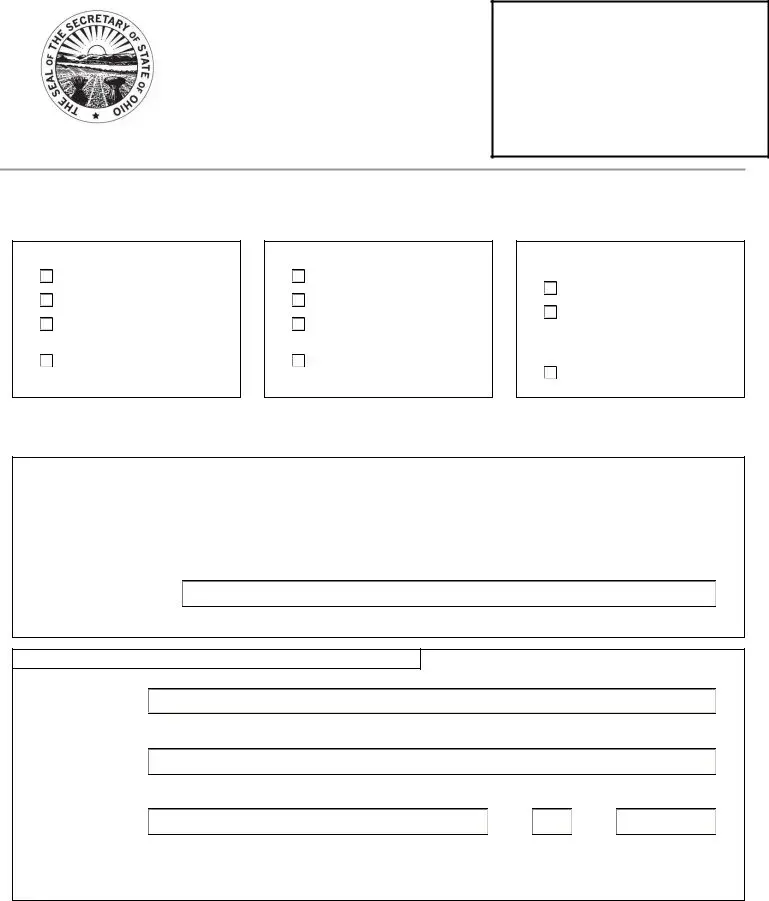

Instructions for Statutory Agent Update

This form should be used to update statutory agent information for a corporation, limited partnership, limited liability company, partnership or business trust. If a corporation, limited partnership or limited liability company or business trust would like to appoint a new statutory agent, please select box 1.

If a corporation, limited partnership, limited liability company, or business trust would like to change the address of the current agent, please select box 2. If the agent of a corporation, limited partnership, limited liability company, partnership, or business trust would like to resign from their position, please select box 3.

A partnership and limited liability partnership must complete a statement of amendment to appoint a new agent or change the address of the current agent.

Entity Information

The corporation, limited partnership, limited liability company, partnership, or business trust must provide its name, charter/license/registration number and the name of the current agent. The current agent's name must be the same as the agent listed in our office's records.

Appointment of New Agent

Pursuant to Ohio Revised Code sections 1701.07, 1702.06, 1703.041, 1782.04, 1705.06 and 1746.04,

a corporation, limited partnership, limited liability corporation and business trust must appoint and maintain a statutory agent to accept service of process on behalf of the entity. The statutory agent must be one

of the following: (1) an Ohio resident; (2) an Ohio corporation; or (3) a foreign corporation that is licensed to do business in Ohio.

If the entity is a domestic corporation, limited liability partnership, limited liability company or business trust, the statutory agent must sign the Acceptance of Appointment on Page 2. The agent of a foreign entity does not have to accept appointment by signing the form.

If the new statutory agent is an individual using a P.O. Box address, the agent must check the box to confirm that he or she is an Ohio resident.

Change of Address of an Agent

Pursuant to Ohio Revised Code sections 1701.07, 1702.06, 1703.041, 1782.04, 1705.06 and 1746.04, a corporation, limited partnership, limited liability company and business trust must appoint and maintain a statutory agent to accept service of process on behalf of the entity. The statutory agent must be one of the following: (1) an Ohio resident; (2) an Ohio corporation; or (3) a foreign corporation that is licensed to do business in Ohio.

Please provide the new address. If the statutory agent is an individual using a P.O. Box address, the appropriate box must be checked to confirm that he or she is an Ohio resident.

Resignation of Agent

Pursuant to Ohio Revised Code sections 1701.07, 1702.06, 1703.041, 1705.06, 1776.07, 1782.04, 1705.06 and 1746.04, an agent may resign by filing this form, stating their intent to resign and providing the current or last known address of the entity's principal office. On the date of filing this form with our office or prior to that date, the agent must send a copy of the resignation form to the current or last known address of the entity's principal office.

one of the form, the filing will be processed within 2 business days after it is received by our office.

one of the form, the filing will be processed within 2 business days after it is received by our office. is only available to

is only available to

Partnership

Partnership

If an agent is an individual using a P.O. Box, the agent must check this box to confirm that the agent is an Ohio resident.

If an agent is an individual using a P.O. Box, the agent must check this box to confirm that the agent is an Ohio resident.