Time Period in Which To File (Statute of Limitations)

1.Generally, you can claim a refund within four years from the date of the overpayment of the tax, interest or penalty. For most taxpayers, the four-year period begins on the date that the Ohio income tax return was due without extensions. For example, 2008 Ohio forms IT 1040 and IT 1040EZ were due April 15, 2009; for 2008 Ohio forms IT 1040 and IT 1040EZ the four-year period begins on April 15, 2009.

2.If your Ohio amended return shows a refund due to a decrease in your federal adjusted gross income and if the IRS issues you a refund check due to that decrease, you always have at least 60 days from the date that the IRS agreed to the decrease to

file your Ohio amended return.

3.If your Ohio amended return shows a refund due to an increase in your Ohio resident credit, you always have 60 days from the date that the other state increased the tax owed to that state to

file your Ohio amended return.

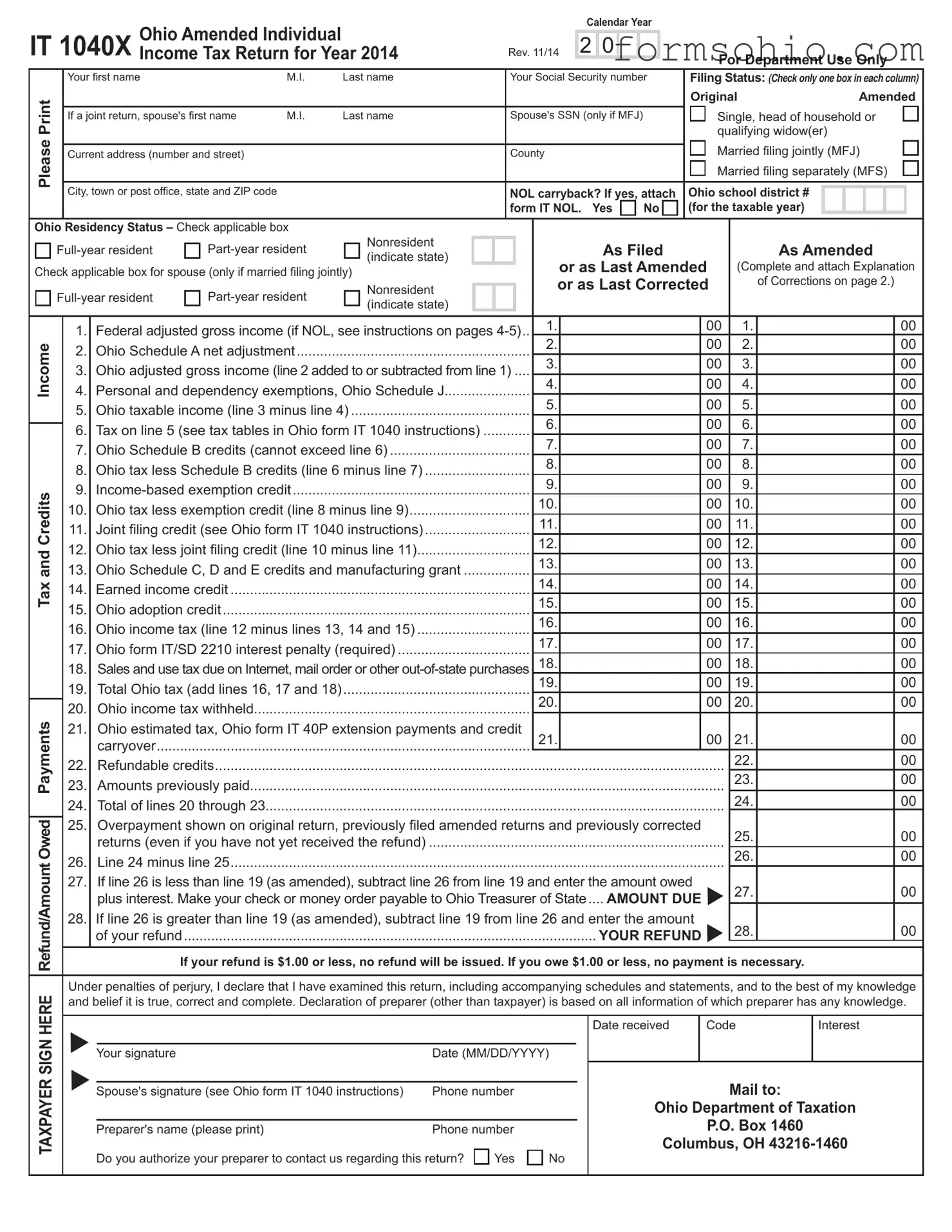

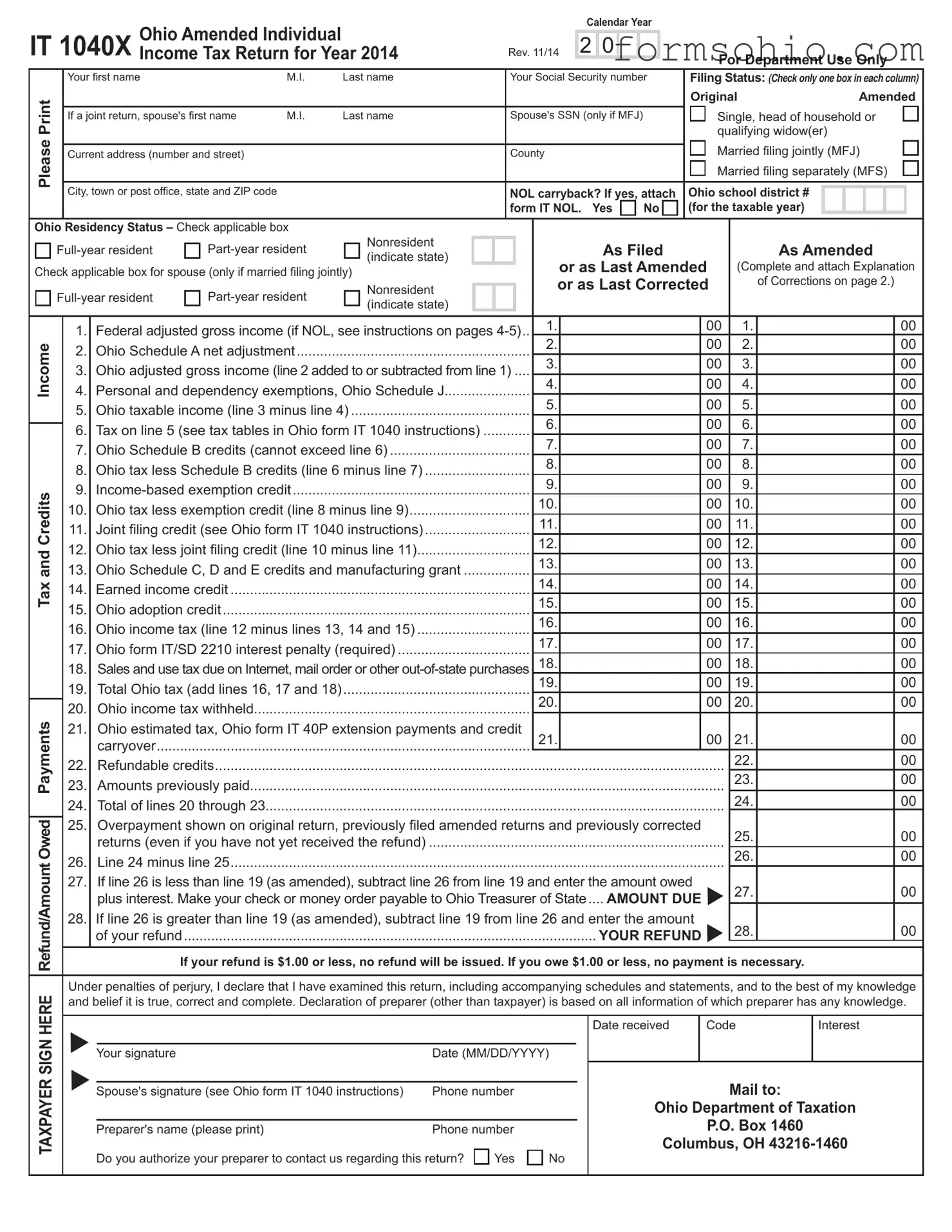

Change in Filing Status

1.Check the box on page 1 of Ohio form IT 1040X that corre- sponds with the filing status of the federal income tax return for which this Ohio form IT1040X is based.

2.You can change your filing status from married filing separately to married filing jointly at any time within the statute of limita- tions, but without taking into consideration any extension of time to file.

3.You cannot change your filing status from married filing jointly to married filing separately after the time (including extensions, if any) has expired for the filing of either your return or your spouse's return.

General Information

1.Use Ohio form IT 1040X to do the following:

correct your Ohio income tax return; AND/OR

request a refund of tax, interest and/or penalty previously paid;

AND/OR

report IRS changes that affected the number of exemptions claimed; AND/OR

report IRS changes that affected your federal adjusted gross income; AND/OR

change your filing status (see Change in Filing Status above).

2.You can file Ohio form IT 1040X only after you have filed an Ohio income tax return (Ohio forms IT 1040 or IT 1040EZ, or any of the department's paperless or electronic tax return filing options).

3.You must complete all of the information requested on the form. Otherwise, we cannot process your amended return and we may have to contact you for additional information.

Please note that if your filing status for your federal income tax return is married filing jointly, then you must place on line 1 of the Ohio income tax return the amount you show as adjusted gross income on your federal income tax return. You must show this amount even if only one spouse earned or received any income in Ohio. See Ohio Administrative Code Rule 5703-7-18, which is available through our Web site at tax.ohio.gov.

4.If your amended return shows a refund due to any of the following:

a decrease in your federal adjusted gross income;

a change in your filing status from married filing jointly to mar- ried fi ling separately; OR

an increase in the number of exemptions claimed,

then you must include the following to avoid delays:

(a)A copy of the federal account transcript; OR

(b)A copy of your amended federal income tax return (federal form 1040X) and either a copy of the IRS acceptance letter or a copy of the refund check. (Under federal law the copy of your check must either be larger than or smaller than the size of the original check. If you make a reduced-size copy, please make sure that the copy is legible.)

Your amended return may not be processed until after Oct. 15th.

Net Operating Losses (NOL)

Be sure you complete and attach Ohio form IT NOL, Net Operating Loss Carryback Worksheet on page 6 and check the box on the front of this return indicating that you are amending for an NOL.

Your NOL carryback deduction on the Ohio amended income tax return is limited by the following:

the amount of your federal itemized deductions and personal exemption amounts allowed in the carryback year; AND

the depreciation adjustment discussed below.

Itemized Deductions and Exemptions: Your federal adjusted gross income, after application of the allowed net operating loss car- ryback amount, will not be zero dollars if you claimed any itemized deductions or exemptions on your federal income tax return. For more information please see our Aug. 12, 2002, information release entitled "Personal Income Tax Information Release: Net Operating Loss Carryback Five-Year Rule" at tax.ohio.gov.

Depreciation Adjustment: If the federal NOL carryback/ carryforward reflects either Internal Revenue Code (I.R.C.) section 168(k) bonus depreciation or I.R.C. section 179 expensing, then you must reduce the federal net operating loss carryback/carryforward amount by both of the following:

Adjustment for the I.R.C. section 168(k) bonus depreciation; AND

Adjustment for the excess of the I.R.C. section 179 amount over the amount that would have been allowed based upon I.R.C. section 179 in effect on Dec. 31, 2002.

For more information please see Ohio Revised Code section 5747.01(A)(20) as amended by the 129th General Assembly in HB 365 and our information release entitled "Recently Enacted Ohio Legislation Affects Depreciation Deductions for Taxable Years Ending in 2001 and Thereafter" at tax.ohio.gov.

Example 1: In 2007 Maria reported $800,000 in federal adjusted gross income. Maria’s 2007 federal return as filed reflected $350,000 in itemized deductions and personal exemption amounts. Maria’s 2007 federal modified taxable income was $450,000. In 2009 Maria incurred a federal NOL of $1 million including an I.R.C. section 168(k) bonus depreciation amount of $300,000. Maria must first reduce the federal NOL carryback/carryforward by $250,000 (5/6 of