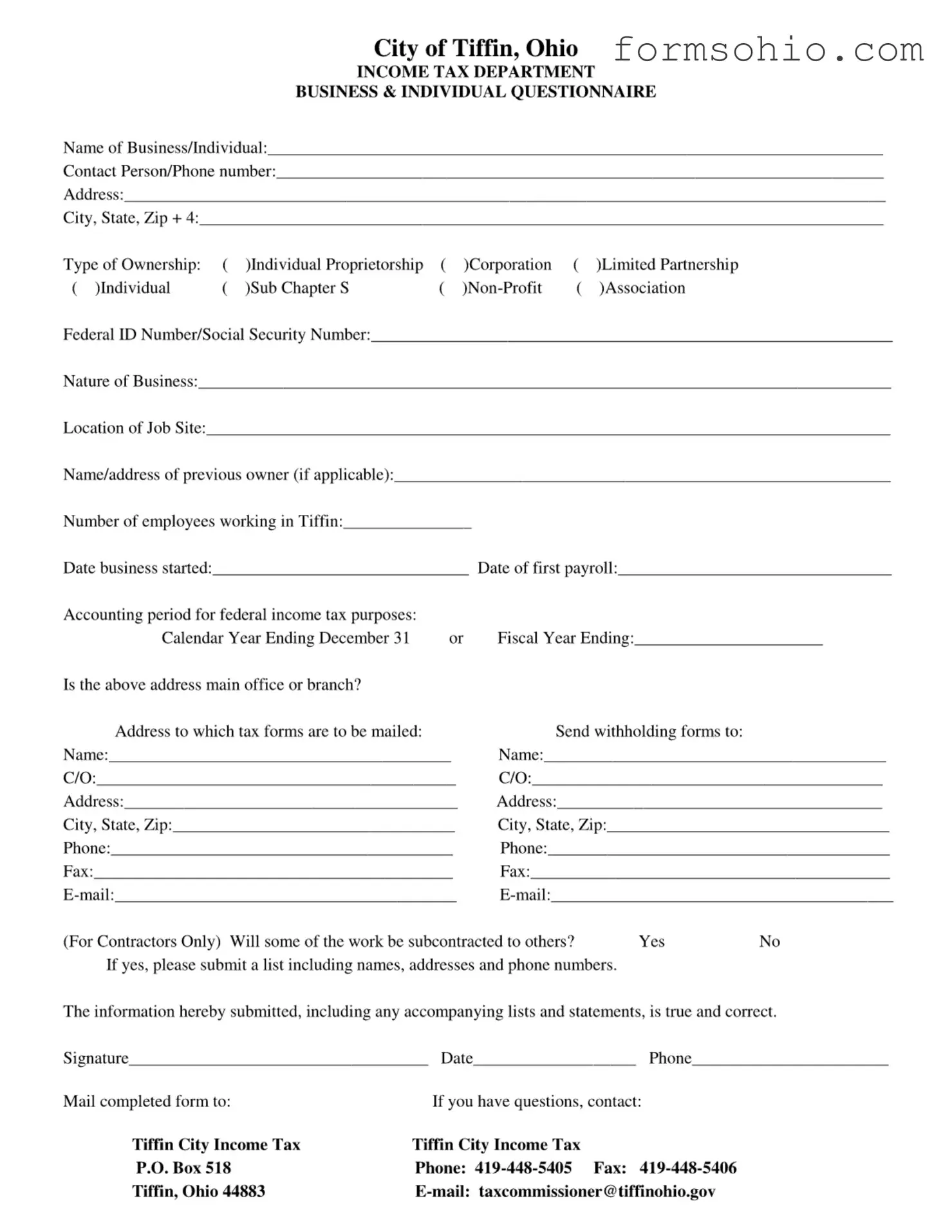

Fill a Valid City Of Tiffin Ohio Income Tax Form

The City of Tiffin, Ohio Income Tax form serves as a crucial document for both businesses and individuals to report their income and fulfill local tax obligations. This form collects essential information such as the name of the business or individual, contact details, and the nature of the business, ensuring compliance with the city’s income tax regulations. Completing this form accurately is vital for maintaining good standing with the City of Tiffin’s Income Tax Department.

Get This Document Online

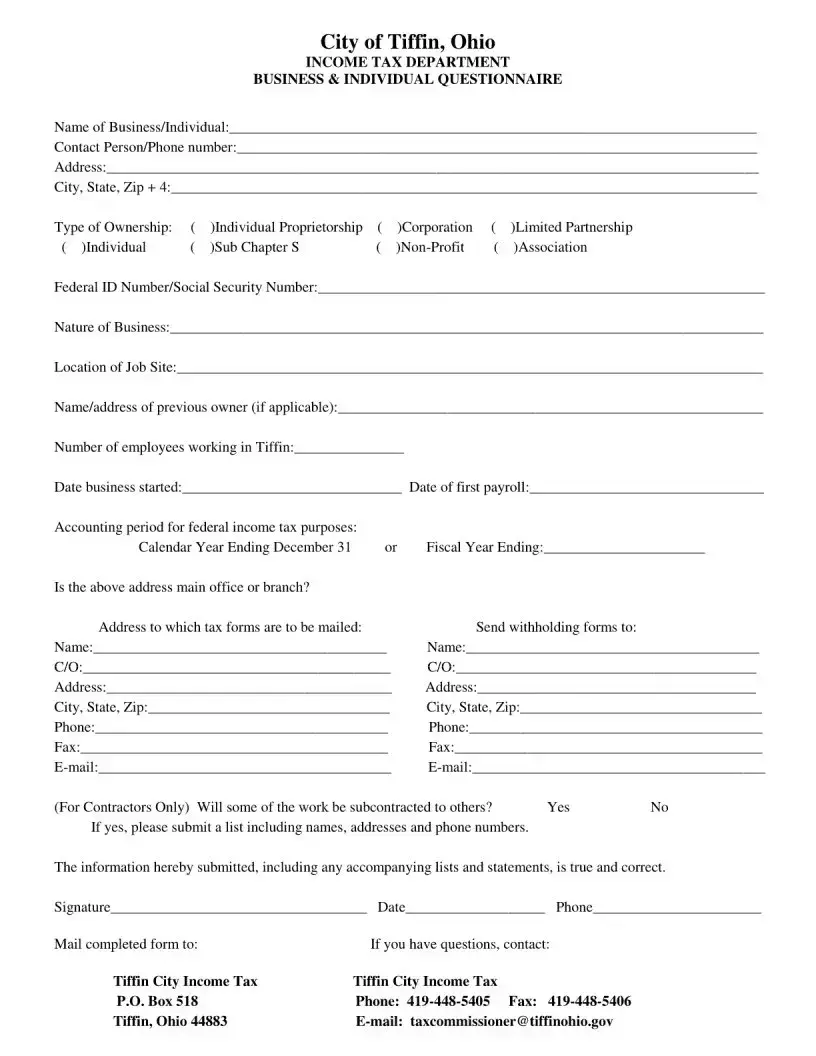

Fill a Valid City Of Tiffin Ohio Income Tax Form

Get This Document Online

Complete this form efficiently and quickly

Complete City Of Tiffin Ohio Income Tax online without printing hassles.

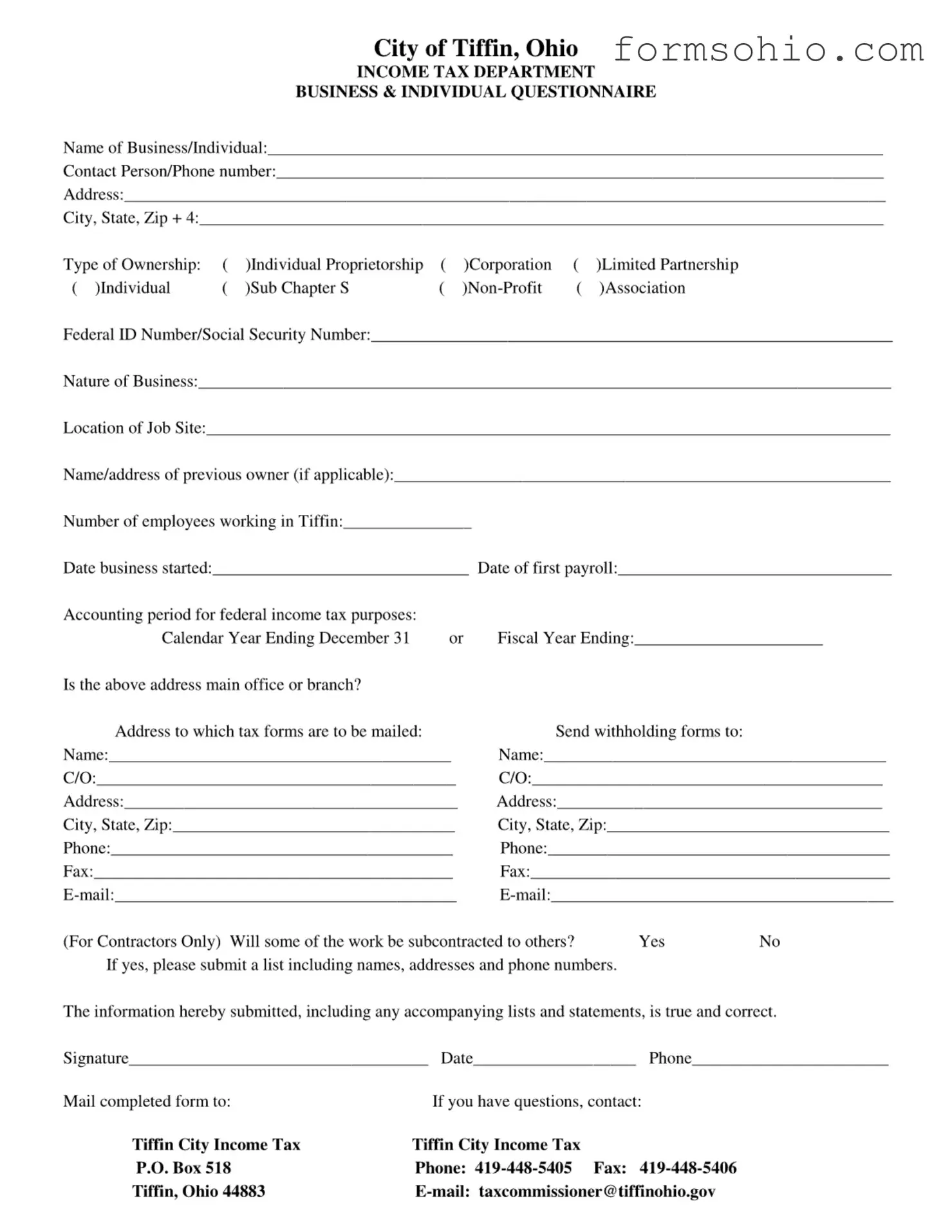

Get This Document Online

or

Free PDF File