Filling out the Ohio DLC 1551 form can be a straightforward process, but many applicants make common mistakes that can lead to delays or complications. Understanding these pitfalls can help ensure a smoother application experience.

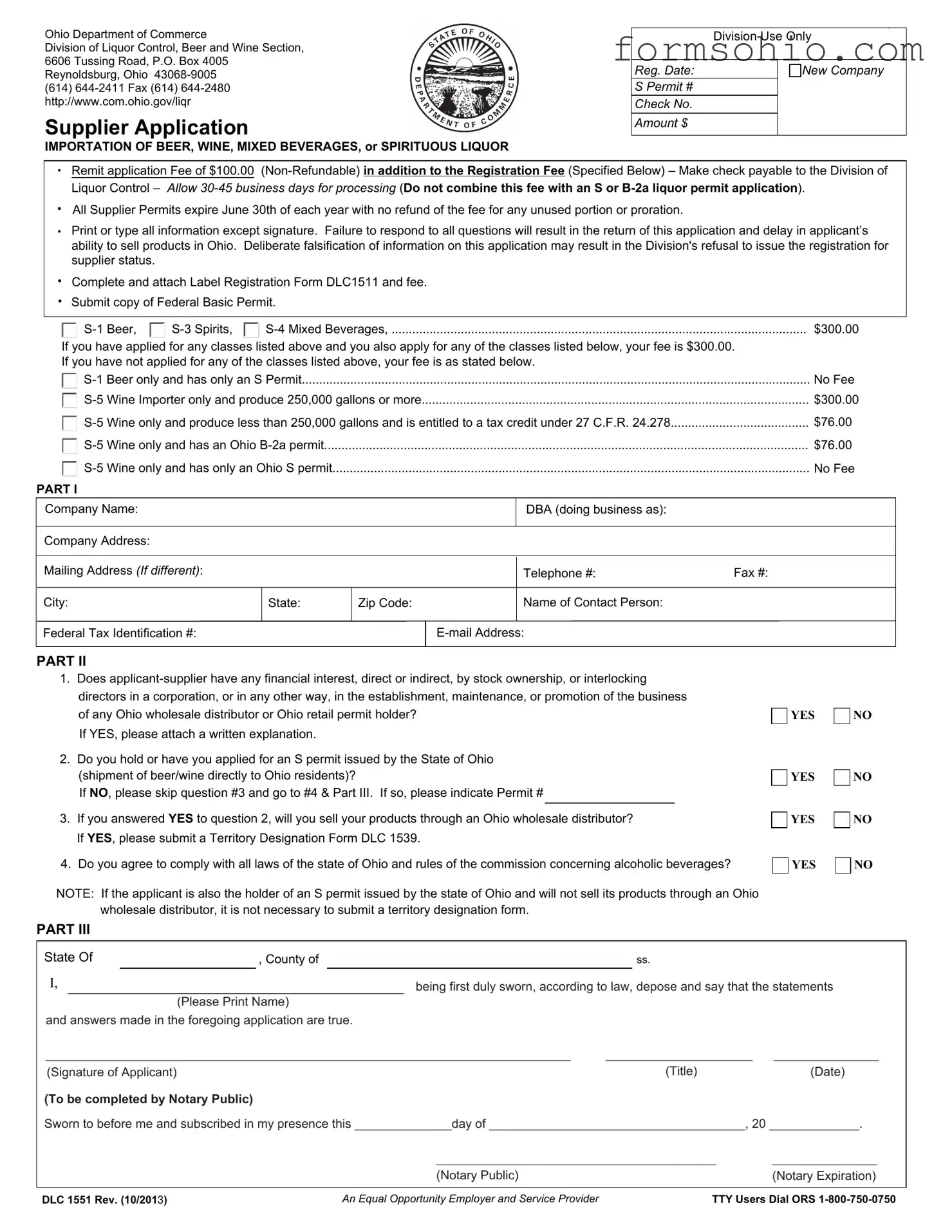

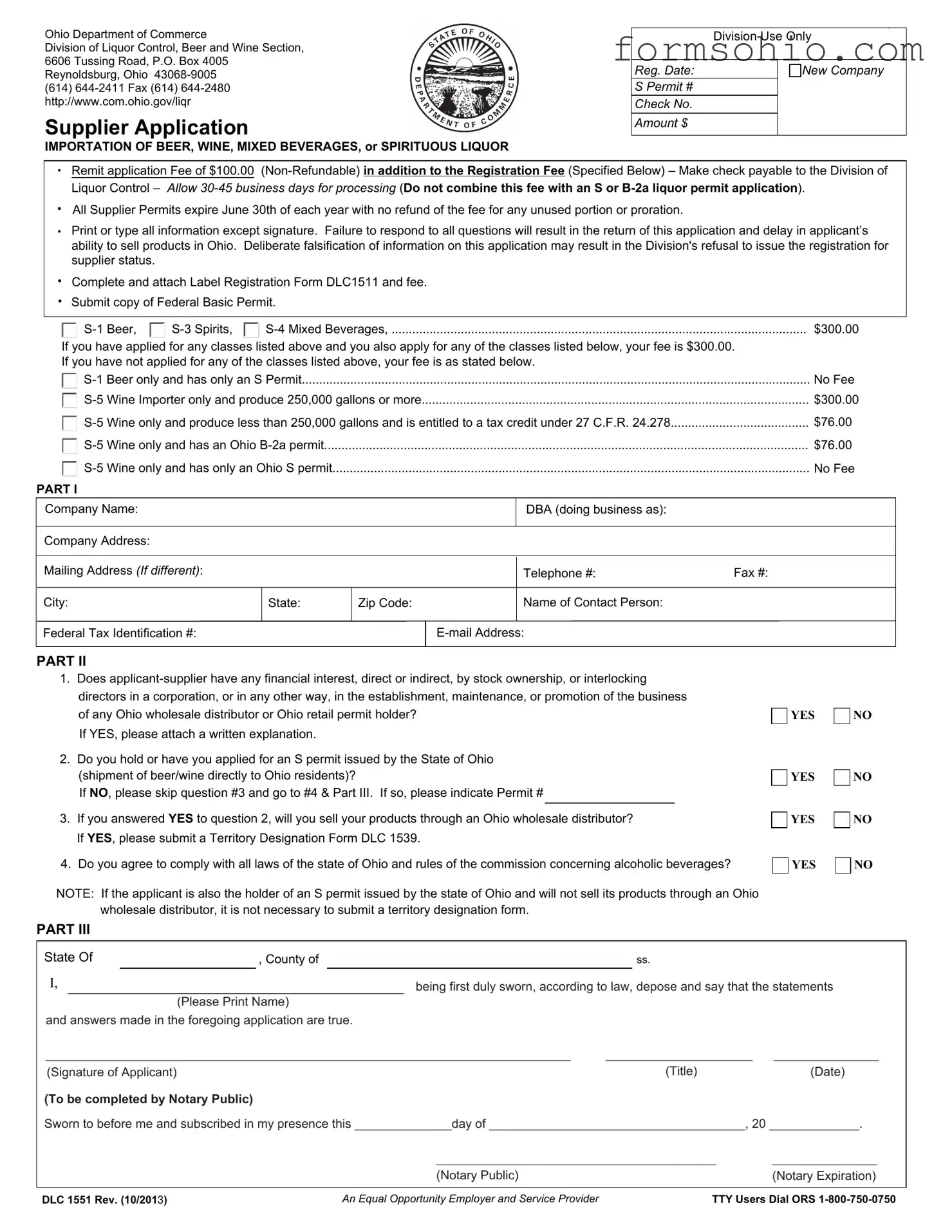

One frequent error is not providing complete information. The form requires specific details about the company, including the Company Name, DBA, and Federal Tax Identification Number. Omitting any of these can result in the application being returned. It's crucial to double-check that all sections are filled out accurately.

Another mistake involves the payment of fees. The application requires a non-refundable fee of $100, in addition to the registration fee. Some applicants mistakenly combine this fee with other permit applications, which can lead to processing delays. Always ensure that the payment is separate and clearly labeled.

Many applicants also overlook the requirement to submit a copy of the Federal Basic Permit. This document is essential for the application process. Without it, the application will be incomplete and could be rejected.

Some individuals fail to answer all the questions in Part II of the form. For instance, if an applicant has a financial interest in an Ohio wholesale distributor, they must provide a written explanation. Ignoring this can result in significant delays as the Division may require additional information.

Additionally, not adhering to the signature requirements can be problematic. The applicant must sign the form, and it must be notarized. If either of these steps is skipped, the application will not be valid, causing further delays.

Another common oversight is neglecting to attach the Label Registration Form DLC1511. This form is necessary for the application to be processed. Failing to include it can lead to confusion and a return of the application.

Some applicants mistakenly skip question #3 if they answered "NO" to question #2. This can lead to confusion in the application process. It's important to follow the instructions carefully and answer all relevant questions.

Another issue arises when applicants do not keep copies of their submitted forms. Having a copy can be beneficial for tracking the application status or addressing any issues that may arise later.

Lastly, many applicants do not allow enough time for processing. The Division advises allowing 30-45 business days. Applying close to a deadline can lead to unnecessary stress and complications. Planning ahead is essential.

By avoiding these common mistakes, applicants can improve their chances of a successful application process for the Ohio DLC 1551 form.