Fill a Valid Cat Cr Ohio Form

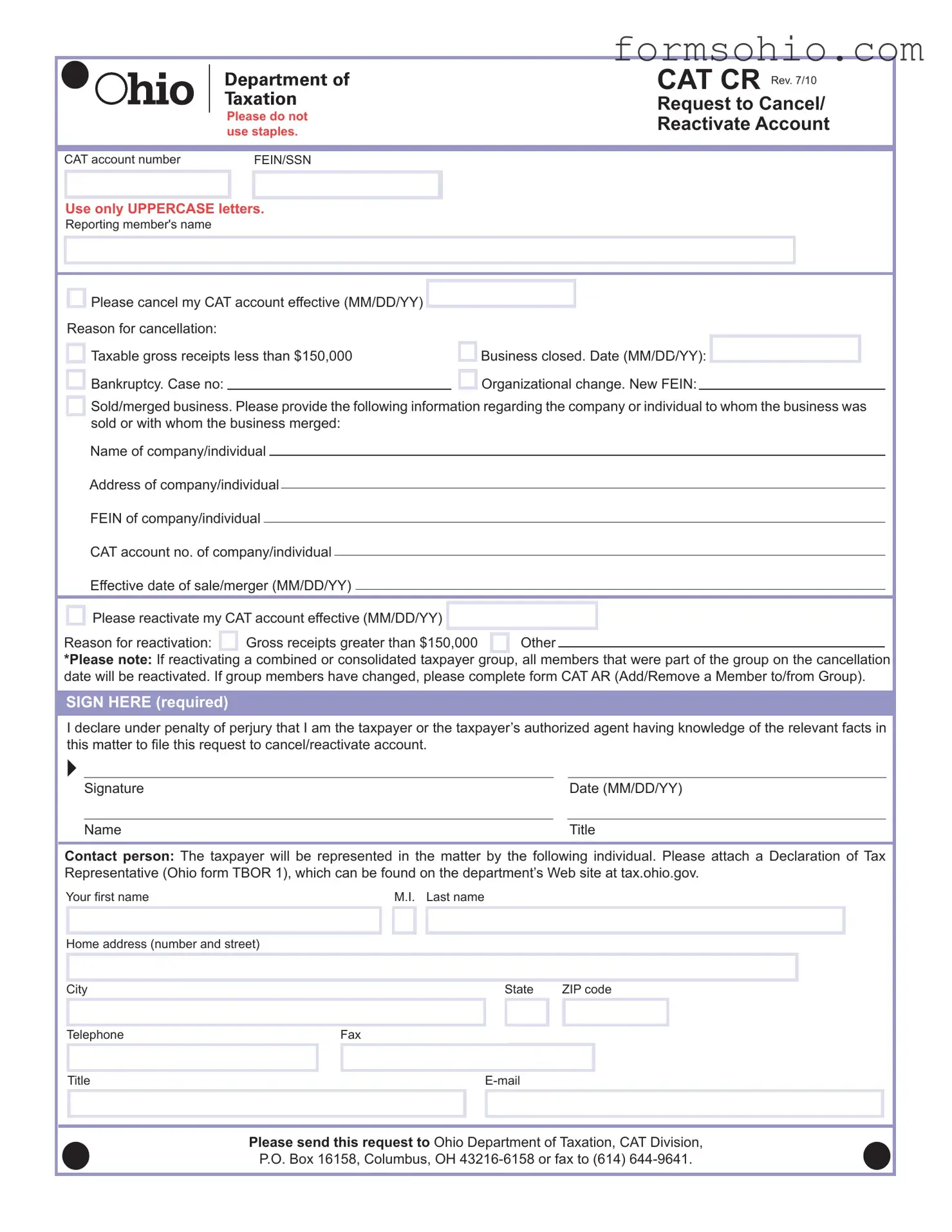

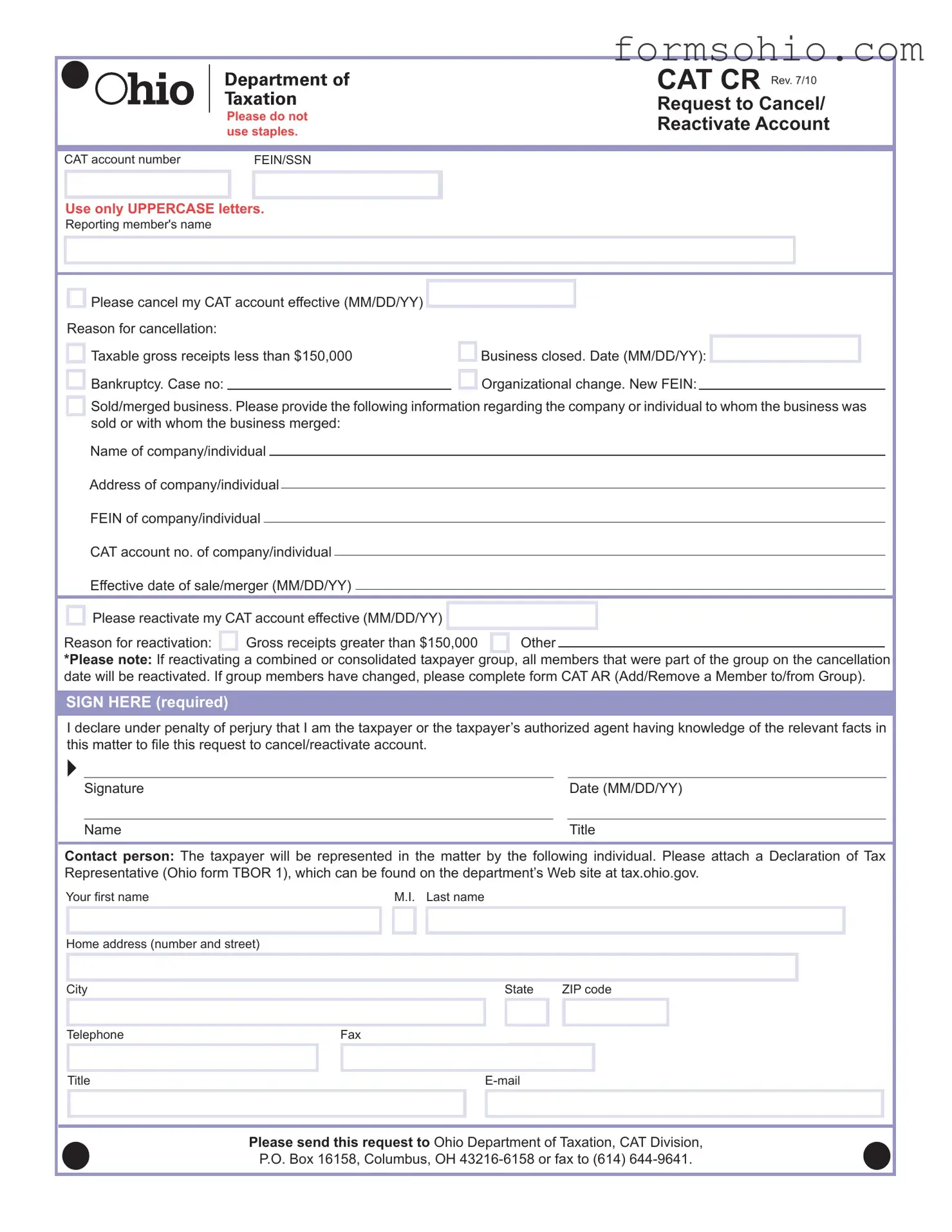

The CAT CR Ohio form is a document used to request the cancellation or reactivation of a Commercial Activity Tax (CAT) account in Ohio. This form is essential for businesses that need to formally notify the Ohio Department of Taxation about changes in their tax status, such as closing operations or exceeding gross receipts thresholds. Proper completion ensures compliance and helps avoid potential penalties.

Get This Document Online

Fill a Valid Cat Cr Ohio Form

Get This Document Online

Complete this form efficiently and quickly

Complete Cat Cr Ohio online without printing hassles.

Get This Document Online

or

Free PDF File

Please cancel my CAT account effective (MM/DD/YY)

Please cancel my CAT account effective (MM/DD/YY)

Bankruptcy. Case no:

Bankruptcy. Case no: Business closed. Date (MM/DD/YY):

Business closed. Date (MM/DD/YY):

Organizational change. New FEIN:

Organizational change. New FEIN: