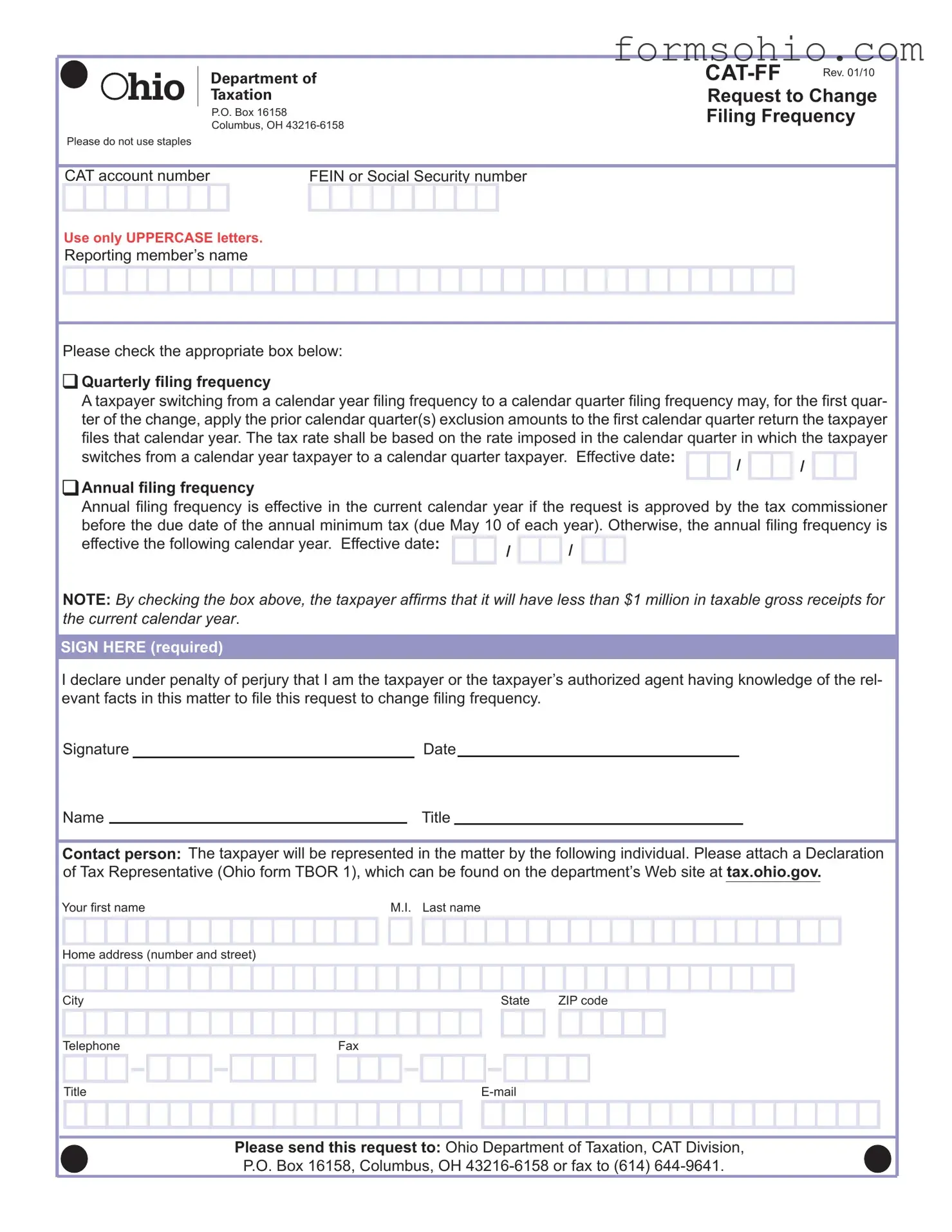

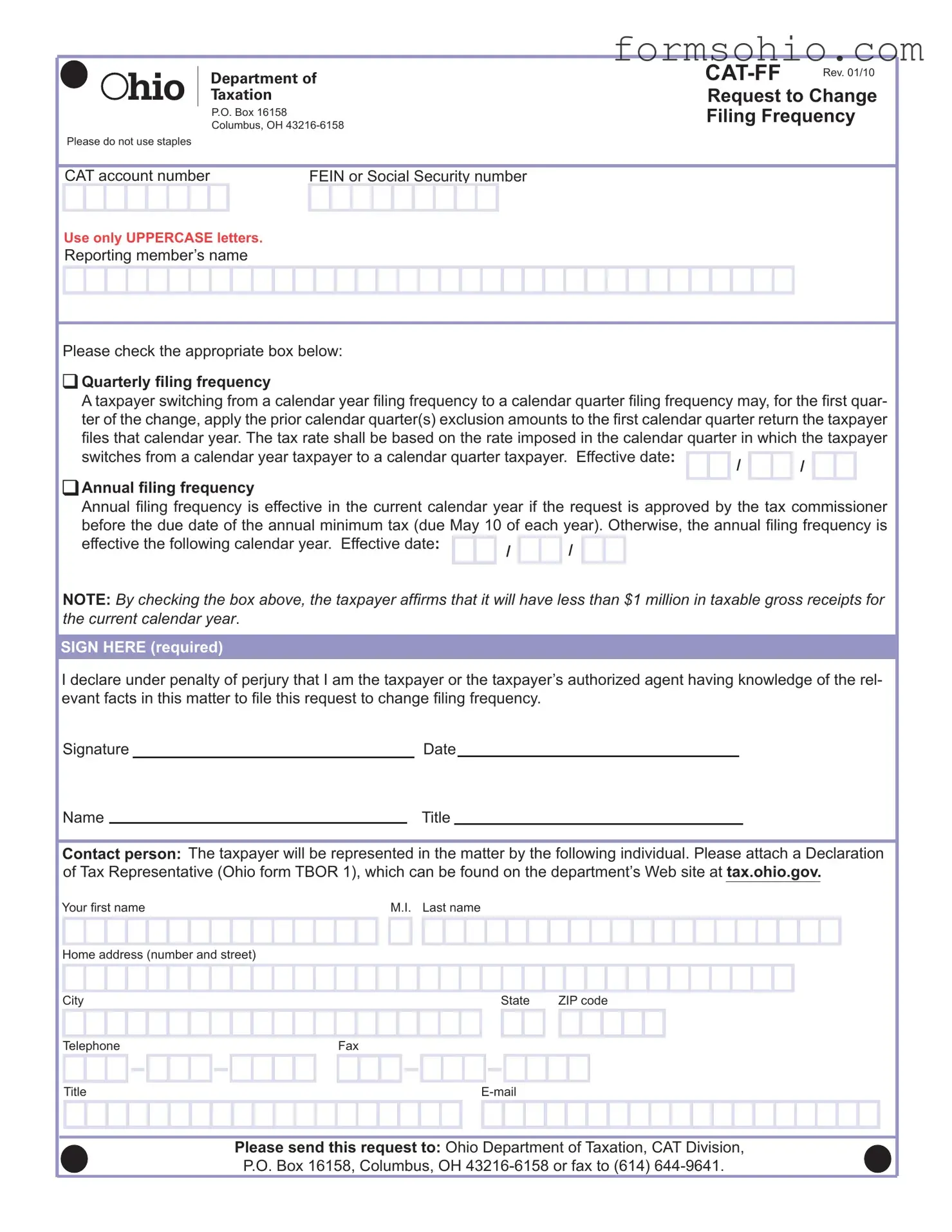

Filling out the Ohio CAT Ff form can be a straightforward process, but many people make common mistakes that can lead to delays or even rejections. Here are nine mistakes to avoid when completing this important form.

First, failing to use UPPERCASE letters is a frequent error. The form specifically instructs taxpayers to fill it out using only uppercase letters. Using lowercase or mixed case can cause confusion and may lead to processing delays.

Another common mistake is not checking the appropriate filing frequency box. Taxpayers must indicate whether they are opting for quarterly or annual filing. If this box is left unchecked, it can result in the form being returned for correction, wasting time and effort.

Many individuals also overlook the effective date of the filing frequency change. It’s crucial to fill in the effective date clearly. If the date is missing or incorrect, it could affect when the new filing frequency takes effect, potentially leading to penalties.

Providing incorrect or incomplete taxpayer identification numbers is another mistake. Whether it’s a CAT account number, FEIN, or Social Security number, ensure that these numbers are accurate. Errors here can complicate the processing of your request.

Signatures are often forgotten or improperly completed. The form requires a signature under penalty of perjury. Make sure to sign and date the form; otherwise, it will not be considered valid.

In addition, failing to attach the required Declaration of Tax Representative can be problematic. If you are having someone represent you, include this document. Not doing so may delay your request.

Another mistake is neglecting to provide complete contact information. Ensure that the home address, telephone number, and email are all filled out accurately. Missing contact details can hinder communication from the tax department.

Many taxpayers also forget to double-check their forms for errors before submission. Take a moment to review everything for accuracy. Small mistakes can lead to significant issues later on.

Lastly, failing to send the form to the correct address can cause delays. Make sure you send your request to the Ohio Department of Taxation at the specified address. If you choose to fax it, verify that the number is correct.

By avoiding these common pitfalls, you can streamline the process of changing your filing frequency and ensure a smoother experience with the Ohio Department of Taxation.

HIO

HIO