ET 2

Rev. 12/01

OHIO ESTATE TAX

RETURN AND

INSTRUCTIONS

For estates with dates of death on or after

January 1, 2002 with a gross value of more than $338,333.

For completing the Ohio estate tax return for estates with dates of death on or after January 1, 2002, please review the following:

Read the General Information section located on pages 6 and 7 for in- structions.

Complete only the applicable schedules of the return, which are available through our web site (tax.ohio.gov) or by contacting the Ohio Department of Taxation. See pages 4 and 5 for listing of schedules.

Check your computation.

Follow the instructions in the General Information section, page 6, for where to file and pay.

Note: Estates with dates of death January 1, 2001–December 31, 2001 are re- quired to file an Ohio estate tax form 2, revised 1/2001.

Estates with dates of death prior to January 1, 2001 are required to file an

Ohio estate tax form 2, revised 7/2003.

For further information, please contact the Estate Tax Division’s

toll-free information and assistance line

at

1 (800) 977-7711

(Ohio Relay Service)

1 (800) 750-0750

Ohio Estate Tax Return for all Resident Filings for Dates of Death on or after January 1, 2002

File in duplicate with the Probate Court

Check one: |

Taxable |

Nontaxable |

Estate of: Decedent’s last name |

Decedent’s first name and initial |

Date of death |

|

|

|

|

|

Date of birth |

Cause of death |

Occupation |

|

|

|

Decedent retired Yes |

No |

|

|

|

Address of decedent at time of death (number and street, city, state and ZIP code) |

Decedent’s social security number |

|

|

|

|

County in Ohio where probate court located, will probated or estate administered |

Case number |

|

|

|

|

|

|

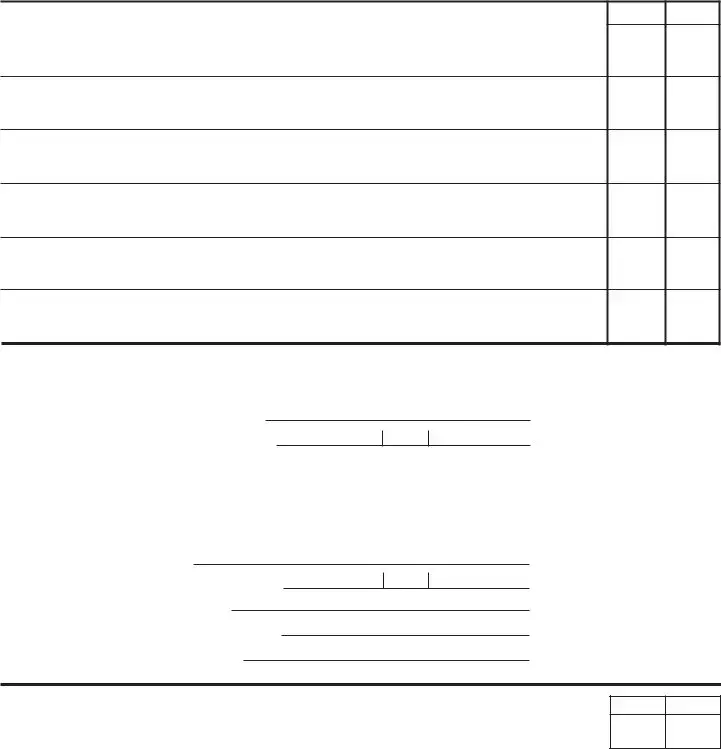

Tax Computation |

|

|

|

|

|

|

|

|

1. |

Total gross estate (if less than $338,333, return is not required) (from page 2) |

$ |

|

|

|

|

|

|

|

|

|

2. |

Total deductions (from page 2) |

$ |

( |

) |

|

|

|

|

|

|

|

3. |

Net taxable estate (line 1 minus line 2) |

$ |

|

|

|

|

|

|

|

|

|

4. |

Tentative tax based on line 3 (use table on page 2) |

$ |

|

|

|

5. |

Less: Estate tax credit |

$ |

( 13,900 |

) |

|

|

|

|

|

|

|

6. |

Tax (subtract line 5 from line 4; if line 5 is more than line 4, enter -0-) |

$ |

|

|

|

|

|

|

|

|

|

7. |

Less: Previous payments |

$ |

( |

) |

|

|

|

|

|

|

|

8. |

Balance due(ifamountonline7islessthantaxamountonline6,enterdifferenceasbalancedue) |

$ |

|

|

|

|

|

|

|

|

|

9. |

Overpayment (ifamountonline7isgreaterthantaxamountonline6,enterdifferenceasarefund) |

$ |

( |

) |

|

|

|

|

|

|

|

Executor/Administrator Waiver to Receive Correspondence

I/we do not wish to receive further correspondence from the Ohio Department of Taxation regarding this estate, and hereby authorize all such communication to be directed only to the estate’s legal representative named below.

Signature of executor/administrator

Declaration

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct and complete. Declaration of preparer other than the deceased’s personal representative or person in possession of property is based on all information of which preparer has any knowledge.

Name of attorney representing the estate

Address (number and street, city, state and ZIP code)

Name of executor/administrator(s)

Address (number and street, city, state and ZIP code)

Signature of executor/administrator(s)

Date Filed with Probate Court

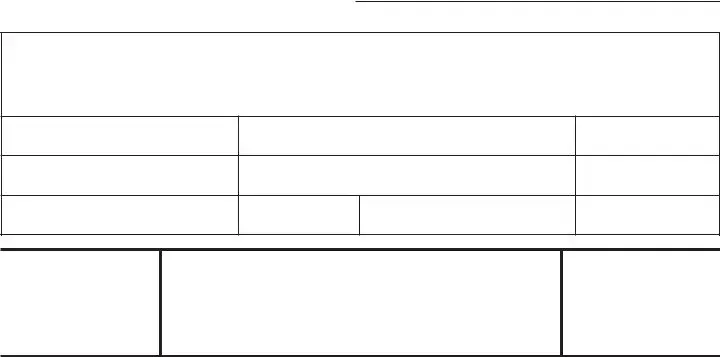

Distribution of Subdivision’s Share of Tax

(Ohio Revised Code Section 5731.48 and 5731.50)

Percentage |

City, Village or Township |

|

|

|

|

Date Received by

Ohio Department of Taxation

ET 2

Rev. 12/01

Page 3

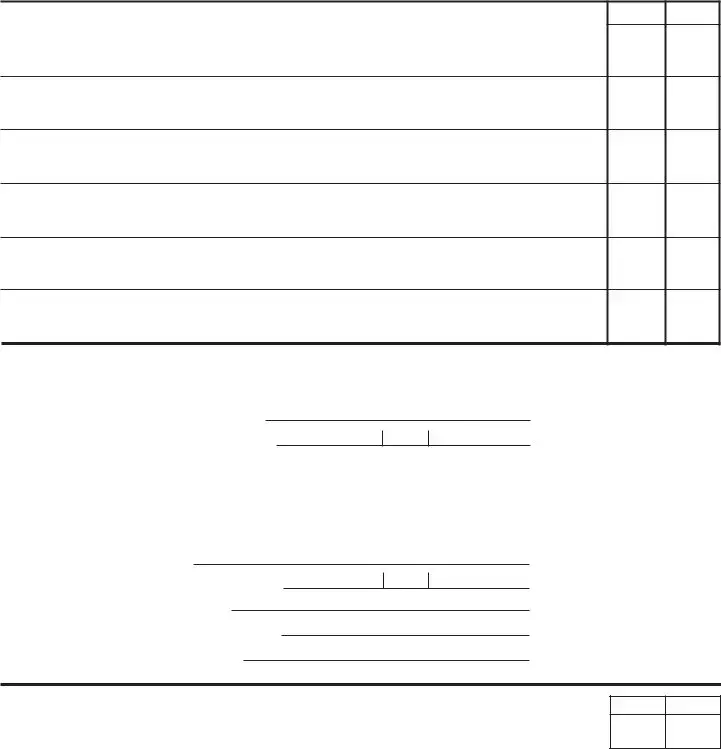

Information

1.Did the decedent die testate? ..............................................................................................................................

If yes, please attach a copy of the will.

2.During the decedent’s lifetime, were there any trusts created (by the decedent or others for the decedent)? ..

If yes, please attach a copy of the trust.

3.Were any disclaimers filed or elections to take against the will made? .............................................................

If yes, please attach copies of the disclaimer or election.

4.Have federal gift tax returns ever been filed? .......................................................................................................

If yes, please attach copies of the returns.

5.Was a federal estate tax return required? ............................................................................................................

If yes, please attach pages 1, 2 and 3 of federal form 706.

6.Did the decedent own any real property? .............................................................................................................

If yes, please attach copies of any appraisals.

7.Marital status of the decedent at time of death:

Married

Name of surviving spouse (if applicable )

Social security number of surviving spouse

Single

Legally separated

Divorced

Widowed

Name of deceased spouse

Social security number of deceased spouse

Date of death of deceased spouse

Case number of deceased spouse’s estate

County of deceased spouse’s estate

8. If widow or widower, was a QTIP deduction elected in the predeceased spouse’s estate? .............................

If yes, please read information below and complete Schedule F.

R.C. section 5731.131 requires the estate to include property in which the decedent had an income interest for life for which a marital deduction was allowed with respect to the transfer of that property under any of the following:

a. R.C. section 5731.15(A)(1) (for dates of death on or before June 30, 1993) b. R.C. section 5731.15(B) R.C. (for dates of death on or after July 1, 1993)

c. Internal Revenue Code (I.R.C.) section 2523(f) (lifetime QTIP gift tax election)

d. Where the decedent’s predeceased spouse was not a resident of the state of Ohio but was permitted a marital deduction under I.R.C. section 2056(b)(7).

- 3 -

Schedules of Assets

Jointly owned property must be listed on Schedule E.

Schedule A – Real Estate

Schedule B – Stocks and Bonds

Schedule C – Mortgages, Notes and Cash

Schedule D – Insurance

Schedule E – Joint and Survivorship Assets (R.C. Section 5731.10)

Part I – Interest Held By the Decedent and Spouse as the Only Joint Tenants

Schedule E – Joint and Survivorship Assets (R.C. Section 5731.10)

Part II – All Other Joint Interests

Schedule F – Miscellaneous Property

Schedule G – Transfers During Decedent’s Life

Schedule H – Powers of Appointment

Schedule I – Annuities, Pensions, Retirement and Other Employer Death Benefit Plans

Schedules of Deductions

Schedule J – Debts and Administration Expenses Schedule K – Charitable Deduction

Schedule L – Marital Deduction Reconciliation

Schedule M – Bequests to Surviving Spouse

Part I – Property Interests that are not subject to a QTIP election

Schedule M – Bequests to Surviving Spouse

Part II – Property Interests that are subject to a QTIP election

Please visit our web site at

tax.ohio.gov

to download these schedules.

Explanation of Elections

Alternate Valuation Date [R.C. Section 5731.01(A) and (D)]

The gross estate may be valued on the decedent’s date of death or on an alternate valuation date. The alternate valuation date is six months from date of death unless the property item is sold, disposed of or distributed within that six months.

The executor must make an election by checking “yes” in the Elections section of the return. This election is mutually ex- clusive of the federal election. However, it must be elected

within one year and nine months from the date of decedent’s death or within one year from any extensions granted by the tax commissioner. Once made, this election is irrevocable.

If alternate valuation is elected, please list both date of death values and alternate values, and the alternate valuation date on the applicable schedules.

Qualified Farm Property Valuation (R.C. Section 5731.011)

The estate may elect Qualified Farm Property Valuation for determining the value of farm property as an alternative to its fair market value. To have qualified farm property valued at this special valuation, certain conditions must be met.* This elec-

tion must be made on a timely filed return determined with regard to any approved extensions of time to file.

To help expedite the audit, please attach the following:

1.A complete estate tax form 34;

2.Most recent county auditor real estate propertyrecord;

3.Current agricultural use valuation (CAUV) cards (from county auditor);

4.Fair market value appraisal (broken down into one acre homesite, improvements and bare land only).

If the qualified farm property valuation is elected, use the quali- fied farm property value column in Schedule A or identify the qualified property under Schedule E or G.

*Please refer to estate tax Bulletin 5.

Qualified Terminable Interest Property (QTIP)

(R.C. Section 5731.15)

The Qualified Terminable Interest Property (QTIP) election al- lows certain life estates held for the surviving spouse to qualify for the marital deduction.

The requirements for QTIP are the following:

1.Surviving spouse must receive all the income for life pay- able annually or at more frequent intervals; and

2.No one can have a power to appoint the property to any person other than the surviving spouse during surviving spouse’s life; and

3.The executor must make an election by checking “yes” in the Elections section of the return. Once the election is

made, it is irrevocable. This election must be made on a timely filed return determined with regard to any approved extensions of time to file.

The executor may make a partial QTIP election only if it is in the form of a fraction or percentage of available QTIP property. The specific interest should be clearly identified as QTIP.

The surviving spouse’s estate must include all QTIP property claimed in the first spouse’s estate, to the extent not con- sumed or given away, at the value on the date of death of the surviving spouse.