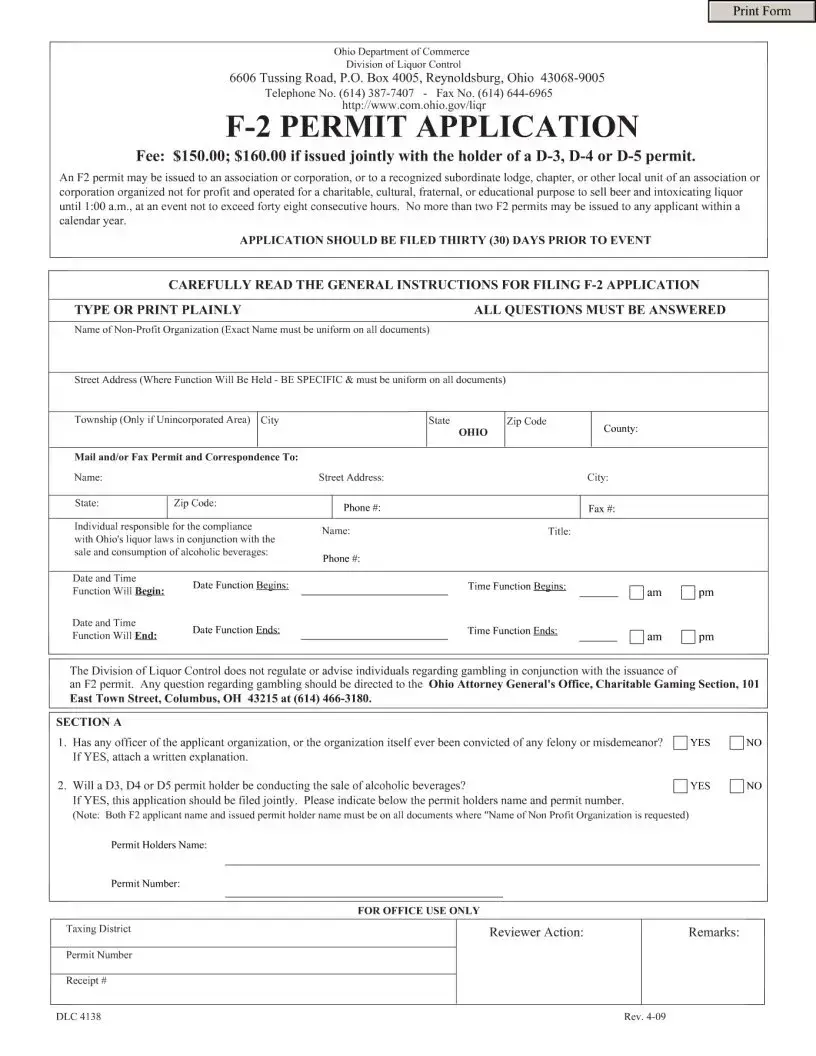

Filling out the Ohio F-2 Permit form can be a straightforward process, but many applicants make common mistakes that can delay their approval. One significant error is failing to provide the exact name of the non-profit organization. It's essential that this name matches exactly across all documents. Any discrepancies can lead to confusion and may result in the application being rejected.

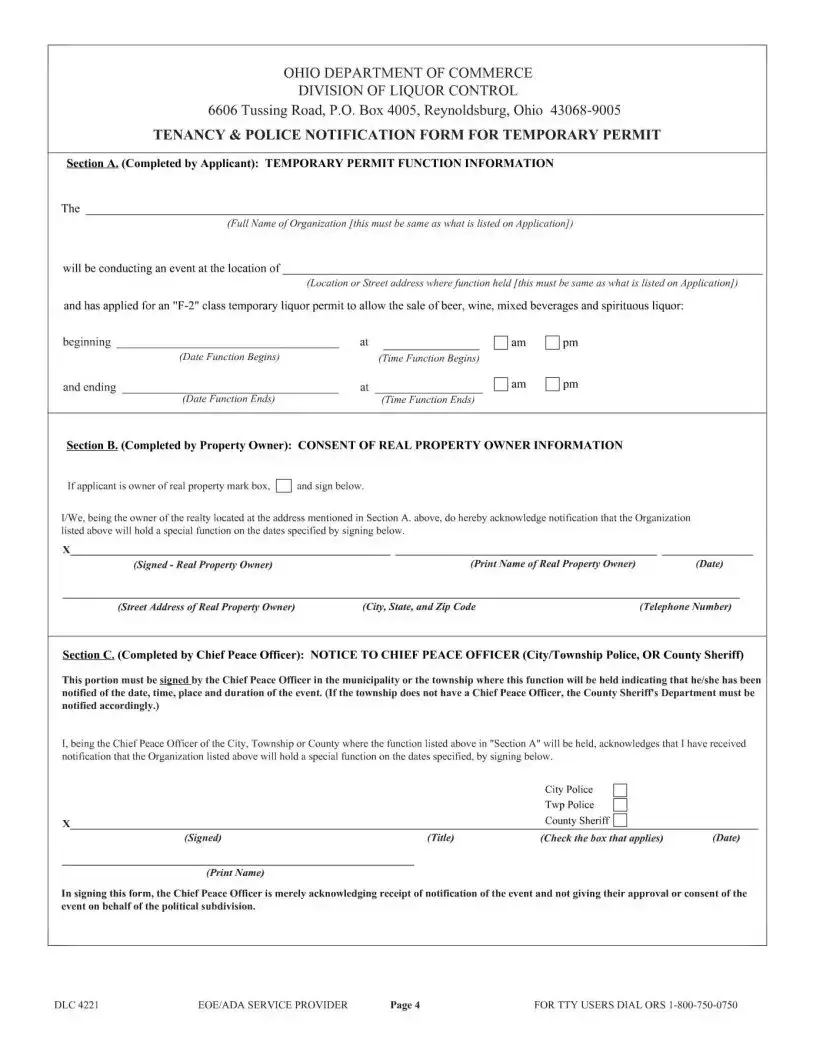

Another frequent mistake involves the street address where the event will take place. Applicants often provide vague or incomplete addresses. Being specific is crucial; the address must be uniform across all submitted documents. This helps ensure that the permit is processed without unnecessary delays.

Many people overlook the importance of answering all questions on the application. Leaving questions blank can raise red flags and may cause the application to be returned for completion. Each section is designed to gather necessary information, and skipping any part could jeopardize your chances of obtaining the permit.

Another common error is not filing the application 30 days prior to the event. This timeline is crucial, as it allows the Division of Liquor Control adequate time to process the application. Last-minute submissions can lead to denial, so planning ahead is key.

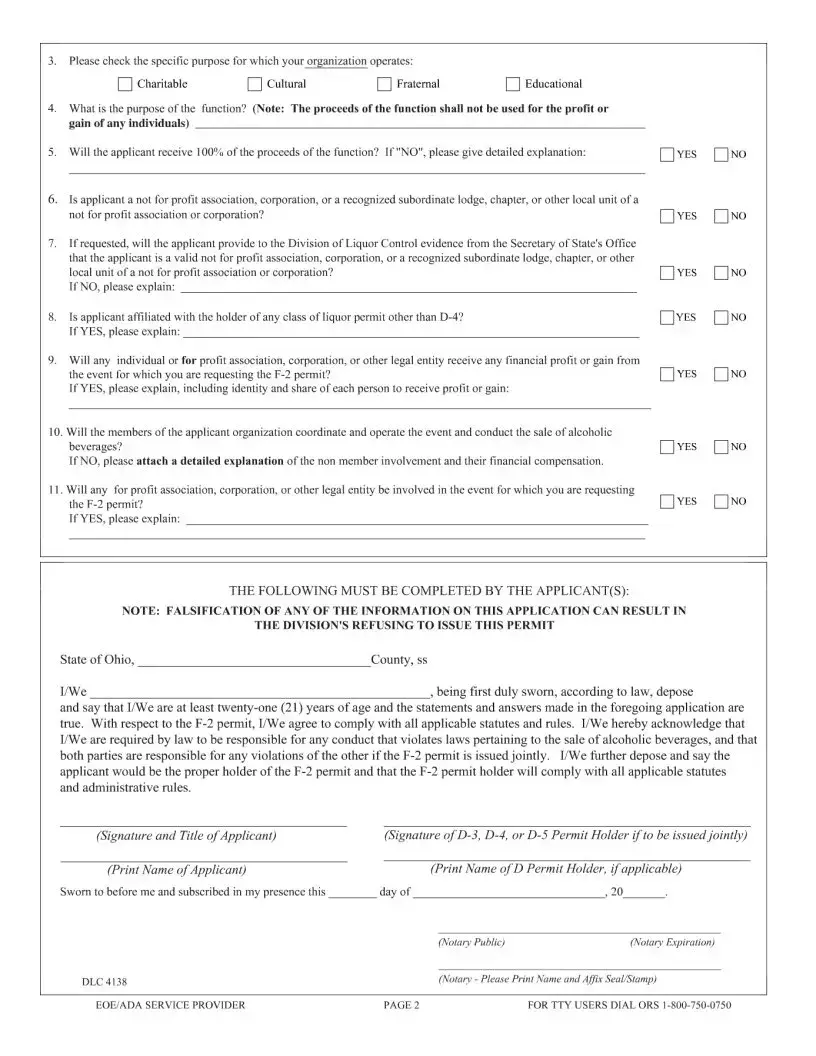

Some applicants mistakenly assume that they can receive more than two F-2 permits in a calendar year. This is not the case; the law clearly states that no more than two permits can be issued to any applicant within a single year. Ignoring this rule can lead to wasted time and effort.

When it comes to the financial aspects of the event, applicants often fail to clarify whether any for-profit entities will benefit from the proceeds. If the answer is yes, a detailed explanation is required. Not providing this information can lead to complications or even denial of the permit.

Another area where mistakes frequently occur is in the section regarding the event's purpose. Applicants sometimes provide vague descriptions or fail to align the purpose with the organization's mission. Clear and specific details about the event's purpose are necessary for approval.

It's also important to remember that the application must be signed by the appropriate individuals. Missing signatures or incorrect titles can render the application invalid. Ensure that all required parties sign where indicated, as this is a critical step in the submission process.

Lastly, some applicants neglect to provide the necessary documentation to prove their non-profit status. If requested, evidence from the Secretary of State's Office must be submitted. Failing to include this documentation can lead to delays or denial of the permit.

By avoiding these common mistakes, applicants can streamline the process and increase their chances of successfully obtaining an F-2 permit in Ohio. Attention to detail is vital, and understanding the requirements will make the journey much smoother.