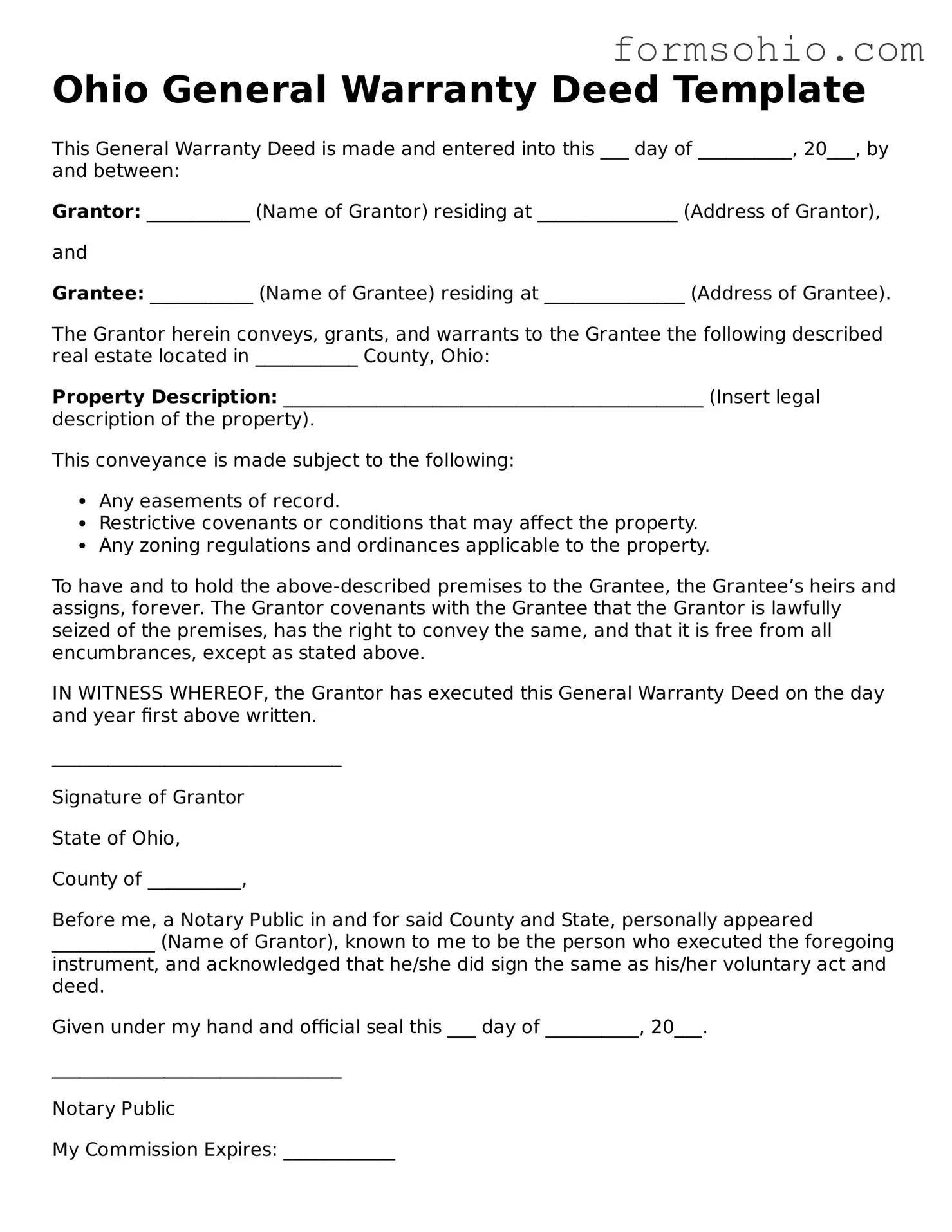

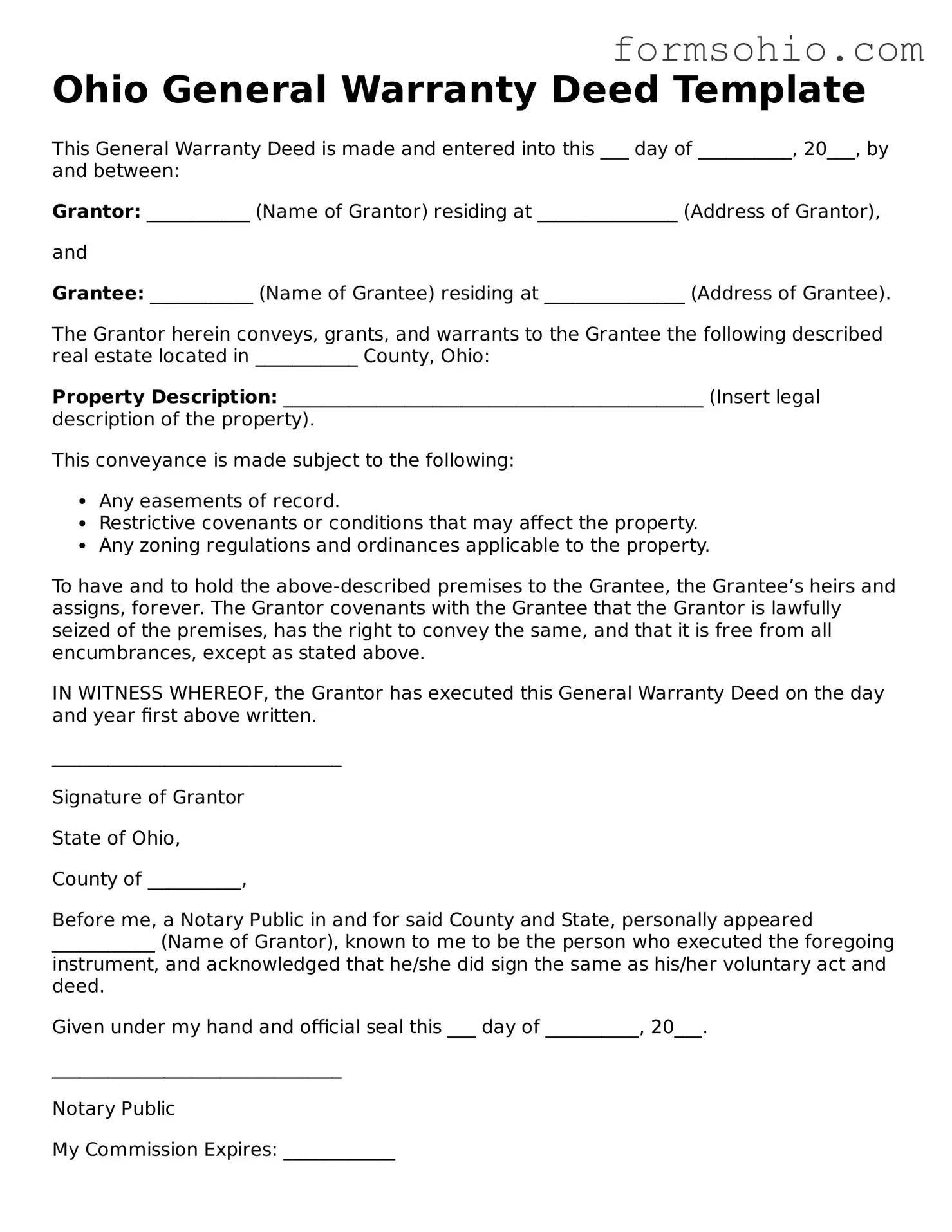

Printable Deed Template for the State of Ohio

A deed form is a legal document that facilitates the transfer of property ownership from one party to another. In Ohio, understanding the specific requirements and types of deeds is essential for ensuring a smooth transaction. This article will guide you through the key aspects of the Ohio deed form, helping you navigate the process with confidence.

Get This Document Online

Printable Deed Template for the State of Ohio

Get This Document Online

Complete this form efficiently and quickly

Complete Deed online without printing hassles.

Get This Document Online

or

Free PDF File