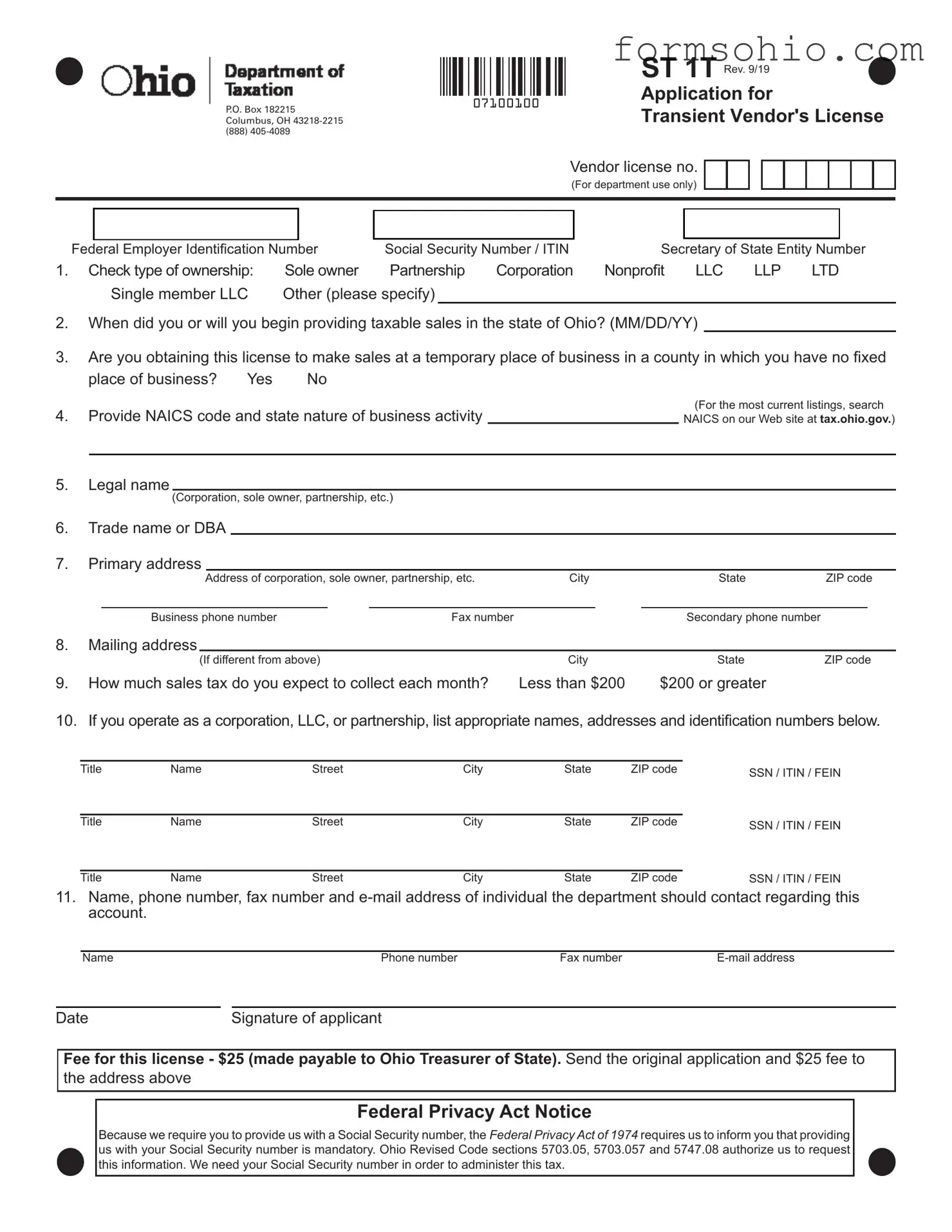

Filling out the Ohio Application for Vendor's License can be a straightforward process, but many applicants make common mistakes that can delay approval. One frequent error is failing to select the correct type of ownership. Applicants must clearly indicate whether they are a sole owner, partnership, corporation, or another entity. Omitting this detail can lead to confusion and unnecessary processing delays.

Another mistake involves not providing the correct Federal Employer Identification Number (FEIN) or Social Security Number (SSN). This information is crucial for tax administration purposes. Ensure that the numbers are accurate and match the official documents. Inaccurate information can result in rejection of the application.

Many applicants overlook the requirement to specify the start date for taxable sales in Ohio. This date must be formatted correctly (MM/DD/YY). Failing to provide this information can cause delays in processing your application, as the department needs this detail to determine your eligibility for the license.

Providing the wrong NAICS code or failing to include it altogether is another common pitfall. The NAICS code helps classify your business activity and is essential for tax purposes. Always double-check the code on the official website to ensure it is current and relevant to your business.

Address inaccuracies can also create complications. When listing your primary and mailing addresses, ensure they are complete and correct. A missing ZIP code or incorrect city can lead to miscommunication and delays in receiving important correspondence from the department.

Many applicants underestimate the importance of estimating the expected sales tax collection. The form requires you to indicate whether you expect to collect less than $200 or $200 or greater each month. Providing an inaccurate estimate can affect your licensing status and tax obligations.

When operating as a corporation, LLC, or partnership, it is essential to list all appropriate names, addresses, and identification numbers accurately. Omitting details or making errors in this section can lead to complications in verifying your business structure.

Lastly, failing to provide complete contact information for the individual the department should reach out to can result in missed communications. Ensure that the name, phone number, fax number, and email address are all correct and up to date. Clear communication is vital for a smooth application process.