General Instructions

Submit three copies of this application to the auditor’s office in the county where the property is located (make a copy for your records). The final deadline for filing with the county auditor is Dec. 31 of the year for which exemption is sought. If you need assistance in completing this form, contact your county auditor.

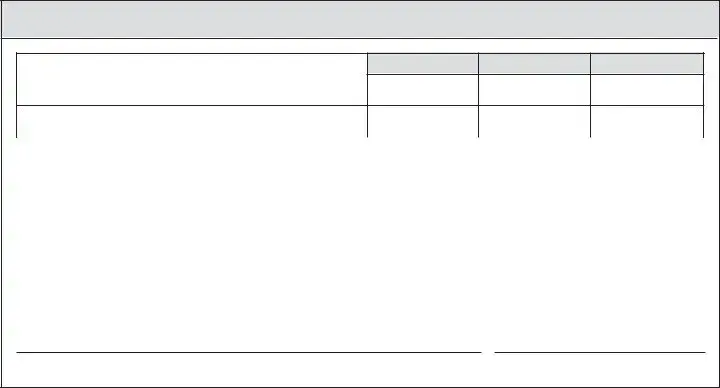

Both the county auditor’s finding (page 3) and the treasurer’s certificate (page 4) of this application must be completed. Ask your county auditor for the procedure to follow to obtain the treasurer’s certificate. When presented with this application, the county treasurer should promptly complete the certificate and return the application to you so it may be filed with the county auditor. The county treasurer should make certain that the treasurer’s certificate is complete and accurately reflects the pay- ment status of taxes, special assessments penalties and interest, by tax year. Obtain a copy of the property record card from the county auditor and enclose it with this application. It is the applicant’s responsibility to make sure the information supplied by the county auditor and county treasurer is complete and accurate.

Answer all questions on the form. If you need more room for any question, use additional sheets of paper to explain details. Please indicate which question each additional sheet is answering. This application must be signed by the property owner or the property owner’s representative.

Special Instructions for Tax Increment Financing Exemptions

If the applicant requests an exemption under Ohio Revised Code (R.C.) 725.02, 1728.10, 5709.40, 5709.41, 5709.73 or 5709.78, the application can be signed by the property owner, the property owner’s representative, the political subdivi- sion without the property owner’s consent, or the political subdivision with the property owner’s consent acting under a power of attorney (attach DTE form 24P). If the application is signed by the political subdivision without the property owner’s consent, such exemption shall be subordinate to an exemption granted under any other section of the Revised Code and service payments shall not be required for the portion of the property exempt under that other section. If the exemption requested involves service payments in lieu of taxes and the application is signed by the property owner, the property owner’s representative, or the political subdivision with the property owner’s consent acting under a power of attorney, those payments will remain in effect for the term of the exemption even if the property is used later for another exempt purpose, unless the political subdivision consents in writing to the subsequent exemption. These service pay- ments are also binding on future owners if the political subdivision or the property owner files a notice with the county recorder after the tax commissioner approves the application, unless the political subdivision consents in writing to the subsequent exemption. Failure to file such notice relieves only future owners from the obligation to make service pay- ments if the property becomes exempt under any other provision of the Revised Code. Consent by a property owner filed with the tax commissioner after the commissioner has approved an application for exemption originally filed by the political subdivision without the property owner’s consent will trigger the same procedures mentioned above for an application fi led by or with the property owner’s consent.

Please Type or Print Clearly

Applicant name

Name

Notices concerning

this application Name (if different from applicant) should be sent to

Address

City |

State |

ZIP |

Telephone number |

Application is hereby made to have the following property placed on the tax-exempt list pursuant to the authorizing agreement, ordinance or resolution, and the limitations in the Ohio Revised Code.

Karen T. Bailey, Champaign County Auditor