|

|

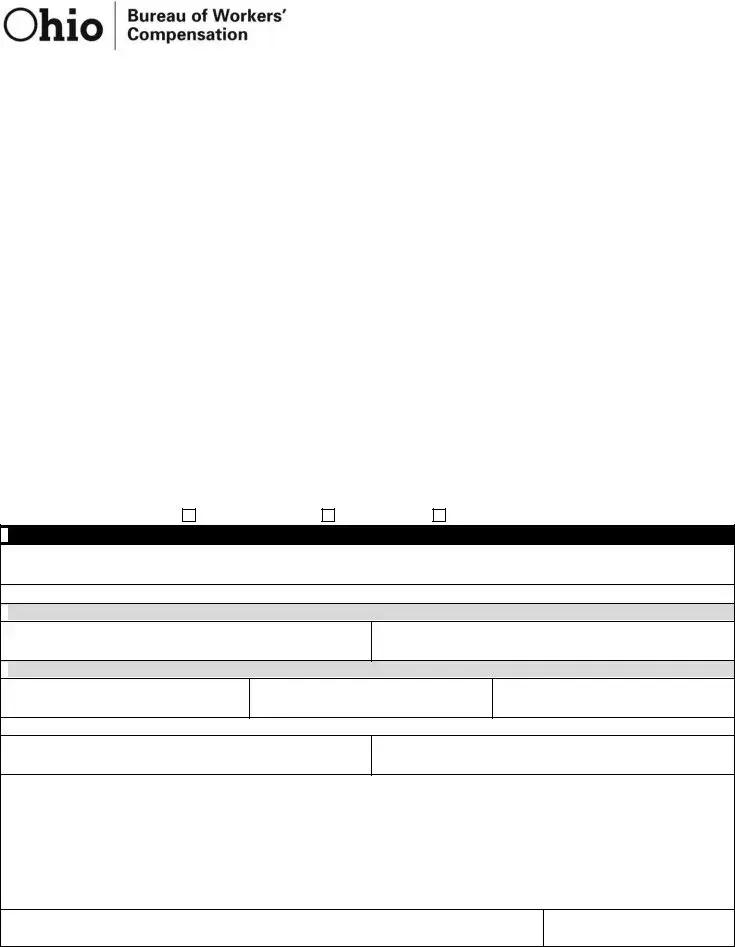

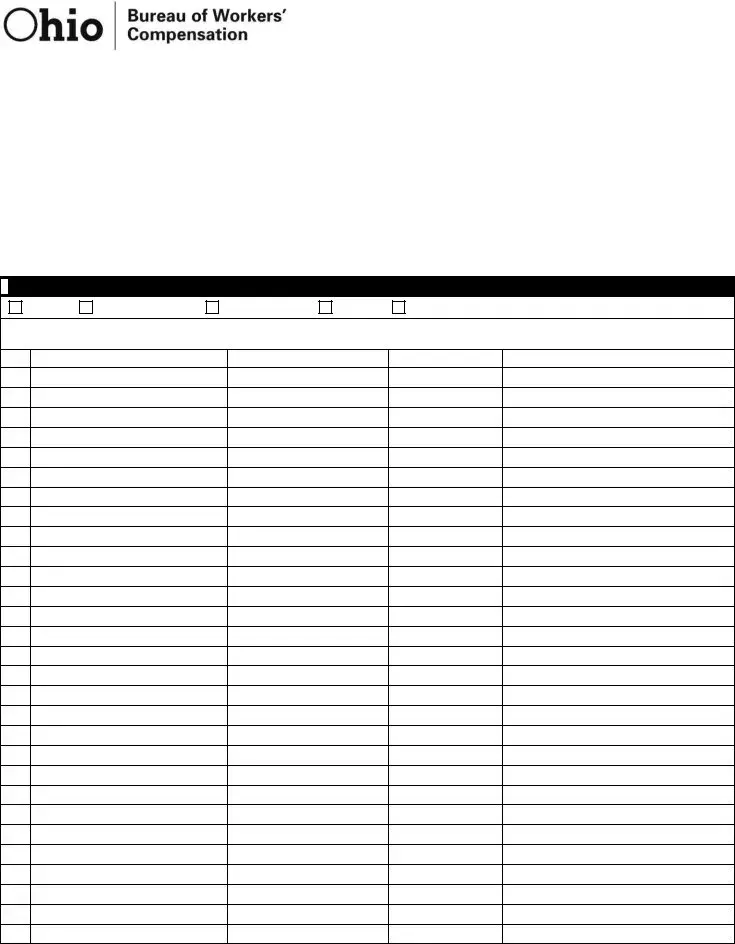

Wage Statement |

|

|

|

Injured worker name |

Date of injury |

Claim number |

|

|

|

Phone number |

Cell number |

|

|

|

|

Employer name |

Phone number |

|

|

|

|

Email address |

|

|

|

|

|

Instructions for the employer

Complete and sign this wage statement. It is not necessary for you to complete the affidavit, unless you are also the injured worker.

Report gross earnings. Gross wages include all earnings for the injured worker prior to any deductions such as for taxes, insurance or employee contributions to retirement programs. Include earnings amounts from paid holidays, vacation, personal or sick leave used (but not leave time paid but not used). Earnings are reported in the periods they are earned, not when they are paid. Some earnings such as bonuses and commissions need to be prorated.

Instructions for the injured worker

Failure to file wage statements may delay or adversely affect rates of compensation.

If you are self-employed or unemployed, complete and sign this report, including the affidavit. The affidavit may be sworn to without cost before a deputy in a BWC local customer service office.

If anyone other than the employer of record in this claim employed you during the year prior to the date of injury, you must obtain this information from those employers. If your other employer completes this form, it is not necessary for that employer to complete the affidavit.

If detailed earnings from your employer(s) are not available, you can provide other documentation such as W-2s or Social Security reports. If you submit a 1099, information reported to the IRS or a sworn statement regarding expenses related to that income must accompany it. BWC will assume earnings submitted on a W-2, Social Security report or 1099 were earned over the entire year unless specifically noted.

This form was completed by:

You must provide this information, even if you are providing weekly earnings on an attached report.

You must provide this information, even if you are providing weekly earnings on an attached report.

Date of hire

Provide information based on pay period begin and end dates, not payment dates.

For the full pay period that ended prior to the date of injury:

For the full pay period that ended prior to the date of injury:

During the last seven days of that pay period:

During the last seven days of that pay period:

If employed less than one full pay period prior to the date of injury, provide the following information:

Number of hours scheduled the week of the injury

If the injured worker received any bonuses, allowances or other payment, please describe the nature of the payment and time period over which it was earned below. You may also provide other information for us to consider in the calculation of FWW and/or AWW such as periods of unemployment in the space below.

BWC-1217 (Rev. 7/30/2012) WAGES formerly known as C-94A

Wage Statement

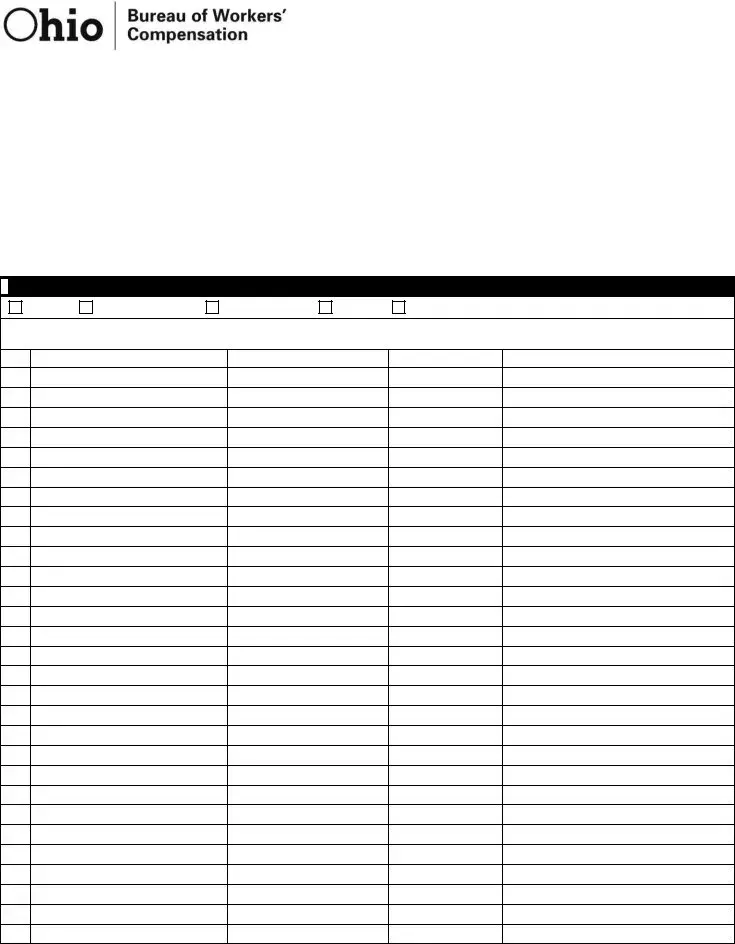

You may submit earnings by providing a report that includes the required information as described below or by completing this worksheet.

Report the pay period dates, not the date payment was made.

Report any periods the injured worker did not work. If payment was made during those periods, report the amount and description of payment the injured worker received.

If the employee received an allowance for meals, lodging, tips, etc in addition to wages, report as other earnings with a description of the earnings. It is not necessary to report reimbursements made to the injured for travel, uniforms, etc. BWC does not consider reimbursements earnings for calculations of wages.

If the injured worker received a bonus during the reporting period, report as other earnings with a description of the earnings which includes the period of time over which it was earned.

Report earnings beginning with the full pay period that ended prior to the date of injury. When setting the

periods to report, you may adjust the reporting periods backward to line up the reporting time frames with the employer’s pay cycle. Do not report wages earned on or after the date of injury.

Payment is made (check one)

Payment is made (check one)

Weekly |

Every two weeks |

Twice a month |

Monthly |

Other |

Use the worksheet below, or attach other documentation to provide earnings information for the 52 weeks prior to the date of injury, beginning with the full pay period prior to the date of injury.

Pay period end date |

Gross amount earned |

Other earnings |

Description of exceptions |

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

BWC-1217 (Rev. 7/30/2012)

WAGES formerly known as C-94A

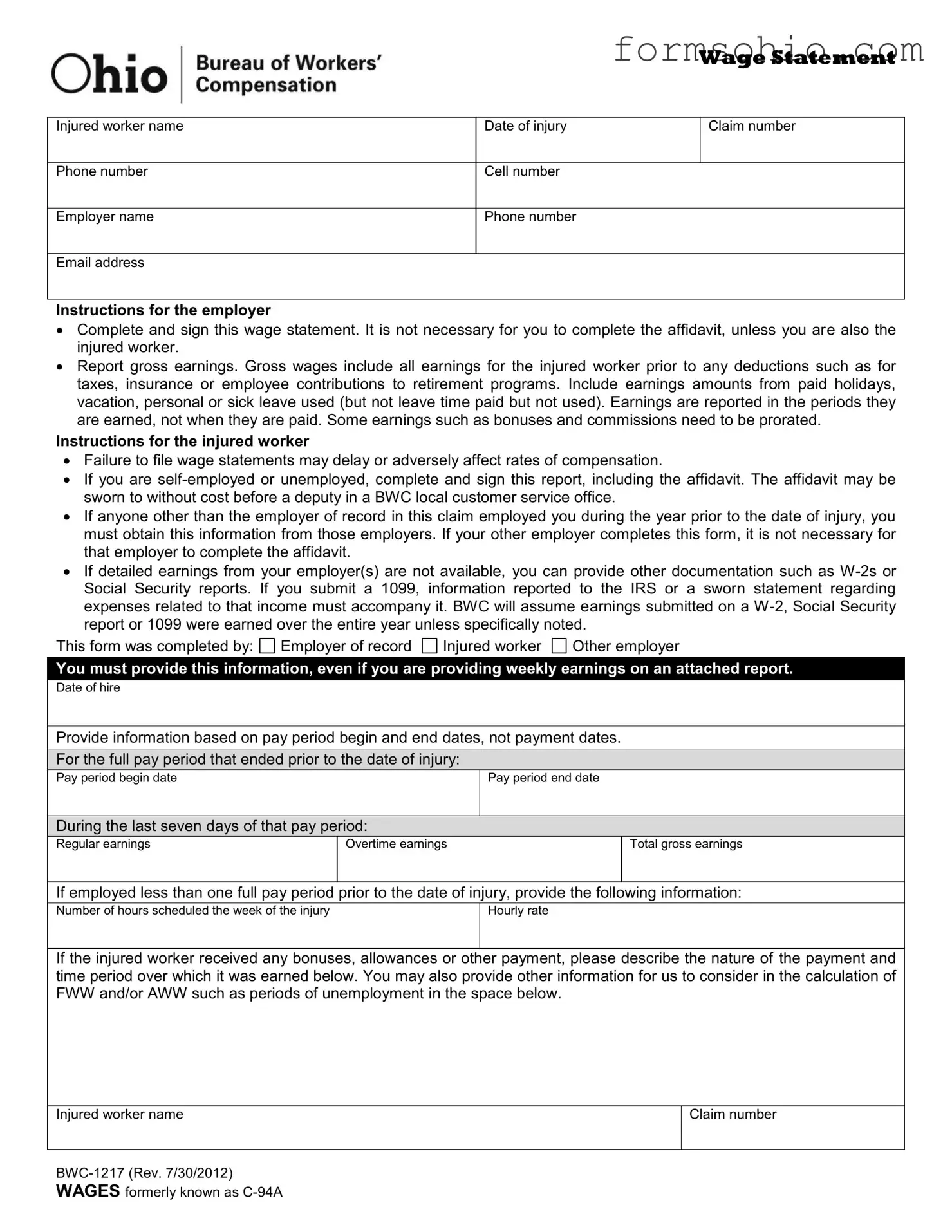

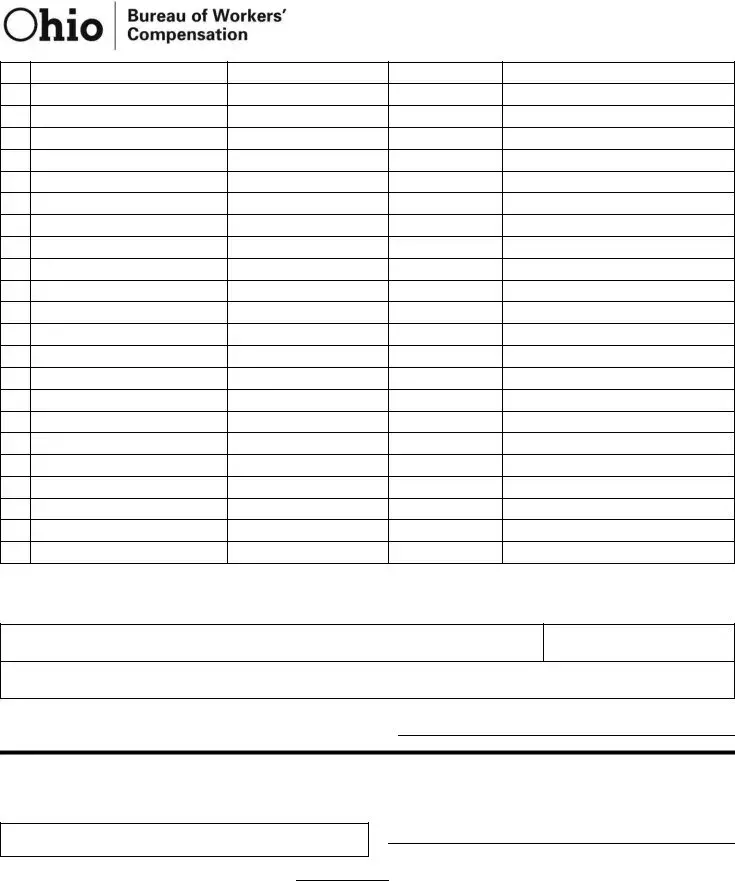

Wage Statement

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

I certify the information provided is correct to the best of my knowledge. I am aware that any person who knowingly makes a false statement, misrepresentation, concealment of fact, or any other act of fraud to obtain payment as provided by the BWC or who knowingly accepts payment to which that person is not entitled, is subject to felony criminal prosecution and may, under appropriate criminal provisions, be punished by a fine, imprisonment or both.

Employer name and title

X

Employer signature and title

Affidavit

State of Ohio, County of __________________________________ Social Security number: __________________________________

being first duly sworn, says that the entire earnings from ___________________ to ___________________ ; as listed above is correct.

If unable to write, mark must be witnessed by two persons.

Sworn to before me, and subscribed in my presence

Official title

BWC-1217 (Rev. 7/30/2012)

WAGES formerly known as C-94A

You must provide this information, even if you are providing weekly earnings on an attached report.

You must provide this information, even if you are providing weekly earnings on an attached report. For the full pay period that ended prior to the date of injury:

For the full pay period that ended prior to the date of injury: During the last seven days of that pay period:

During the last seven days of that pay period:

Payment is made (check one)

Payment is made (check one)