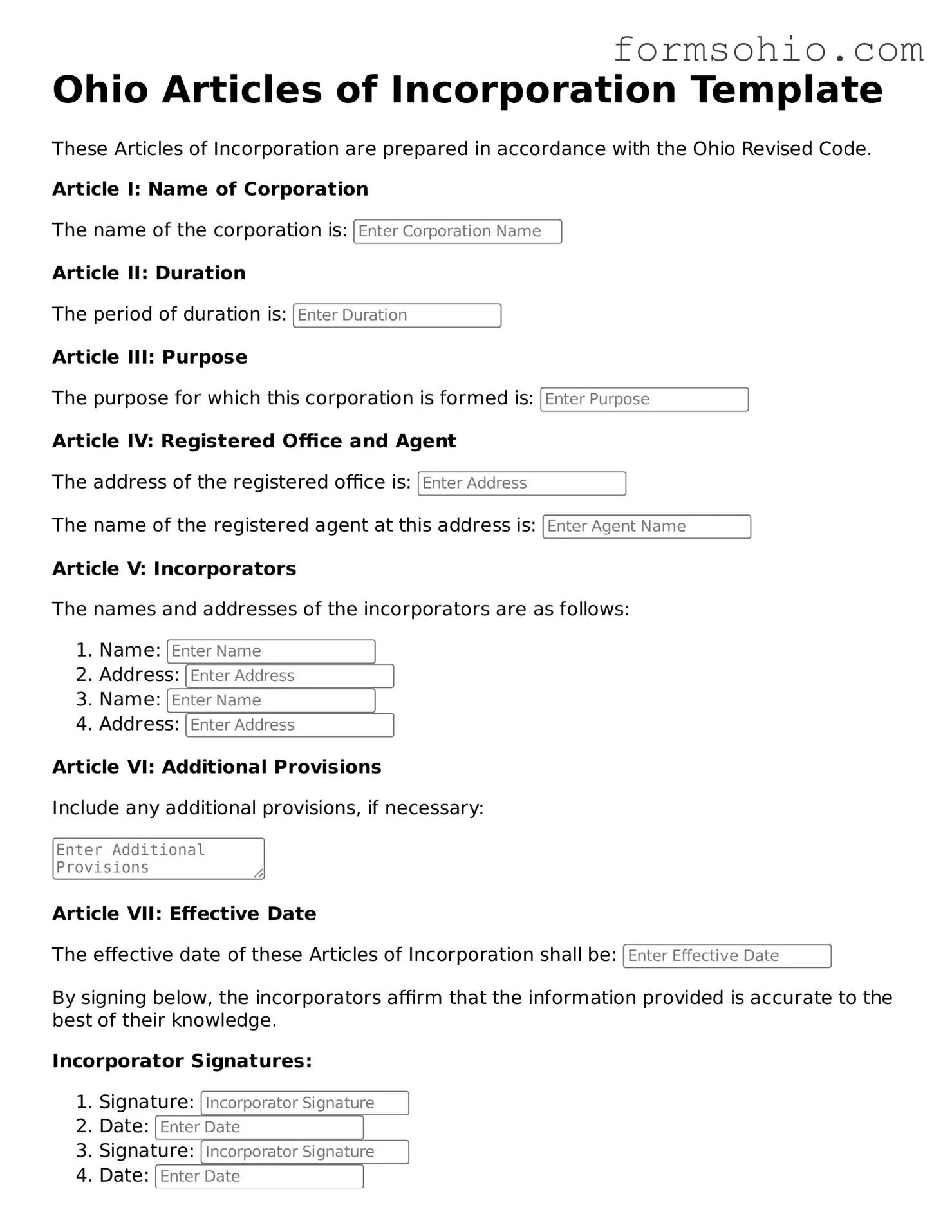

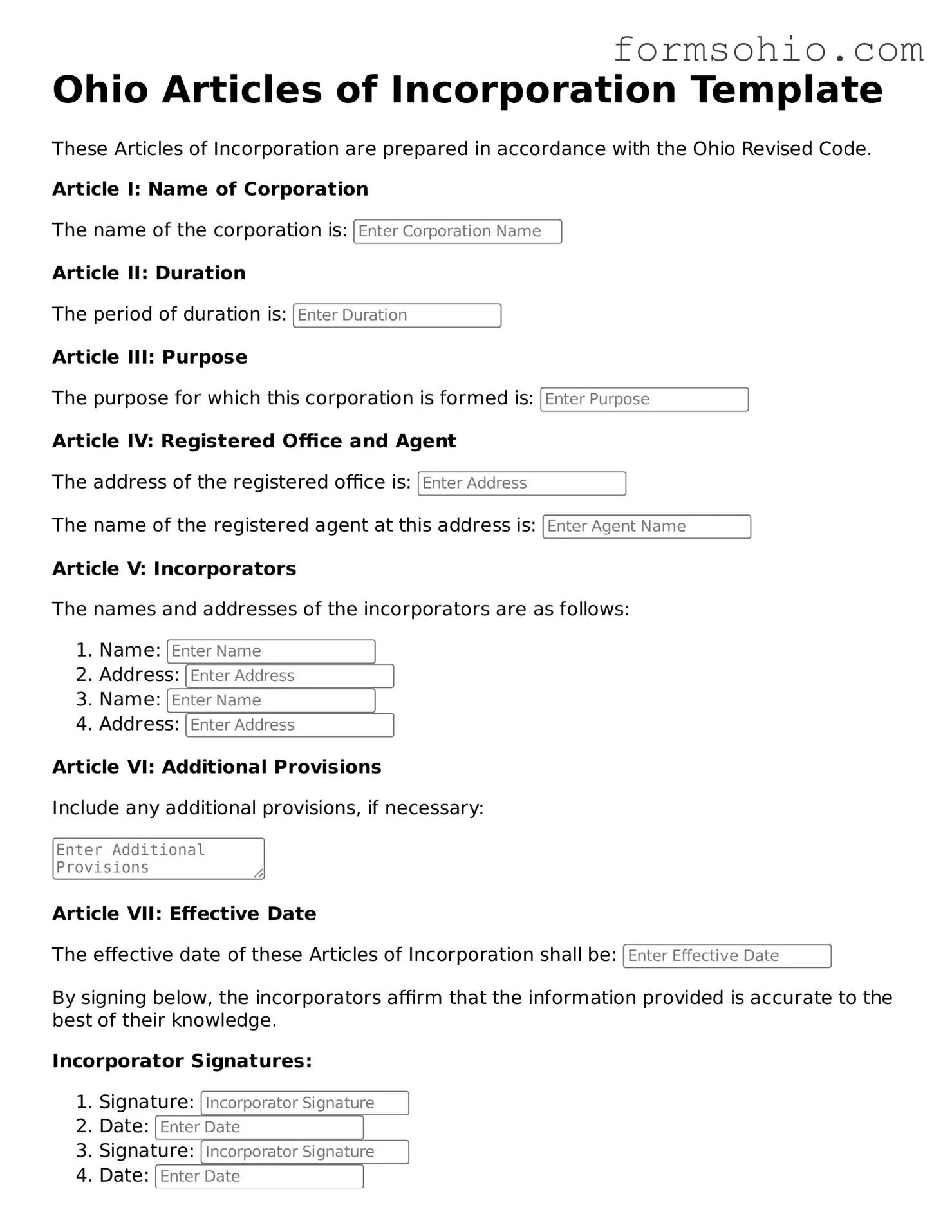

Printable Articles of Incorporation Template for the State of Ohio

The Ohio Articles of Incorporation form is a legal document required to establish a corporation in the state of Ohio. This form outlines essential information about the corporation, including its name, purpose, and structure. Completing this form is a crucial step in the process of forming a business entity in Ohio.

Get This Document Online

Printable Articles of Incorporation Template for the State of Ohio

Get This Document Online

Complete this form efficiently and quickly

Complete Articles of Incorporation online without printing hassles.

Get This Document Online

or

Free PDF File