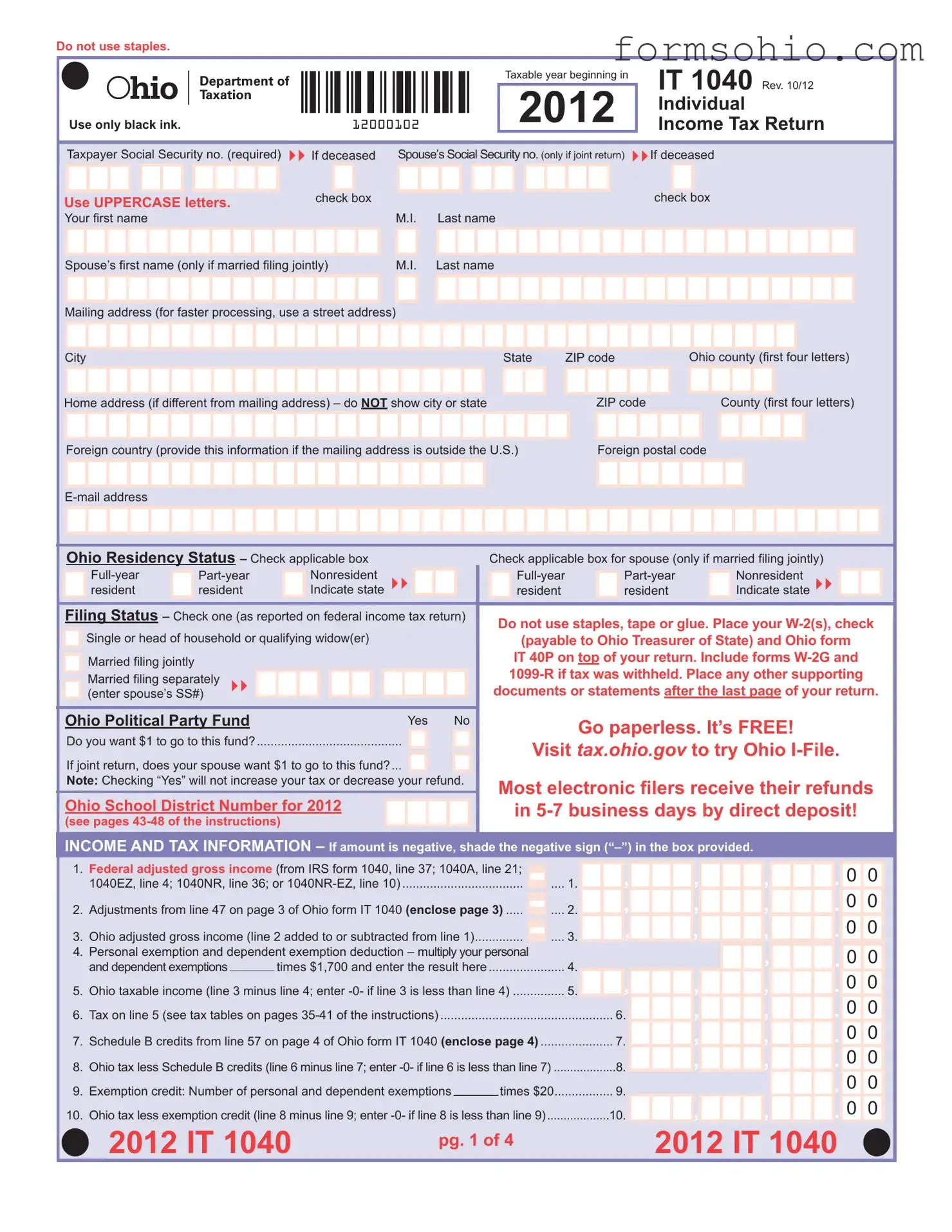

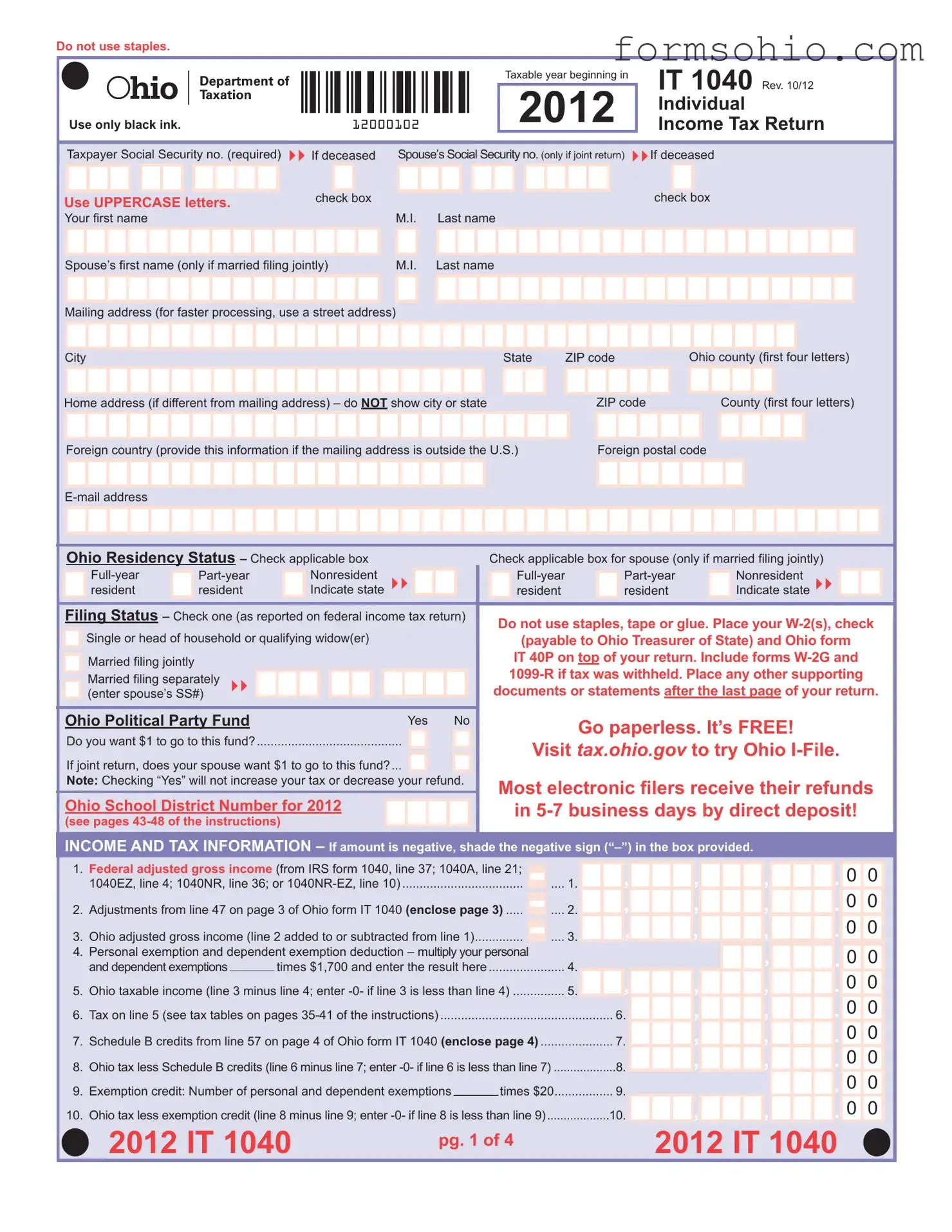

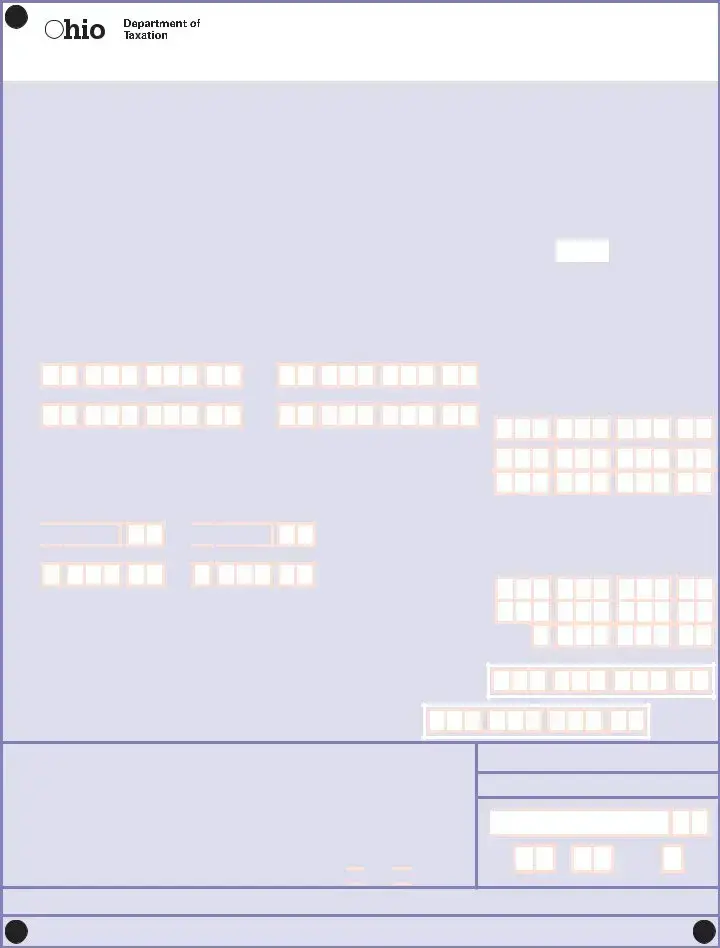

SCHEDULE A – Income Adjustments (Additions and Deductions) |

|

|

|

|

|

Additions (add income items only to the extent not included on page 1, line 1). |

|

|

, |

, |

. 0 0 |

31. |

Non-Ohio state or local government interest and dividends |

31. |

32. |

Certain pass-through entity Ohio taxes paid and Ohio Revised Code section 5733.40(A) |

|

, |

, |

. 0 0 |

|

pass-through entity adjustment |

32. |

33a. |

Federal interest and dividends subject to state taxation |

33a. |

, |

, |

. 0 0 |

b. Reimbursement of college tuition expenses and fees deducted in any previous year(s) and |

|

, |

, |

. 0 0 |

|

noneducation expenditures from a college savings account |

b. |

c. Losses from sale or disposition of Ohio public obligations |

c. |

, |

, |

. 0 0 |

d. Nonmedical withdrawals from a medical savings account |

d. |

, |

, |

. 0 0 |

e. Reimbursement of expenses previously deducted for Ohio income tax purposes, but only if |

|

, |

, |

. 0 0 |

|

the reimbursement is not in federal adjusted gross income |

e. |

f. Lump sum distribution add-back and miscellaneous federal income tax adjustments |

f. |

, |

, |

. 0 0 |

g. Adjustment for Internal Revenue Code sections 168(k) and 179 depreciation expense |

g. |

, |

, |

. 0 0 |

34. |

Total additions (add lines 31 through 33g and enter here). You must complete the |

|

, |

, |

, |

. 0 0 |

|

applicable line items above |

34. |

|

|

|

|

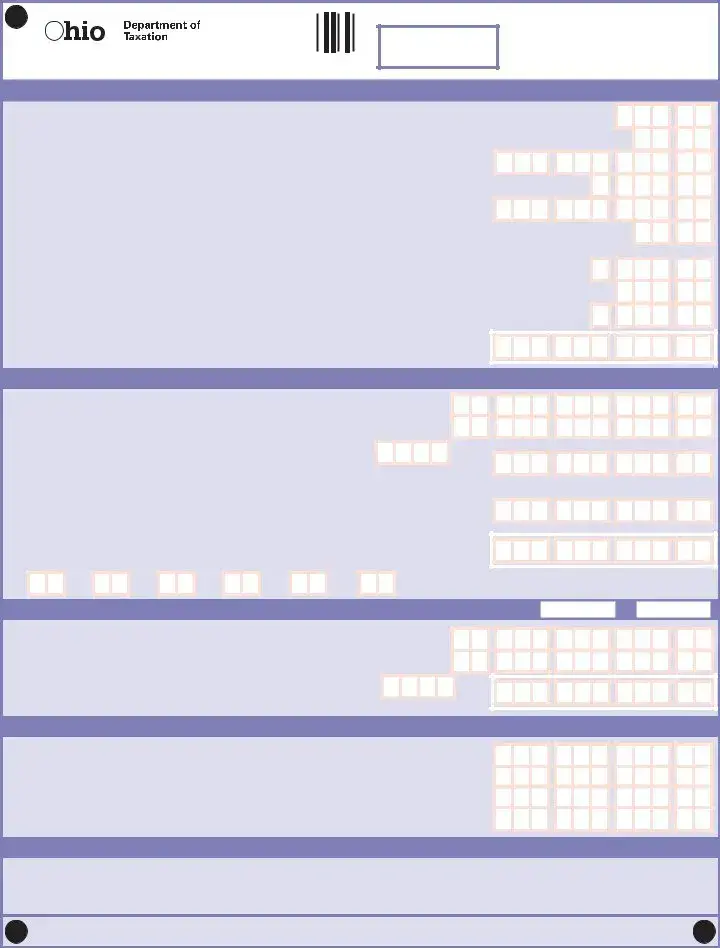

Deductions (deduct income items only to the extent included on page 1, line 1). |

|

|

|

|

. 0 0 |

35a. Federal interest and dividends exempt from state taxation |

35a. |

, |

, |

b. Adjustment for Internal Revenue Code sections 168(k) and 179 depreciation expense |

b. |

, |

, |

. 0 0 |

36. |

Employee compensation earned in Ohio by full-year residents of neighboring states and certain |

, |

, |

. 0 0 |

|

income earned by military nonresidents and civilian nonresident spouses |

36. |

37a. |

Military pay for Ohio residents, but only if the military pay is included on line 1 of this return |

|

, |

, |

. 0 0 |

|

and is received while the military member was stationed outside Ohio |

37a. |

b. Military retirement income and military injury relief fund amounts included in federal adjusted |

|

, |

, |

. 0 0 |

|

gross income (line 1 on page 1) |

b. |

38a. |

State or municipal income tax overpayments shown on IRS form 1040, line 10 |

38a. |

, |

, |

. 0 0 |

b. Refund or reimbursements shown on IRS form 1040, line 21 for itemized deductions claimed |

|

, |

, |

. 0 0 |

|

on a prior year federal income tax return |

b. |

c. Repayment of income reported in a prior year and miscellaneous federal tax adjustments |

c. |

, |

, |

. 0 0 |

39. |

Disability and survivorship benefi ts (do not include pension continuation benefits) |

39. |

, |

, |

. 0 0 |

|

|

|

40. |

Qualifying Social Security benefi ts and certain railroad retirement benefits |

40. |

, |

, |

. 0 0 |

|

|

|

41a. |

Education: Ohio 529 contributions; tuition credit purchases |

41a. |

, |

, |

. 0 0 |

|

|

. 0 0 |

b. |

Pell/Ohio College Opportunity taxable grant amounts used to pay room and board |

b. |

, |

, |

42. |

Certain Ohio National Guard reimbursements and benefits |

42. |

, |

, |

. 0 0 |

43a. |

Unreimbursed long-term care insurance premiums, unsubsidized health care insurance |

|

, |

, |

. 0 0 |

|

premiums and excess health care expenses (see worksheet on page 27 of the instructions) ... |

43a. |

b. Funds deposited into, and earnings of, a medical savings account for eligible health care |

|

, |

, |

. 0 0 |

|

expenses (see worksheet on page 28 of the instructions) |

b. |

|

|

|

|

c. Qualifi ed organ donor expenses (maximum $10,000 per taxpayer) and amounts contributed |

|

, |

, |

. 0 0 |

|

to an individual development account |

c. |

44. |

Wage expense not deducted due to the targeted jobs or the work opportunity tax credits |

44. |

, |

, |

. 0 0 |

45. |

Interest income from Ohio public obligations and from Ohio purchase obligations; gains from |

|

|

|

|

|

the sale or disposition of Ohio public obligations; public service payments received from the |

|

, |

, |

. 0 0 |

|

state of Ohio or income from a transfer agreement |

45. |

2012 IT 1040

2012 IT 1040

,

,

,

,

Yes

Yes

No

No

,

,

,

,