CAT CS

Rev. 12/11

P.O. Box 16158

Columbus, OH 43216-6158

Commercial Activity Tax Credit Report

CAT account number (of primary reporting entity) |

|

|

|

|

|

FEIN/SSN |

|

|

|

Reporting member’s name |

|

|

|

|

|

|

|

|

|

|

|

|

Street address (number and street) |

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

State |

|

|

|

ZIP code |

|

Period covered (MM/DD/YY) |

|

|

|

to (MM/DD/YY) |

|

|

|

|

|

|

|

|

(Quarter for which this report is being submitted) |

|

|

|

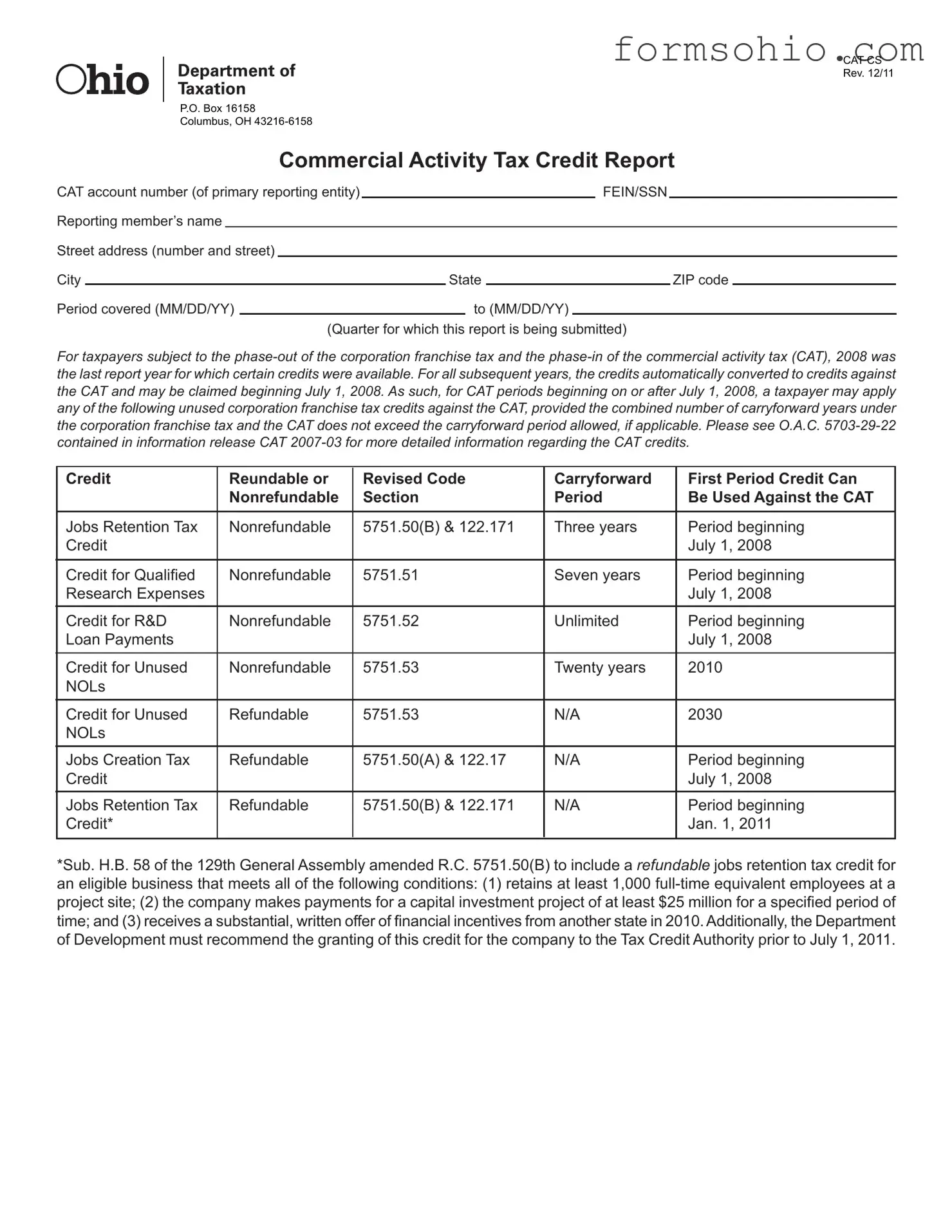

For taxpayers subject to the phase-out of the corporation franchise tax and the phase-in of the commercial activity tax (CAT), 2008 was the last report year for which certain credits were available. For all subsequent years, the credits automatically converted to credits against the CAT and may be claimed beginning July 1, 2008. As such, for CAT periods beginning on or after July 1, 2008, a taxpayer may apply any of the following unused corporation franchise tax credits against the CAT, provided the combined number of carryforward years under the corporation franchise tax and the CAT does not exceed the carryforward period allowed, if applicable. Please see O.A.C. 5703-29-22 contained in information release CAT 2007-03 for more detailed information regarding the CAT credits.

Credit |

Reundable or |

Revised Code |

Carryforward |

First Period Credit Can |

|

Nonrefundable |

Section |

Period |

Be Used Against the CAT |

|

|

|

|

|

Jobs Retention Tax |

Nonrefundable |

5751.50(B) & 122.171 |

Three years |

Period beginning |

Credit |

|

|

|

July 1, 2008 |

|

|

|

|

|

Credit for Qualifi ed |

Nonrefundable |

5751.51 |

Seven years |

Period beginning |

Research Expenses |

|

|

|

July 1, 2008 |

|

|

|

|

|

Credit for R&D |

Nonrefundable |

5751.52 |

Unlimited |

Period beginning |

Loan Payments |

|

|

|

July 1, 2008 |

|

|

|

|

|

Credit for Unused |

Nonrefundable |

5751.53 |

Twenty years |

2010 |

NOLs |

|

|

|

|

|

|

|

|

|

Credit for Unused |

Refundable |

5751.53 |

N/A |

2030 |

NOLs |

|

|

|

|

|

|

|

|

|

Jobs Creation Tax |

Refundable |

5751.50(A) & 122.17 |

N/A |

Period beginning |

Credit |

|

|

|

July 1, 2008 |

|

|

|

|

|

Jobs Retention Tax |

Refundable |

5751.50(B) & 122.171 |

N/A |

Period beginning |

Credit* |

|

|

|

Jan. 1, 2011 |

|

|

|

|

|

*Sub. H.B. 58 of the 129th General Assembly amended R.C. 5751.50(B) to include a refundable jobs retention tax credit for an eligible business that meets all of the following conditions: (1) retains at least 1,000 full-time equivalent employees at a project site; (2) the company makes payments for a capital investment project of at least $25 million for a specified period of time; and (3) receives a substantial, written offer of financial incentives from another state in 2010. Additionally, the Department of Development must recommend the granting of this credit for the company to the Tax Credit Authority prior to July 1, 2011.

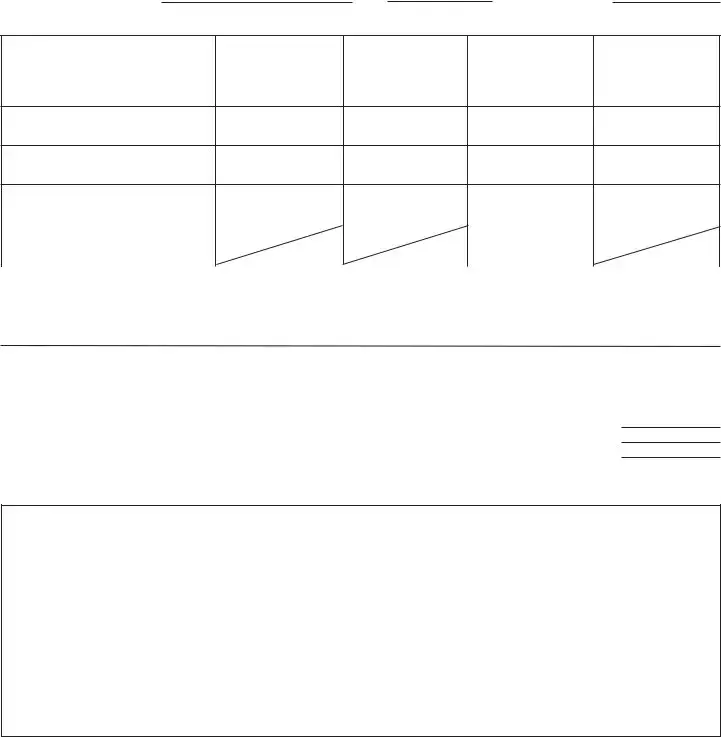

Credit Schedule

(If credits are being claimed by members of a consolidated elected or combined taxpayer group, a separate schedule is required for each entity that is claiming a credit.)

The CAT account number of the entity entitled to the credit may be different than that of the primary reporting entity.

Entity entitled to credit: NameFEINCAT account number

Nonrefundable Credits

|

A |

B |

C |

D |

|

|

|

|

|

|

Opening Unused |

Credit Earned |

Credits Claimed |

Closing Unused |

|

During Current |

During Current |

|

Credit Balance |

Credit Balance |

|

Reporting Period |

Reporting Period |

|

|

|

1.Jobs retention credit+

2.Qualifi ed research expense credit

3.Research and development loan repayment credit+

*Combine with credits being claimed by other entities in group (if any) and carry this forward to line 7 on your CAT return.

+Must attach credit certifi cate received from the Department of Development

Refundable Credits

Must attach credit certifi cate received from the Department of Development

Jobs creation credit |

1. |

Jobs retention credit |

2. |

Total of lines 1 and 2 to be carried forward to line 11 of CAT return |

3. |

Declaration and signature (an offi cer or managing agent of the corporation must sign this declaration)

I declare under penalties of perjury that this report (including any |

use any of its money or property for or in aid of or opposition to |

accompanying schedule or statement) has been examined by |

a political party, a candidate for election or nomination to public |

me and to the best of my knowledge and belief is a true, correct |

office, or a political action committee, legislation campaign fund, |

and complete return and report, and that this corporation has not, |

or organization that supports or opposes any such candidate or |

during the preceding year, except as permitted by Ohio Revised |

in any manner used any of its money for any partisan political |

Code sections 3517.082, 3599.03 and 3599.031, directly or |

purpose whatsoever, or for reimbursement or indemnification of |

indirectly paid, used or offered, consented, or agreed to pay or |

any person for money or property so used. |

|

|

|

|

|

|

|

|

Date (MM/DD/YY) |

Signature of offi cer or managing agent |

Title |

|

|

|

|

|

|

|

|

|

|

|

Contact telephone no. |

|

|

E-mail |

|

|